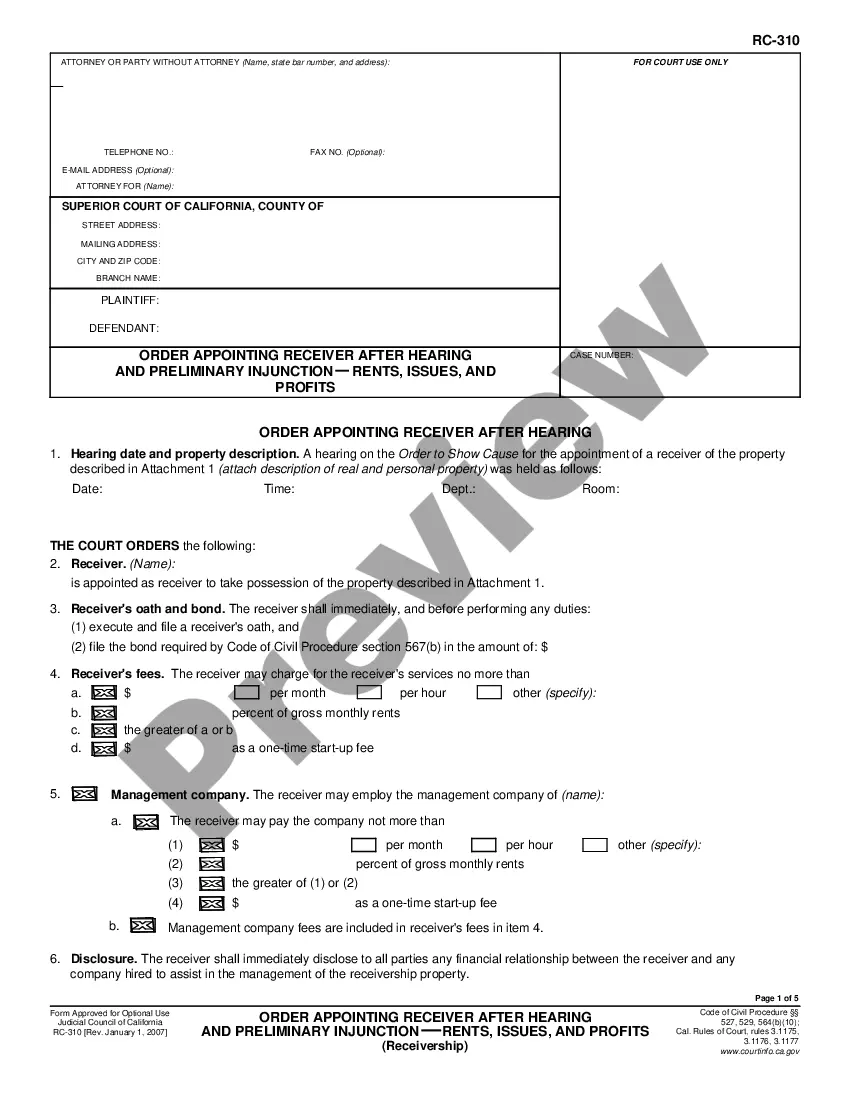

This Depreciation Worksheet is a template used by companies for creating a worksheet to evaluate depreciation expenses. The Depreciation Worksheet organizes and outlines a company's depreciation expenses and can be customized for a company's specific usage.

Maine Depreciation Worksheet

Description

How to fill out Depreciation Worksheet?

Finding the correct legal document template can be a challenge.

Of course, there is a multitude of templates available online, but how can you secure the legal form you require.

Utilize the US Legal Forms website.

First, ensure you have selected the appropriate form for your location. You can preview the form using the Preview option and review the form details to confirm it is suitable for you.

- The service offers thousands of templates, including the Maine Depreciation Worksheet, suitable for business and personal needs.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and select the Download option to obtain the Maine Depreciation Worksheet.

- Use your account to browse the legal forms you have previously acquired.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

To find the depreciation tax shield, begin by estimating your total annual depreciation using a Maine Depreciation Worksheet. This worksheet will help you determine how much depreciation reduces your taxable income. After you calculate the depreciation, multiply it by your tax rate to find the tax shield value. Utilizing resources from uslegalforms can further assist in understanding the implications of depreciation on your taxes.

To file depreciation effectively, you should first gather all necessary financial records and acquire a Maine Depreciation Worksheet. This worksheet helps you calculate the depreciation value of your assets over time. Next, include the calculated depreciation on your income tax return, ensuring accuracy to maximize your deductions. Using resources like uslegalforms can simplify this process, providing you with the correct forms and guidance.

Maine does have its own provisions regarding bonus depreciation, but it does not fully align with federal policy. Therefore, it is essential to be aware of what expenses qualify at the state level. A Maine Depreciation Worksheet can guide you through these specific rules, ensuring you take full advantage of allowable deductions.

For individual taxpayers, the standard deduction in Maine can vary based on your filing status. It is important to stay updated as these numbers can change annually. Using a Maine Depreciation Worksheet can assist you in understanding how this deduction interacts with your overall tax picture.

Maine does not automatically follow the federal guidelines for bonus depreciation. The state has its own rules that could impact your tax strategy. To navigate these complexities effectively, the Maine Depreciation Worksheet can serve as a valuable tool to help you calculate your depreciation correctly.

The state adjustment for depreciation accounts for differences between federal and state depreciation rules. Maine may have specific considerations that affect how you report your depreciation on state tax returns. Consulting a Maine Depreciation Worksheet can help clarify these adjustments and ensure compliance with state tax laws.

Certain assets do not qualify for bonus depreciation, including property used for lodging and certain improvements to residential rental property. Additionally, used property purchased from unrelated parties generally does not qualify. To determine which assets you can claim, refer to the Maine Depreciation Worksheet for specific guidance and categorization.

Yes, bonus depreciation is being phased out gradually. Initially, it allowed a 100% deduction for qualifying assets, but this percentage will decrease in the coming years. This change can affect financial planning, so utilizing a Maine Depreciation Worksheet becomes important to understand your options and prepare for future impacts.

You can find depreciation detailed on your tax return, typically in the form of a deduction. If you have used the Maine Depreciation Worksheet, it will clearly outline the amounts you need to report. Make sure to reference this worksheet as you complete your tax return to ensure that you capture all relevant depreciation information accurately.

Yes, Maine recognizes bonus depreciation, allowing you to take additional deductions under certain conditions. The Maine Depreciation Worksheet can help you navigate these rules, ensuring you maximize your deductions. By accurately reflecting your assets and their value, you can benefit from bonus depreciation while complying with state regulations.