Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Selecting the appropriate legal document format can be a challenge. Clearly, there are many templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service provides thousands of templates, including the Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement, suitable for both business and personal needs. All of the forms are reviewed by experts and comply with federal and state requirements.

If you are already registered, sign in to your account and click the Download button to obtain the Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents section of your account and download another copy of the document you need.

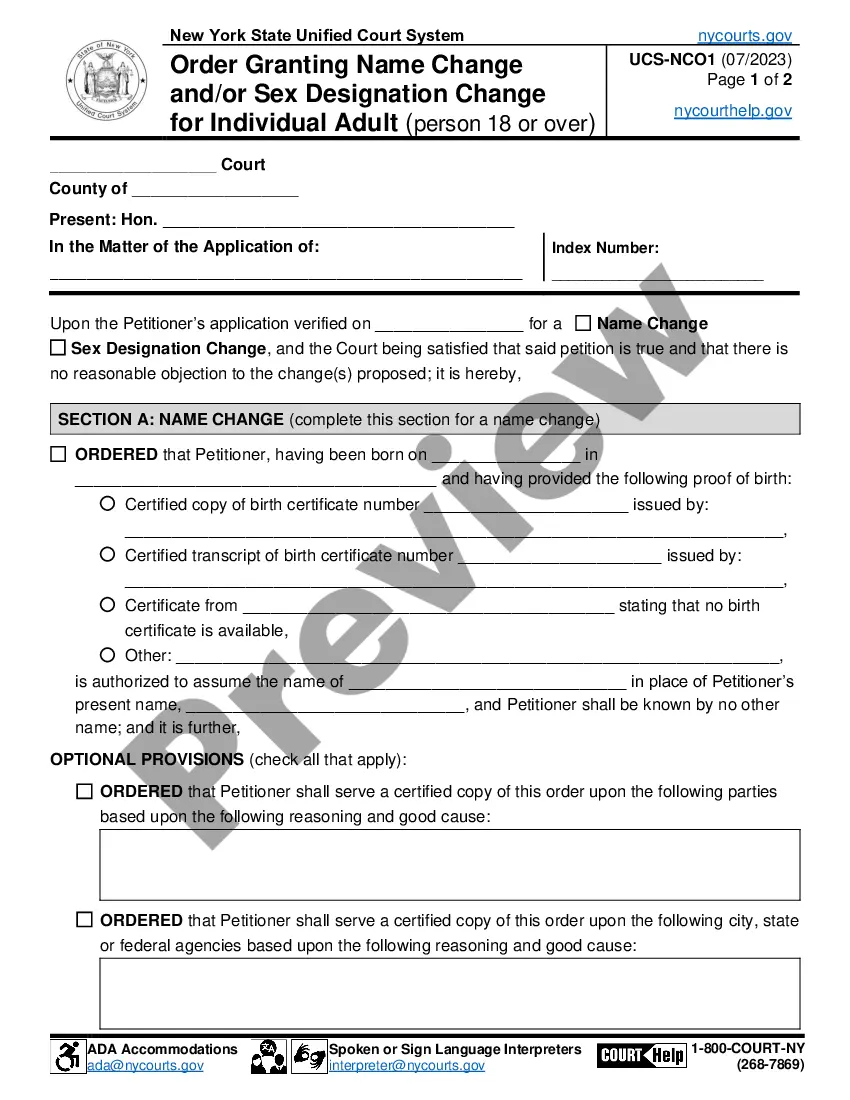

If you are a new user of US Legal Forms, here are some simple steps to follow: First, ensure you have selected the correct form for your region. You can preview the form using the Review option and read the form description to confirm it’s the right one for you. If the form does not meet your needs, use the Search field to find the proper form. Once you are certain that the form is correct, click on the Download now button to acquire the form.

- Select the pricing plan you prefer and enter the required details.

- Create your account and complete the transaction using your PayPal account or credit card.

- Choose the document format and download the legal file format to your device.

- Complete, edit, print, and sign the obtained Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement.

- US Legal Forms is the largest repository of legal forms where you can find numerous document templates.

- Use the service to obtain professionally created documents that comply with state regulations.

Form popularity

FAQ

Yes, additional contributions can be made to a charitable remainder unitrust. This flexibility allows donors to increase their charitable impact while continuing to enjoy a stream of income. The Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement is particularly beneficial for those who envision future contributions and wish to support their charities over time.

While both types of trusts serve similar charitable purposes, the key difference is in their payment mechanisms. A unitrust provides income based on the trust's current value and adjusts annually, whereas a charitable remainder trust distributes a fixed income. By choosing the Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement, you can experience the benefits of tailored income distributions that suit your financial situation.

Amending a charitable remainder trust is generally possible, but the process can be complex. You may need to consult legal advice to ensure compliance with IRS regulations. With the Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement, you have better options for modifications that could benefit your financial and charitable goals.

Yes, you can add assets to a charitable remainder Unitrust. This feature allows for flexibility in funding, offering opportunities to increase your charitable impact over time. Utilizing the Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement empowers you to enhance your contributions while benefiting from income during your lifetime.

Typically, you cannot add assets to a charitable remainder trust once it is established. This restriction is important because it affects the trust's tax treatment. If you want to adjust contributions after setup, consider the Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement, which is designed for those who need to make additional contributions within a certain timeframe.

Yes, Pennsylvania recognizes grantor trusts and provides several benefits to individuals establishing them. These trusts allow the grantor to maintain control over the assets and income, and they can help achieve various estate planning objectives. When utilizing a Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement, grantors can ensure that their charitable wishes are fulfilled while managing their estate effectively. It's important to work with knowledgeable professionals to navigate these trust structures.

The purpose of an inter vivos trust is to manage your assets during your lifetime and define how they should be distributed after your death. This type of trust allows you to maintain control over your assets while providing for beneficiaries, such as family members or charitable organizations. Specifically, a Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement enables you to support charities while enjoying tax benefits. It balances your philanthropic goals with sound financial planning.

A trust can be an effective tool for managing your estate and may help mitigate Pennsylvania inheritance tax. However, whether a trust avoids this tax entirely depends on various factors, including the type of trust established. The Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement can offer estate planning benefits while ensuring that your charitable intentions are met. Consult with a tax advisor or estate planning attorney to understand how this trust impacts inheritance tax.

Certain individuals may be exempt from Pennsylvania local services tax, including those who are retired, disabled, or earning income below the taxable threshold. If your income is generated primarily through a Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement, consider how this may affect your tax status. It's advisable to check local regulations or consult a tax advisor for specific exemptions. Understanding your tax obligations can save you from unexpected liabilities.

A charitable remainder trust typically files Form 1041 for its annual income, which reports the income generated from the trust assets. If your trust is a Pennsylvania Charitable Remainder Inter Vivos Unitrust Agreement, ensure you understand the specific state requirements as well. Consulting with tax professionals can provide clarity on which forms to file and deadlines to meet. Proper filing helps maintain the trust's tax-exempt status.