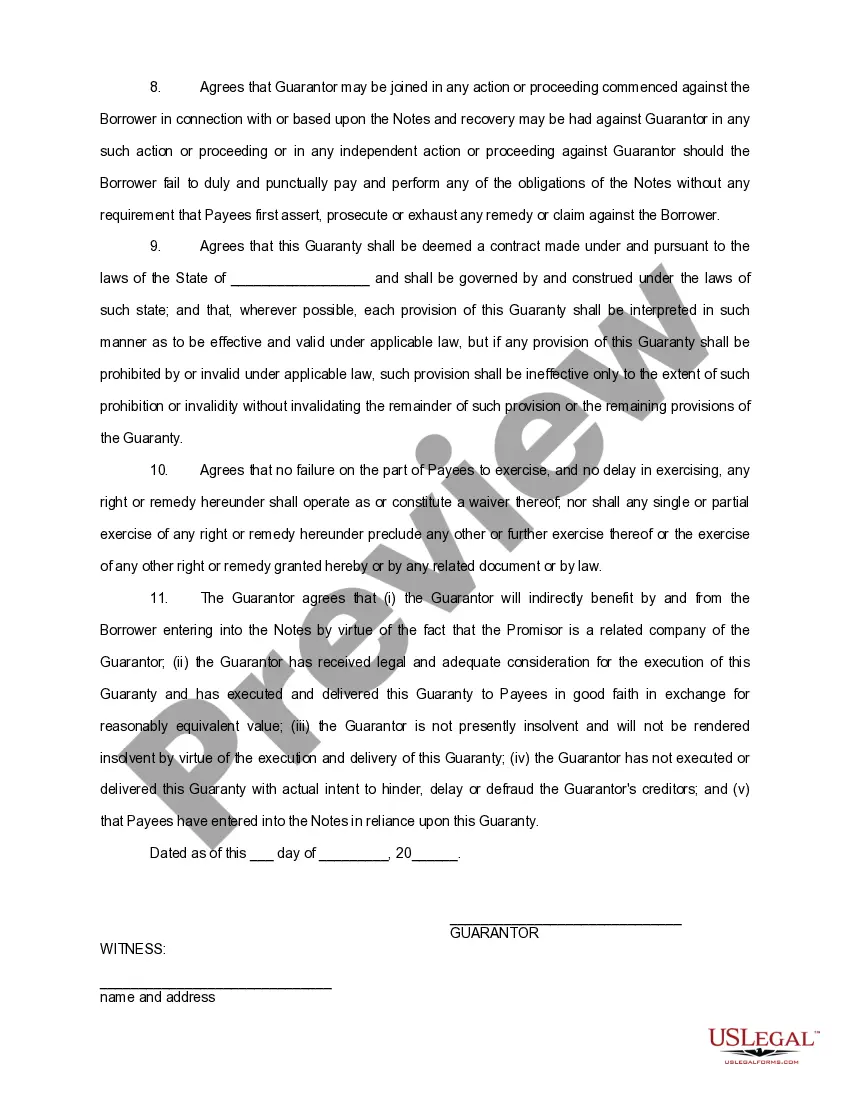

Pennsylvania Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

You can spend hours online searching for the proper legal template that fulfills the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that have been reviewed by experts.

You can easily download or print the Pennsylvania Guaranty of Promissory Note by Individual - Corporate Borrower from the service.

If available, use the Preview button to review the document as well.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can fill out, alter, print, or sign the Pennsylvania Guaranty of Promissory Note by Individual - Corporate Borrower.

- Every legal document you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for your location or area of interest.

- Check the form details to guarantee you have selected the right document.

Form popularity

FAQ

A guarantor is an individual who signs a loan or lease document in addition to the primary borrower. If the primary borrower defaults on the obligation, the guarantor will step in and pay for the debt. Guarantors are sometimes used in rental agreements, on student loans, with mortgages and auto loans.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

When a personal guarantee is accompanied with a promissory note, a personal guarantee acts like collateral. The asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note).

The person or entity that guarantees the borrower's debt is called a guarantor. A guarantor is one whose promise 'is collateral to a primary or principal obligation on the part of another and which binds the obligor to performance in the event of nonperformance by such other, the latter being bound to perform

The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like or .

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Promissory notes are debt instruments. They can be issued by financial institutions. The capital markets consist of two types of markets: primary and secondary.. However, they can also be issued by small companies or individuals.