Pennsylvania Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

Choosing the right authorized file web template might be a have a problem. Needless to say, there are tons of layouts accessible on the Internet, but how can you get the authorized form you will need? Utilize the US Legal Forms web site. The service delivers 1000s of layouts, such as the Pennsylvania Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate, that can be used for business and private demands. Every one of the forms are checked out by specialists and meet up with state and federal needs.

When you are already listed, log in in your bank account and click on the Obtain option to obtain the Pennsylvania Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate. Make use of your bank account to appear from the authorized forms you might have purchased in the past. Check out the My Forms tab of your bank account and have yet another version of your file you will need.

When you are a brand new customer of US Legal Forms, allow me to share simple recommendations that you should comply with:

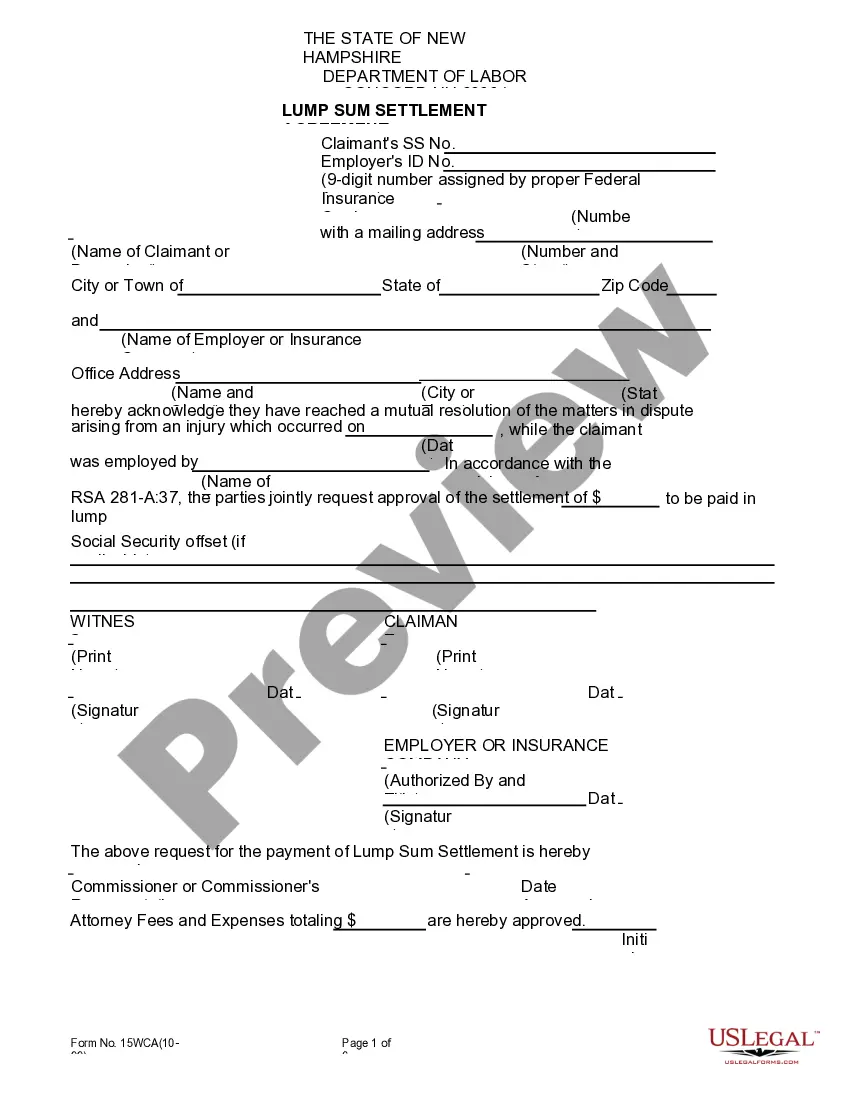

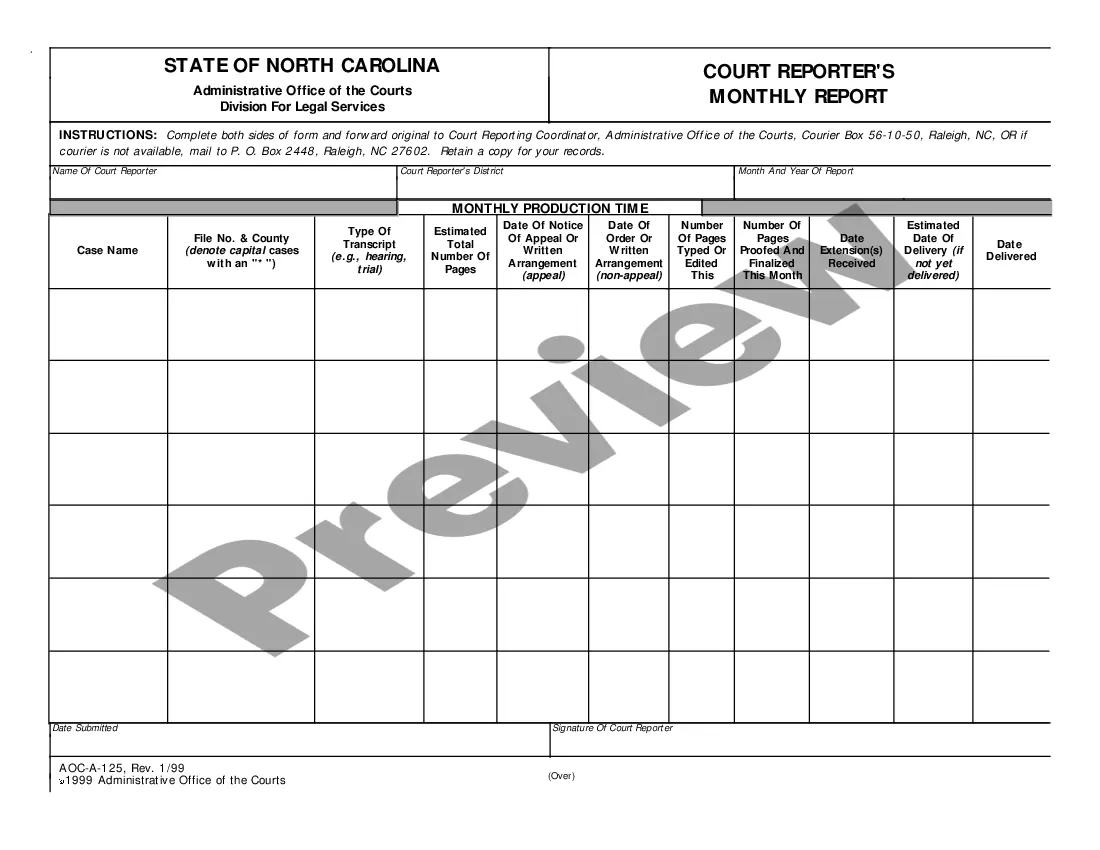

- Initially, ensure you have chosen the right form to your area/county. It is possible to check out the form while using Preview option and study the form explanation to ensure this is the right one for you.

- In the event the form will not meet up with your expectations, make use of the Seach discipline to discover the right form.

- Once you are certain the form is acceptable, go through the Purchase now option to obtain the form.

- Pick the costs prepare you would like and enter in the necessary information and facts. Create your bank account and pay for the order utilizing your PayPal bank account or Visa or Mastercard.

- Opt for the document file format and download the authorized file web template in your gadget.

- Comprehensive, edit and printing and sign the attained Pennsylvania Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate.

US Legal Forms will be the most significant collection of authorized forms in which you can discover various file layouts. Utilize the service to download skillfully-manufactured paperwork that comply with condition needs.

Form popularity

FAQ

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.

The executor has to perform certain duties to settle the estate in Pennsylvania, including paying debts and taxes, determining the value of the estate and distributing remaining assets, ing to the wishes of the decedent.

§ 3102. Settlement of small estates on petition. The authority of the court to award distribution of personal property under this section shall not be restricted because of the decedent's ownership of real estate, regardless of its value.

--Any employer of a person dying domiciled in this Commonwealth at any time after the death of the employee, whether or not a personal representative has been appointed, may pay wages, salary or any employee benefits due the deceased in an amount not exceeding $10,000 to the spouse, any child, the father or mother, or ...

Section 3392 states that all creditor claims shall be paid in the following order: (1) the costs of administering the decedent's estate, which includes any probate fees, attorneys' fees, or personal representative commissions; (2) the family exemption, which is $3,500.00 for each family member who resided with the ...

§ 3102. Except as otherwise provided, whenever in this chapter the criminality of conduct depends on a child being below the age of 14 years, it is no defense that the defendant did not know the age of the child or reasonably believed the child to be the age of 14 years or older.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

Alternatives to Probate in Pennsylvania In some cases, certain assets may be transferred directly to the beneficiary without going through probate. This can include assets with designated beneficiaries, such as life insurance policies, retirement accounts, or payable-on-death (POD) accounts.