Pennsylvania Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

If you require thorough, obtain, or print legal document templates, use US Legal Forms, the largest assortment of legal forms, available online.

Utilize the site's straightforward and convenient search to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Pennsylvania Direct Deposit Form for IRS in just a few clicks.

Every legal document template you download is yours to keep forever. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Complete and download, and print the Pennsylvania Direct Deposit Form for IRS with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to find the Pennsylvania Direct Deposit Form for IRS.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

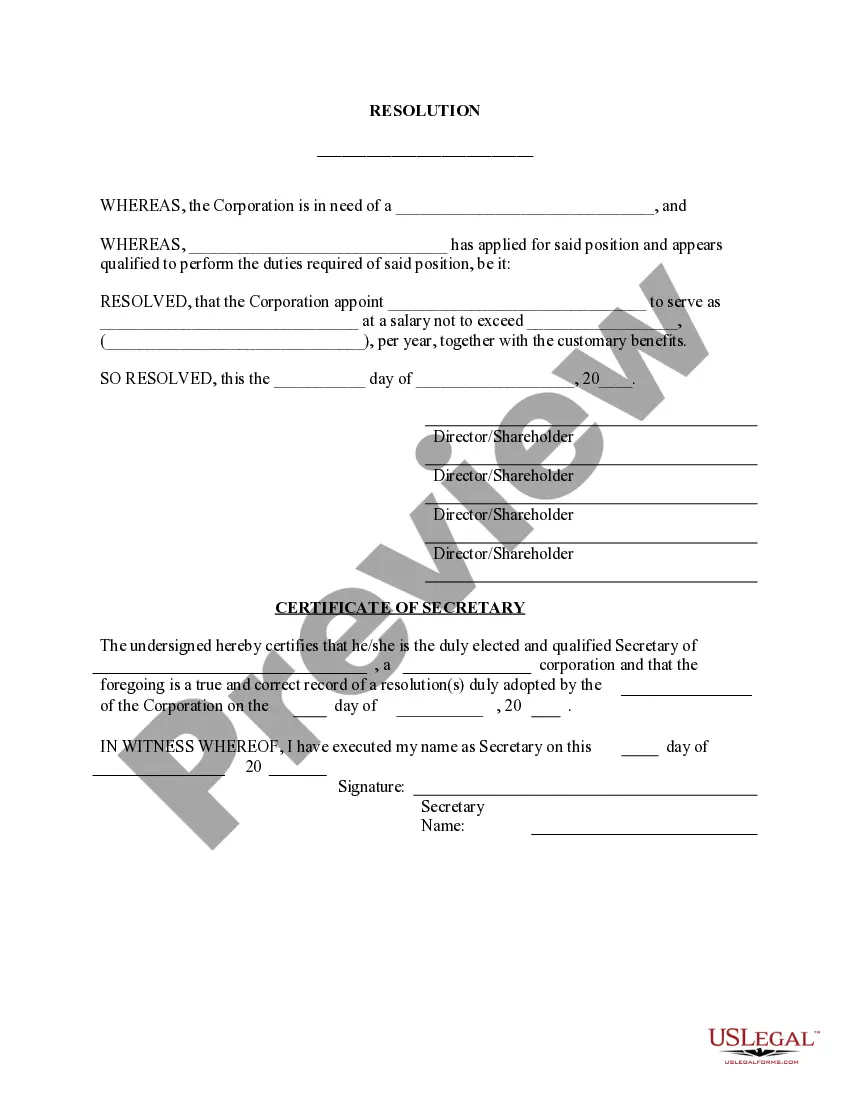

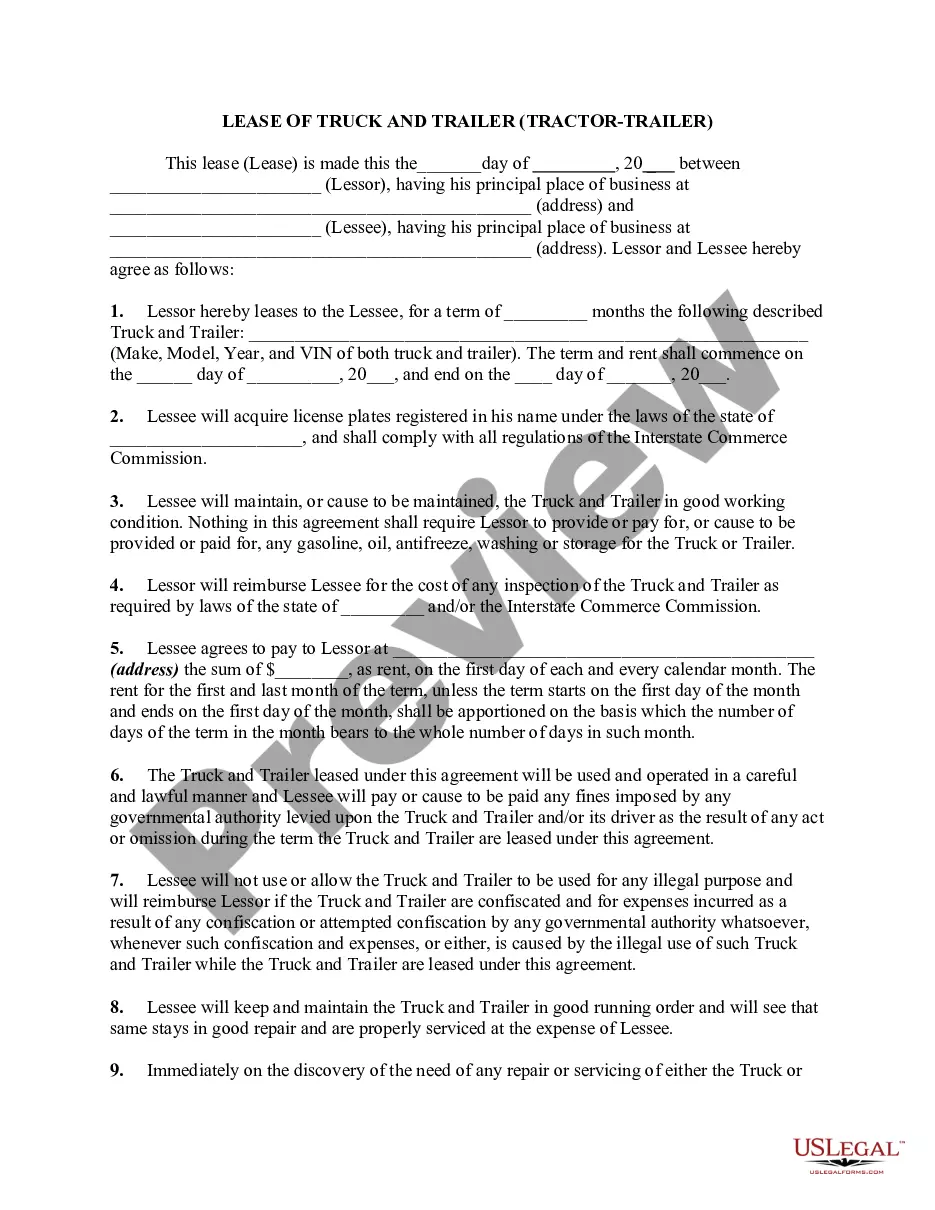

- Step 2. Use the Preview option to review the form's content. Remember to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now option. Choose your preferred pricing plan and enter your credentials to sign up for the account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to process the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, revise, and print or sign the Pennsylvania Direct Deposit Form for IRS.

Form popularity

FAQ

You can get tax forms and booklets from the IRS website, state tax offices, and various online platforms. For convenience, US Legal Forms offers a comprehensive collection of tax forms, including the Pennsylvania Direct Deposit Form for IRS. This way, you can easily access everything you need for your tax preparation in one place.

Yes, retirees may still need to file a Pennsylvania tax return depending on their income sources. If you have taxable income, including pensions or retirement distributions, you should submit the appropriate forms. Utilizing resources like US Legal Forms can streamline the process, ensuring you have the Pennsylvania Direct Deposit Form for IRS ready if you expect a refund.

You can certainly print your own tax forms, including federal and state forms. The IRS website and platforms like US Legal Forms provide downloadable versions that you can easily print. Ensure you have the latest versions of the forms to avoid any filing issues.

Yes, you can print out a direct deposit form, including the Pennsylvania Direct Deposit Form for IRS, from various online resources. Websites like US Legal Forms offer printable versions of this form to ensure you can fill it out with ease. Just make sure you have the correct information ready for a smooth printing process.

As of now, there's no official confirmation regarding a $3000 tax refund from the IRS in June 2025. Tax refund policies can change, so it's best to stay updated through the IRS website or trusted news sources. If you are preparing your taxes, ensure you have your Pennsylvania Direct Deposit Form for IRS ready to receive any potential refunds promptly.

You can obtain Pennsylvania state tax forms from the Pennsylvania Department of Revenue's official website. They offer a comprehensive range of forms, including the Pennsylvania Direct Deposit Form for IRS. Alternatively, platforms like US Legal Forms can provide these forms and allow you to complete them conveniently online.

You can find some tax forms at your local post office, but availability may vary. For a complete selection, including the Pennsylvania Direct Deposit Form for IRS, I recommend visiting the IRS website or using online services like US Legal Forms. These platforms provide easy access to all necessary tax forms and ensure you have everything you need for your filing.