Pennsylvania Corporate Resolution for LLC

Description

How to fill out Corporate Resolution For LLC?

You can dedicate numerous hours online trying to discover the appropriate legal format that satisfies the national and state criteria you require.

US Legal Forms offers thousands of legal forms that have been assessed by professionals.

You can conveniently download or print the Pennsylvania Corporate Resolution for LLC from my support.

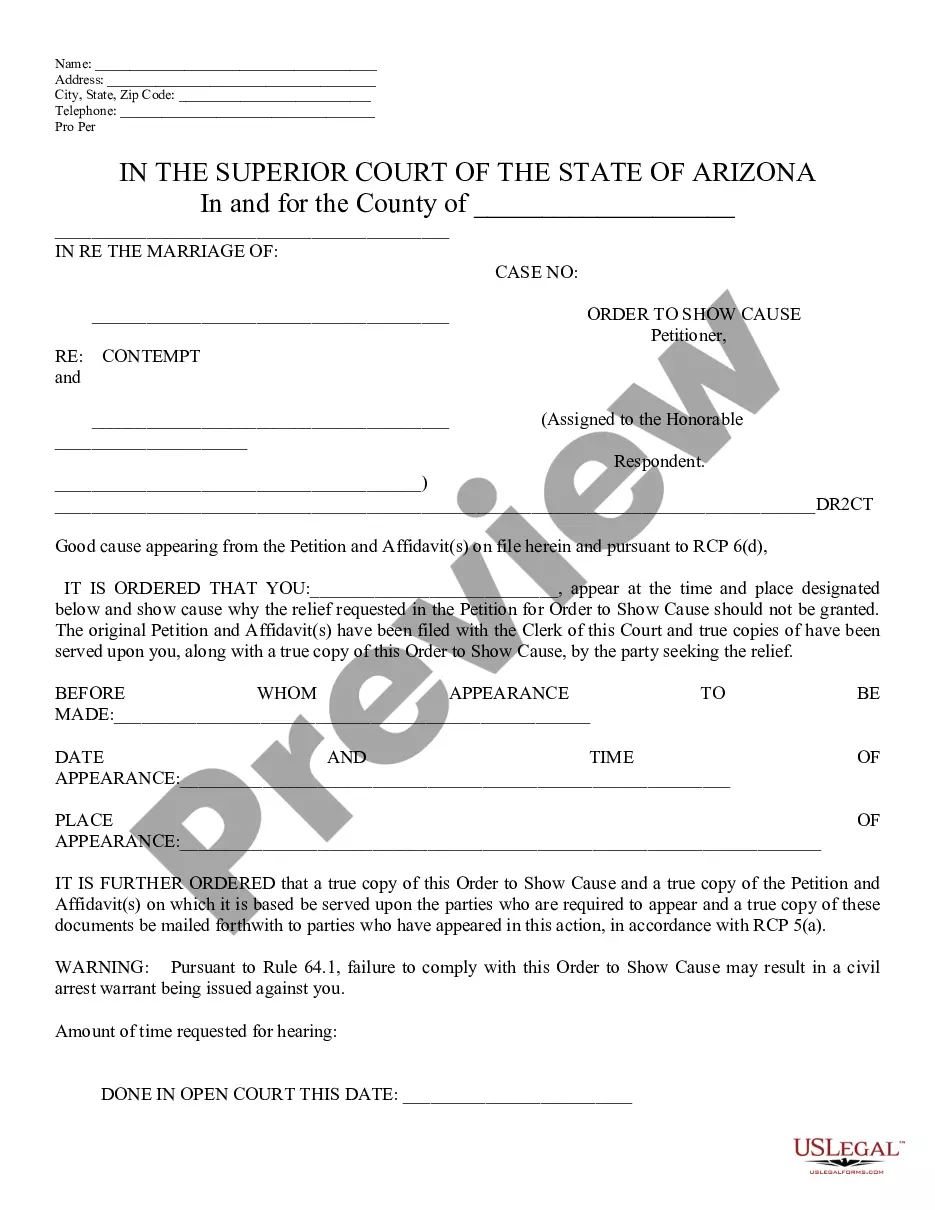

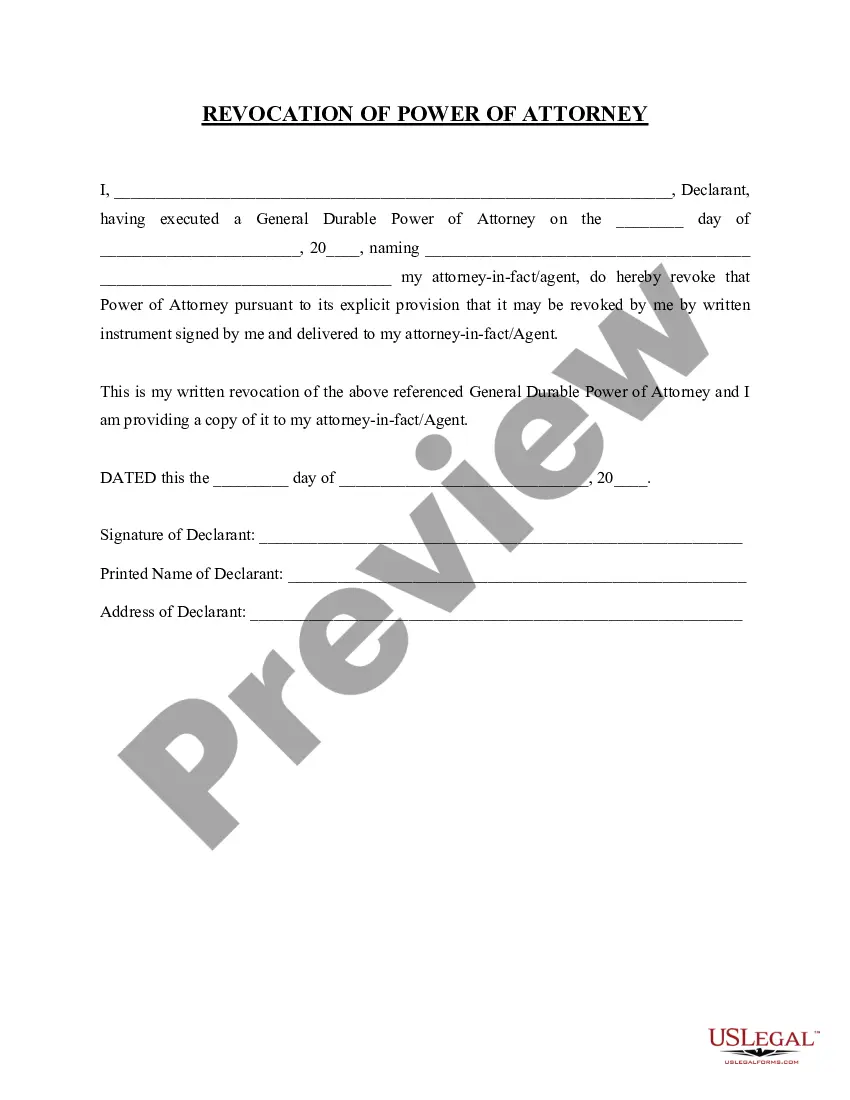

If available, utilize the Preview button to examine the format as well.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can fill out, alter, print, or sign the Pennsylvania Corporate Resolution for LLC.

- Each legal format you acquire belongs to you indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct format for the county/town of your choice.

- Review the form summary to confirm you have chosen the right form.

Form popularity

FAQ

By way of example, corporate resolutions are typically required in order for a company to open bank accounts, execute contracts, lease equipment or facilities, and many more situations where the corporation's ownership or directors must be in agreement in order to transact business.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Unlike LLCs, corporations are required to make resolutions. Therefore, they are used to preparing them when shareholders or the board of directors make decisions. Although an LLC is not required to make resolutions, there are many reasons for getting in the habit of maintaining resolutions.

Issuing corporate resolutions is one way for corporations to demonstrate independence and avoid piercing the veil. In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution is typically found in the board meeting minutes, although its form and structure can vary.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?16-Jun-2021