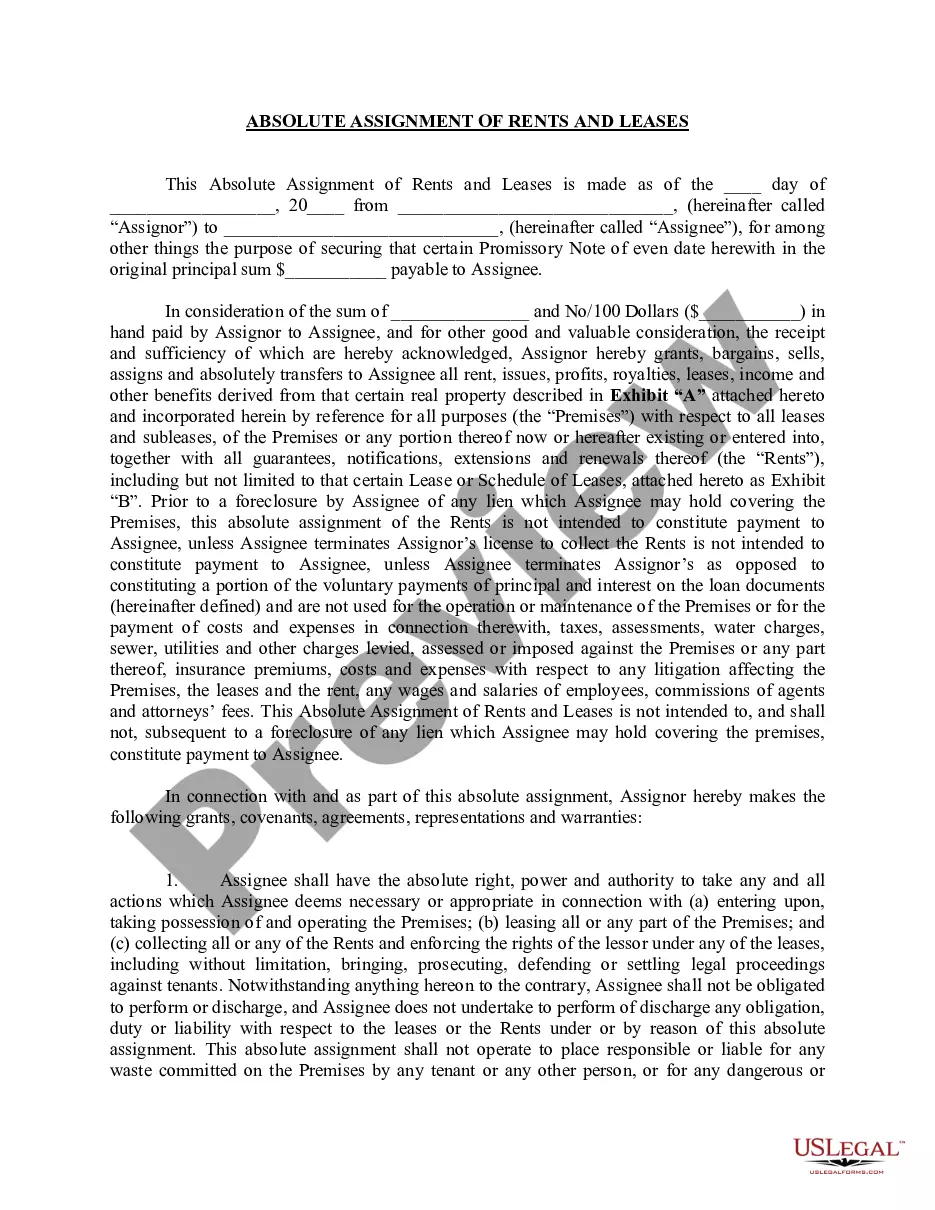

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Pennsylvania Change or Modification Agreement of Deed of Trust

Description

How to fill out Change Or Modification Agreement Of Deed Of Trust?

Are you currently in a situation where you require documents for various business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Pennsylvania Change or Modification Agreement of Deed of Trust, designed to meet federal and state requirements.

If you find the appropriate form, click on Get now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have a free account, simply Log In.

- Then, you can download the Pennsylvania Change or Modification Agreement of Deed of Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to check the form.

- Review the information to confirm you have selected the correct form.

- If the form is not what you're looking for, utilize the Lookup field to find the form that matches your needs and requirements.

Form popularity

FAQ

The 5 year rule for trusts refers to the look-back period for Medicaid eligibility, where any transfers made within five years prior to applying for benefits may affect eligibility. Understanding this rule is crucial for effective estate planning and trust management. If you're navigating a Pennsylvania Change or Modification Agreement of Deed of Trust, ensure you account for this rule to avoid potential complications.

While it is not legally required to have an attorney to transfer a deed in Pennsylvania, it is highly recommended. An attorney can help ensure that all legal requirements are met and that the transfer is executed correctly. By using a Pennsylvania Change or Modification Agreement of Deed of Trust, you can streamline this process and gain peace of mind.

You can amend a trust agreement if it is a revocable trust. Amendments allow the grantor to make changes to the trust's terms, beneficiaries, or assets. For those seeking a Pennsylvania Change or Modification Agreement of Deed of Trust, this flexibility can be beneficial to adapt to changing circumstances.

Yes, a codicil must be notarized in Pennsylvania to be considered valid. This document modifies an existing will and must follow the same formalities as the original will. Using a Pennsylvania Change or Modification Agreement of Deed of Trust ensures that any updates to your estate planning documents, including codicils, are properly executed.

Yes, a trust agreement can be changed if it is revocable. The grantor can modify the terms, add beneficiaries, or even revoke the trust altogether. If you are looking into a Pennsylvania Change or Modification Agreement of Deed of Trust, it is essential to consult with a legal expert to ensure that all modifications comply with state laws.

To change a deed in Pennsylvania, you must prepare a new deed that reflects the desired changes. This new deed must be signed, notarized, and recorded in the county where the property is located. Utilizing a Pennsylvania Change or Modification Agreement of Deed of Trust can help streamline this process and ensure all legal requirements are met.

Irrevocable trusts cannot be changed once they are established. This means that the grantor relinquishes control over the trust assets, making modifications or revocations impossible without court intervention. If you are considering a Pennsylvania Change or Modification Agreement of Deed of Trust, it's important to understand the type of trust you have and its limitations.

A trust modification typically refers to a substantial change in the terms or structure of a trust, which may require legal approval. In contrast, an amendment is often a more minor adjustment or clarification that can be made without extensive legal processes. Understanding these differences is crucial when dealing with a Pennsylvania Change or Modification Agreement of Deed of Trust, as each may have different legal implications. For tailored solutions, consider using US Legal Forms to simplify your document preparation.

In Pennsylvania, changing an irrevocable trust is quite challenging. Generally, once you establish an irrevocable trust, you cannot modify its terms without consent from all beneficiaries or through a court order. However, a Pennsylvania Change or Modification Agreement of Deed of Trust may offer a pathway for specific adjustments under certain conditions. It is advisable to consult with a legal expert to navigate these complexities.