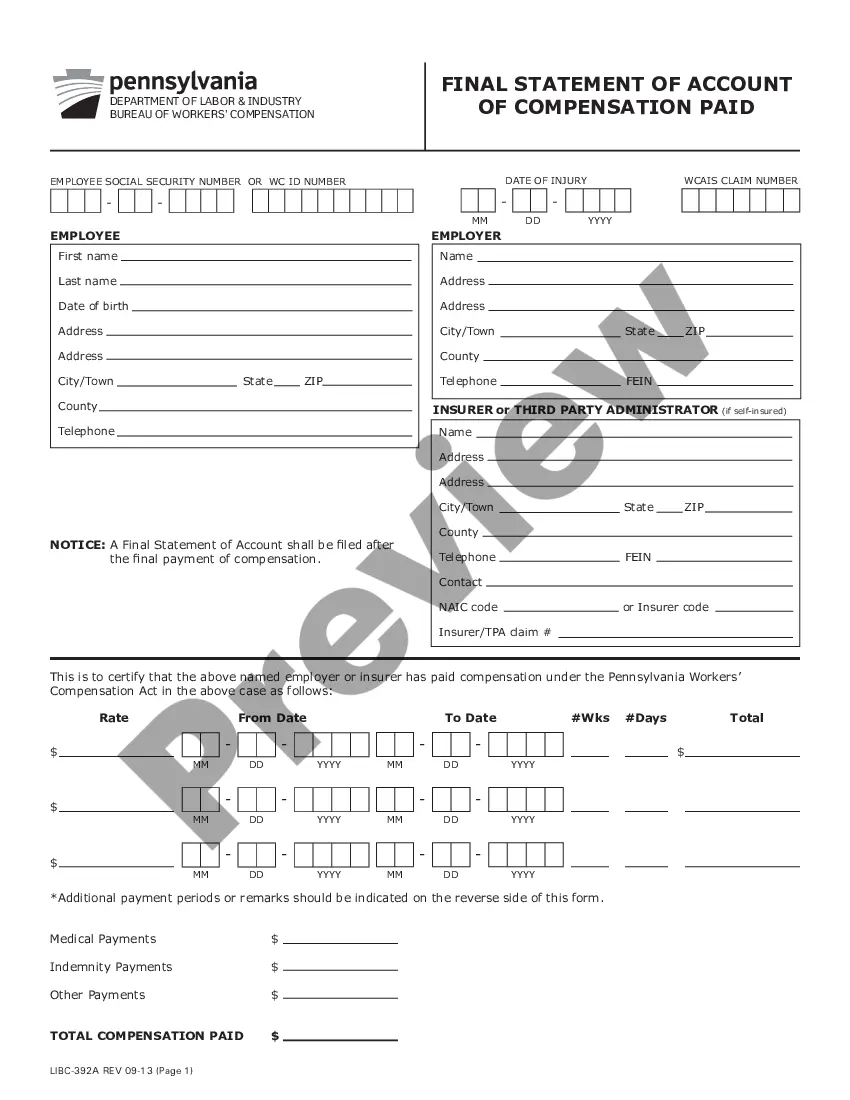

The Pennsylvania Final Statement of Account of Compensation Paid is a document provided by the Commonwealth of Pennsylvania to employers and employees in the state. This statement itemizes the wages and other compensation paid to an employee during a specific period of time. It is typically issued on a quarterly basis and provides an overview of the wages, taxes, and deductions that have been withheld from an employee's salary. There are two types of Pennsylvania Final Statements of Account of Compensation Paid: the Employer's Statement and the Employee's Statement. The Employer's Statement is issued to the employer and is used to record and reconcile the wages and taxes for each employee. The Employee's Statement is issued to the employee and is used to track the wages and deductions taken from an employee's paycheck. Both statements include information such as the employee's name, social security number, wages paid, taxes withheld, and deductions taken.

Pennsylvania Final Statement of Account of Compensation Paid

Description

How to fill out Pennsylvania Final Statement Of Account Of Compensation Paid?

Dealing with official paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Pennsylvania Final Statement of Account of Compensation Paid template from our service, you can be sure it meets federal and state regulations.

Working with our service is straightforward and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Pennsylvania Final Statement of Account of Compensation Paid within minutes:

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Pennsylvania Final Statement of Account of Compensation Paid in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Pennsylvania Final Statement of Account of Compensation Paid you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

In the typical workers' comp settlement, amounts originate from two-thirds of your average weekly pay and the 500 weeks that injured workers in Pennsylvania are eligible for benefits. For example, if two-thirds of your average weekly pay was $500, then you'll multiply $500 by 500 weeks for a total of $250,000.

How Much Money Will I get from my Workers Compensation Claim and How is it Calculated? ing to the Workers' Compensation Act, injured workers are entitled to wage-loss benefits equal to two-thirds of their weekly wage for a work-related injury.

What is a Notice of Temporary Compensation Payable? An NTCP is a form sent by your employer or their insurer to notify you that your claim has been temporarily accepted. This means that you will begin receiving compensation for medical expenses and lost wages if applicable.

If the insurance company or employer accepts your claim, then you can expect workers' compensation checks within roughly 28 days of your date of injury.

Compensation Rate Tiers Average Weekly WageCompensation RateAbove $1,807.50Flat Rate of $1,205$1,807.50 ? $903.76? of Average Weekly Wage$903.75 ? $669.44Flat Rate of $602.50Below $669.4390% of Average Weekly Wage

Under the Workers' Compensation Act, injured workers are entitled to indemnity (wage-loss) benefits equal to two-thirds of their weekly wage for a work-related injury.

1994) (?Section 204(a) prohibits, as against public policy, an employer from agreeing with his employee to hold employer harmless for any future injury the employee may suffer.?) (emphasis changed).

One thing you need to remember is that the judge won't make a decision at the final day of your workers comp hearing. It will take some time for them to formulate and write their decision. In most cases, it takes around 30 to 90 days after the last day of hearing to receive a notice of decision.