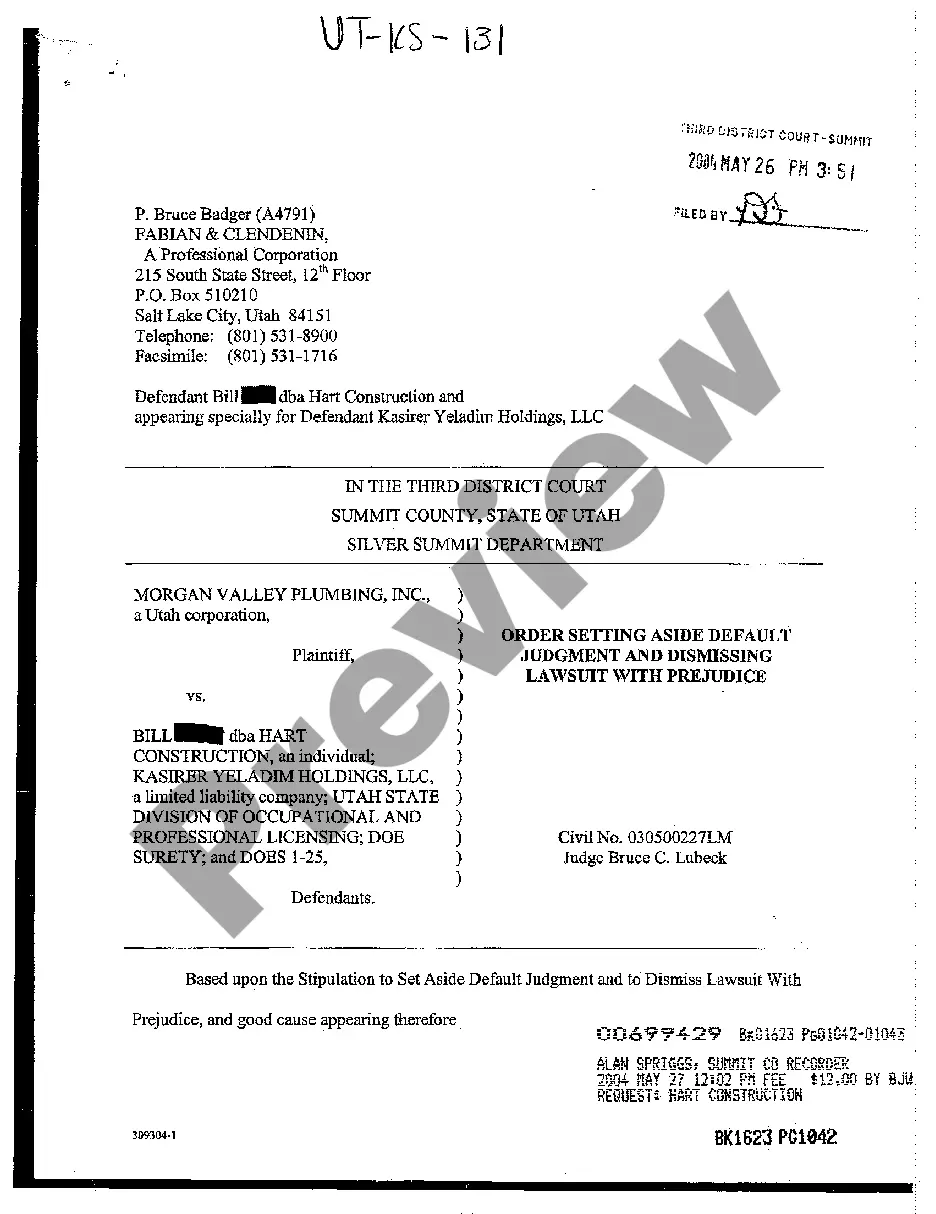

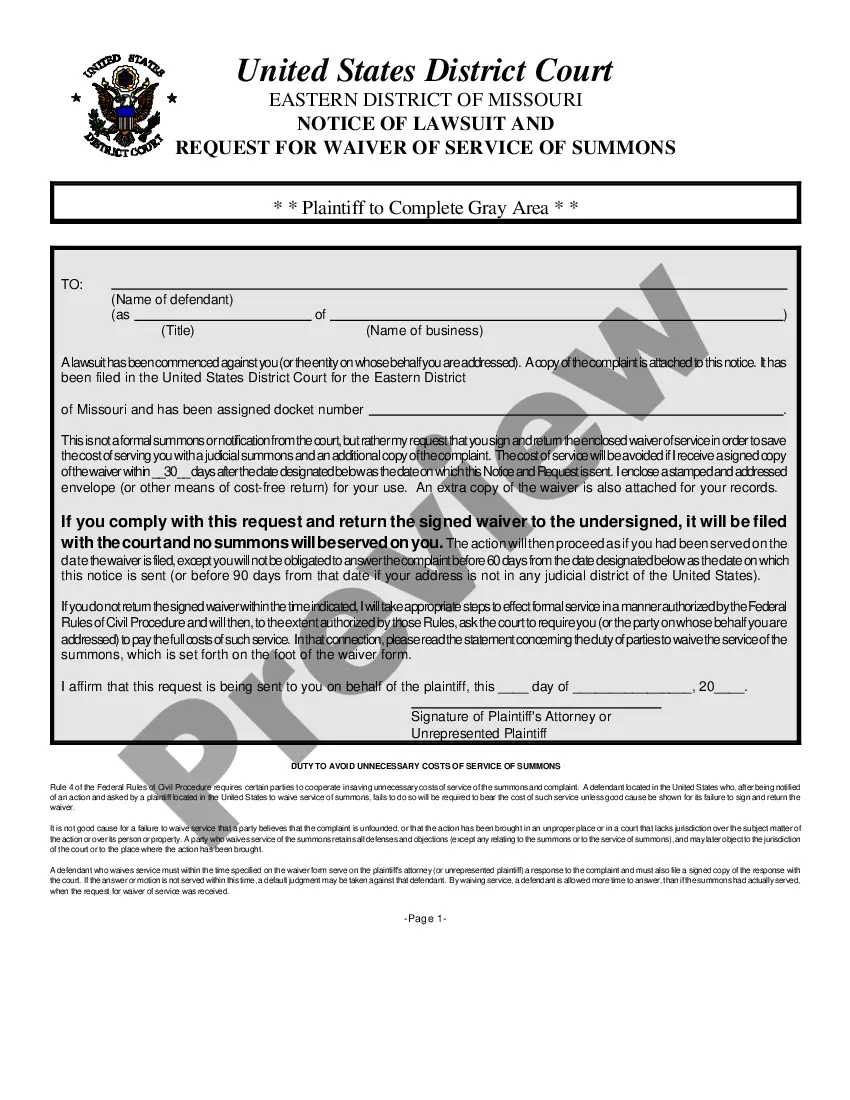

Pennsylvania REV-1737-A -- Inheritance Tax Return — Nonresident Decedent is a form used by an executor or administrator of the estate of a nonresident decedent to file a Pennsylvania inheritance tax return. This form is used to report the transfer of any assets that the decedent owned at the time of death. The form includes sections for the decedent's personal information, the executor's information, and the total value of the decedent's assets. It also includes a declaration that the executor believes that the information reported is true and accurate. The form can be filed electronically or by paper. There are three types of inheritance tax returns for nonresident decedents: Form REV-1737-A, Form REV-1737-B, and Form REV-1737-C.

Pennsylvania REV-1737-A -- Inheritance Tax Return - Nonresident Decedent

Description

How to fill out Pennsylvania REV-1737-A -- Inheritance Tax Return - Nonresident Decedent?

How much time and resources do you typically spend on composing official paperwork? There’s a better way to get such forms than hiring legal specialists or spending hours searching the web for a proper template. US Legal Forms is the premier online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Pennsylvania REV-1737-A -- Inheritance Tax Return - Nonresident Decedent.

To get and prepare a suitable Pennsylvania REV-1737-A -- Inheritance Tax Return - Nonresident Decedent template, follow these easy steps:

- Examine the form content to make sure it meets your state requirements. To do so, check the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, find another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Pennsylvania REV-1737-A -- Inheritance Tax Return - Nonresident Decedent. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your Pennsylvania REV-1737-A -- Inheritance Tax Return - Nonresident Decedent on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

An inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to PA inheritance tax. The tax is due within nine months of the decedent's death.

One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.

Use REV-1737-4, Schedule E to report any probate assets not reportable under any other schedule. Do not report a retained life estate on this schedule. See instructions for REV-1737-6, Schedule G. List and describe all tangible personal property having its situs in Pennsylvania.

Use REV-1737-7, Schedule J to report beneficiaries and their relationship to the decedent. IMPORTANT: When flat rate is elected, list beneficia- ries of ONLY Pennsylvania property. When propor- tionate method is elected, list all beneficiaries.

In the case of a nonresident decedent, all real property and tangible personal property located in Pennsylvania at the time of the decedent's death is taxable. Intangible personal property of a nonresident decedent is not taxable.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

In California, there is no state-level estate or inheritance tax. If you are a California resident, you do not need to worry about paying an inheritance tax on the money you inherit from a deceased individual. As of 2023, only six states require an inheritance tax on people who inherit money.

Use REV-1737-6, Schedule G to report transfers made by decedent during life, by trust or otherwise, to the extent they were made without valuable and adequate consideration in money or money's worth at the time of transfer.