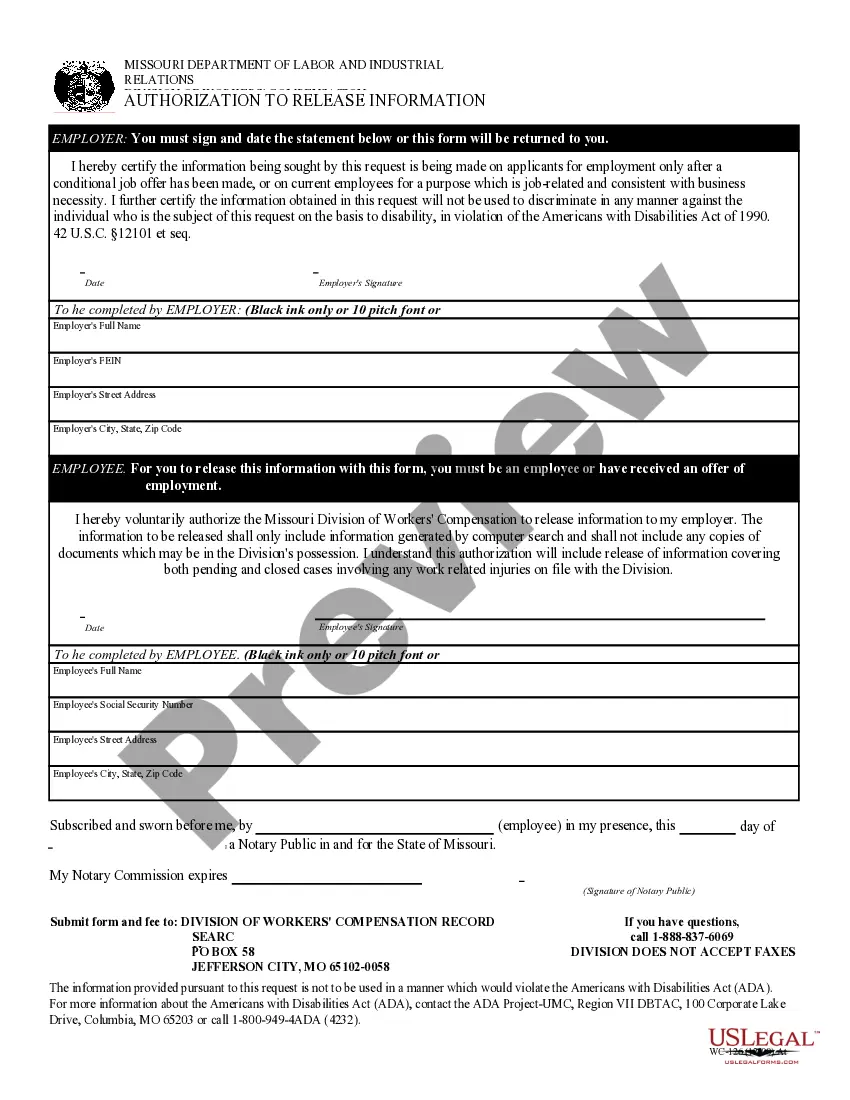

Pennsylvania REV-1511 -- Schedule H — Funeral Expenses and Administrative Costs is a form that is used to report funeral expenses and administrative costs for the death of an individual and to claim a credit against the Pennsylvania Inheritance Tax. This form is used to claim a credit against the Pennsylvania Inheritance Tax for those funeral expenses and administrative costs incurred due to the death of an individual. The types of Pennsylvania REV-1511 -- Schedule H — Funeral Expenses and Administrative Costs are: Funeral Expenses, Administrative Costs, and Cemetery Costs.

Pennsylvania REV-1511 -- Schedule H - Funeral Expenses and Administrative Costs

Description

How to fill out Pennsylvania REV-1511 -- Schedule H - Funeral Expenses And Administrative Costs?

How much time and resources do you often spend on drafting formal paperwork? There’s a better option to get such forms than hiring legal experts or wasting hours searching the web for a proper template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Pennsylvania REV-1511 -- Schedule H - Funeral Expenses and Administrative Costs.

To obtain and prepare an appropriate Pennsylvania REV-1511 -- Schedule H - Funeral Expenses and Administrative Costs template, adhere to these simple steps:

- Look through the form content to make sure it meets your state requirements. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, locate another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Pennsylvania REV-1511 -- Schedule H - Funeral Expenses and Administrative Costs. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally safe for that.

- Download your Pennsylvania REV-1511 -- Schedule H - Funeral Expenses and Administrative Costs on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

Funeral and related expenses paid after death are allowable. However, the only travel and lodging expenses allowable are those of the executor or administrator of the estate and not for anyone else.

Another way to trigger the inheritance tax in Pennsylvania is to own real estate or tangible personal property that is located within the state. Therefore, if your relative lived outside of the state but bestowed upon you property that was within Pennsylvania, you are subject to the inheritance tax.

Funeral expenses should be itemized on Line 1, Section A, and the total of the expense should be entered under ?Total.? If the estate was reimbursed for any of the funeral costs, the reimbursed amount must be deducted from your total expenses before claiming them on Form 706.

If you choose to deduct them on the estate tax return, you cannot deduct them on a Form 1041 filed for the estate. Funeral expenses are only deductible on the estate tax return.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

The Bottom Line of Funeral Expense Tax Deductions Funeral and burial expenses are only tax-deductible when paid by the decedent's estate, and the executor of the estate must file an estate tax return and itemize the expenses in order to claim the deduction.

Tax-deductible funeral expenses Casket or urn. Burial plot and burial (internment) Green burial services. Tombstone, gravestone or other grave markers.

What deductions are available to reduce the Estate Tax? Charitable Deduction: If the decedent leaves property to a qualifying charity, it is deductible from the gross estate. Mortgages and Debt. Administration expenses of the estate. Losses during estate administration.