Pennsylvania REV-1510 -- Schedule G Interviewsos Transfers and Misc. Non-Probate Property is a form used by Pennsylvania residents to report non-probate transfers of property, including interviews transfers, transfers of powers of appointment, transfers of life insurance policies, and transfers of joint and survivor accounts. This form is used to report the transfer of property to another person prior to the death of the owner, without going through the probate process. Types of Pennsylvania REV-1510 -- Schedule G Interviewsos Transfers and Misc. Non-Probate Property include interviews transfers, transfers of powers of appointment, transfers of life insurance policies, and transfers of joint and survivor accounts.

Pennsylvania REV-1510 -- Schedule G - Inter-Vivos Transfers and Misc. Non-Probate Property

Description

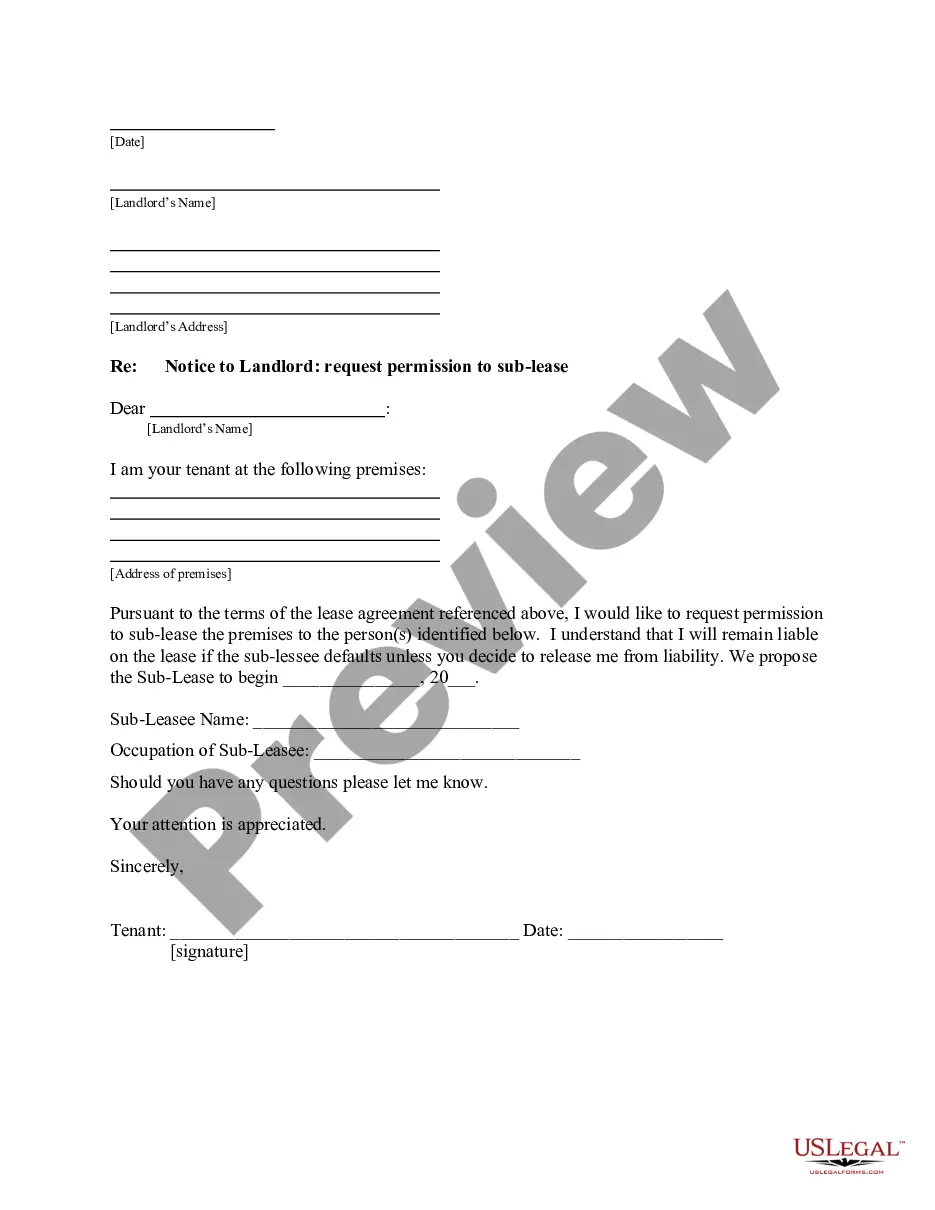

How to fill out Pennsylvania REV-1510 -- Schedule G - Inter-Vivos Transfers And Misc. Non-Probate Property?

Handling legal paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Pennsylvania REV-1510 -- Schedule G - Inter-Vivos Transfers and Misc. Non-Probate Property template from our library, you can be sure it complies with federal and state regulations.

Working with our service is simple and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Pennsylvania REV-1510 -- Schedule G - Inter-Vivos Transfers and Misc. Non-Probate Property within minutes:

- Remember to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Pennsylvania REV-1510 -- Schedule G - Inter-Vivos Transfers and Misc. Non-Probate Property in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Pennsylvania REV-1510 -- Schedule G - Inter-Vivos Transfers and Misc. Non-Probate Property you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Non-probate assets are generally includable in your estate for federal estate tax purposes and for New Jersey and Pennsylvania inheritance tax purposes.

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

Use PA Schedule G-L to calculate and report the amount of resident credit claimed for income tax, wage tax or other tax (measured by gross or net earned or unearned income) paid to another state when the other state imposes its tax on income also subject to PA personal income tax in the same taxable year.

As a result of the life estate interest, the property value will be subject to PA Inheritance Tax upon the death of the life tenant. PA has varying tax rates depending on how the decedent is related to the person inheriting.

Probate is the process through which a court determines how to distribute your property after you die. Some assets are distributed to heirs by the court (probate assets), and some assets bypass the court process and go directly to your beneficiaries (non-probate assets).

Properties that are eligible for inheritance tax in Pennsylvania. All the decedent's tangible property, including but not limited to cash, furniture, automobiles, jewelry, antiques and more that are located within the state of Pennsylvania at the time of the decedent's passing, are eligible for inheritance tax.

Assets Owned In a Revocable Trust: Generally, if someone dies owning assets in a revocable trust over which he or she had access and control those assets, those assets will be 100% taxable for Pennsylvania inheritance tax purposes.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.