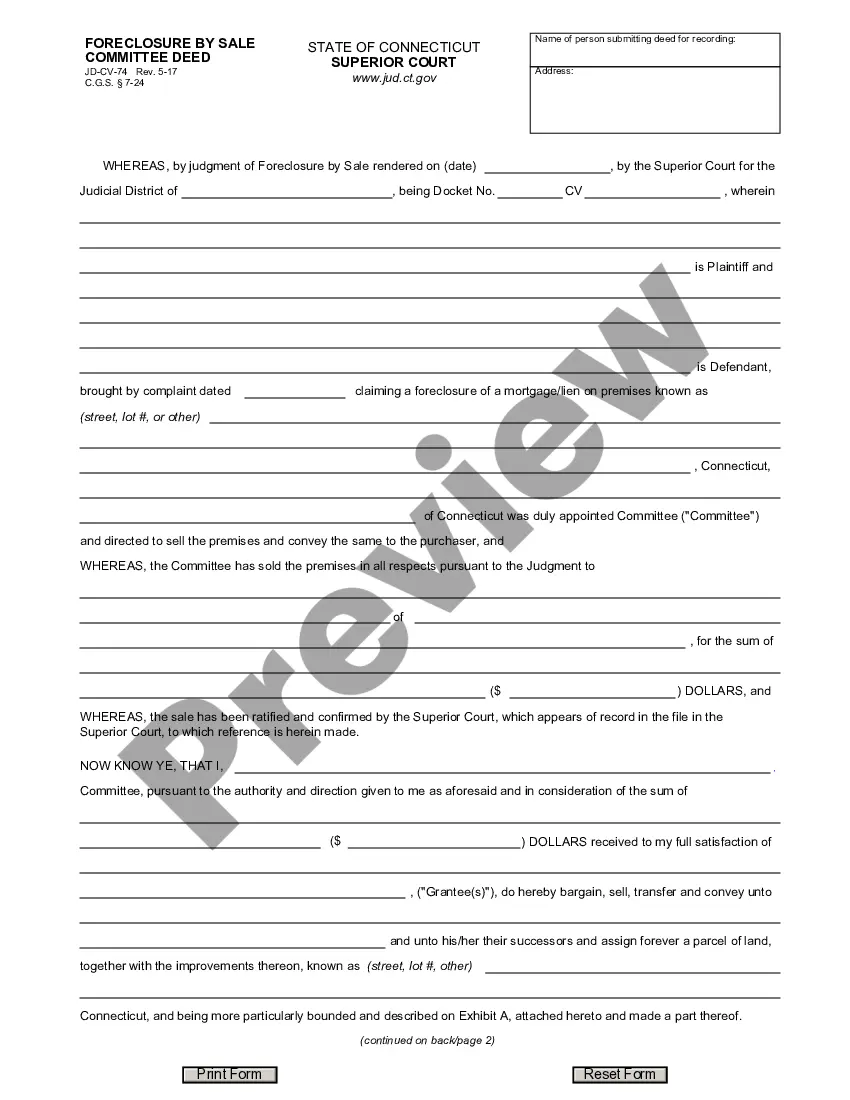

Pennsylvania Inventory Statement is a form used by Pennsylvania businesses to report their inventory on hand for the reporting period. It is used to calculate the inventory tax due to the state. There are two types of Pennsylvania Inventory Statements: Annual Inventory Statement and Quarterly Inventory Statement. The Annual Inventory Statement is used to report the ending inventory on hand for the prior year. It is used to calculate the annual inventory tax due for the year. This statement is due by April 15 of each year. The Quarterly Inventory Statement is used to report the ending inventory on hand for the current year. It is used to calculate the quarterly inventory tax due for the quarter. This statement is due by the 15th day of the month following the end of the quarter. The Pennsylvania Inventory Statement requires businesses to include detailed information such as the cost of goods sold, beginning inventory, purchases, and ending inventory. The statement must be signed and dated by the business owner.

Pennsylvania iNVENTORY STATEMENT

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Pennsylvania INVENTORY STATEMENT?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state regulations and are checked by our specialists. So if you need to fill out Pennsylvania iNVENTORY STATEMENT, our service is the perfect place to download it.

Getting your Pennsylvania iNVENTORY STATEMENT from our service is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they find the proper template. Later, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and fulfills your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Pennsylvania iNVENTORY STATEMENT and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

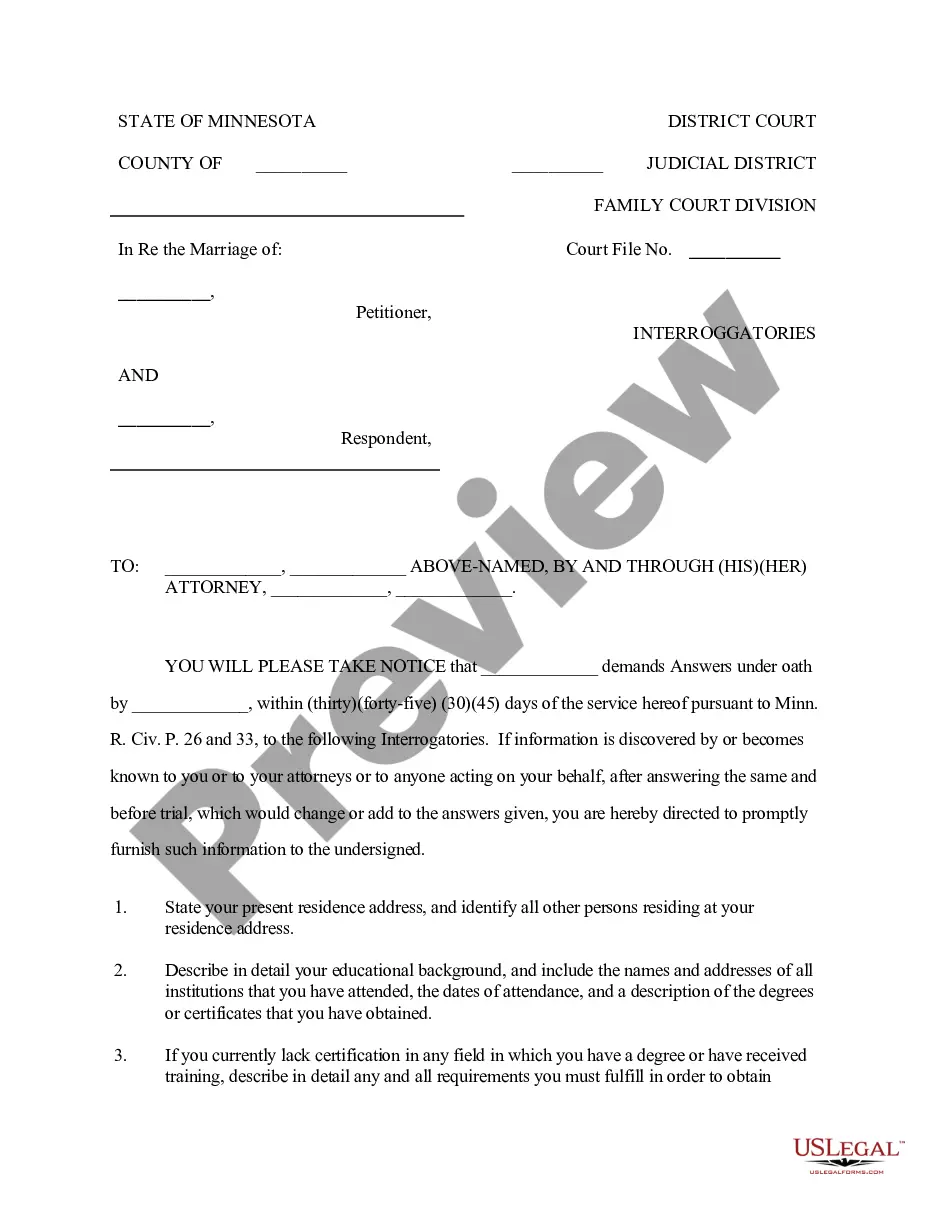

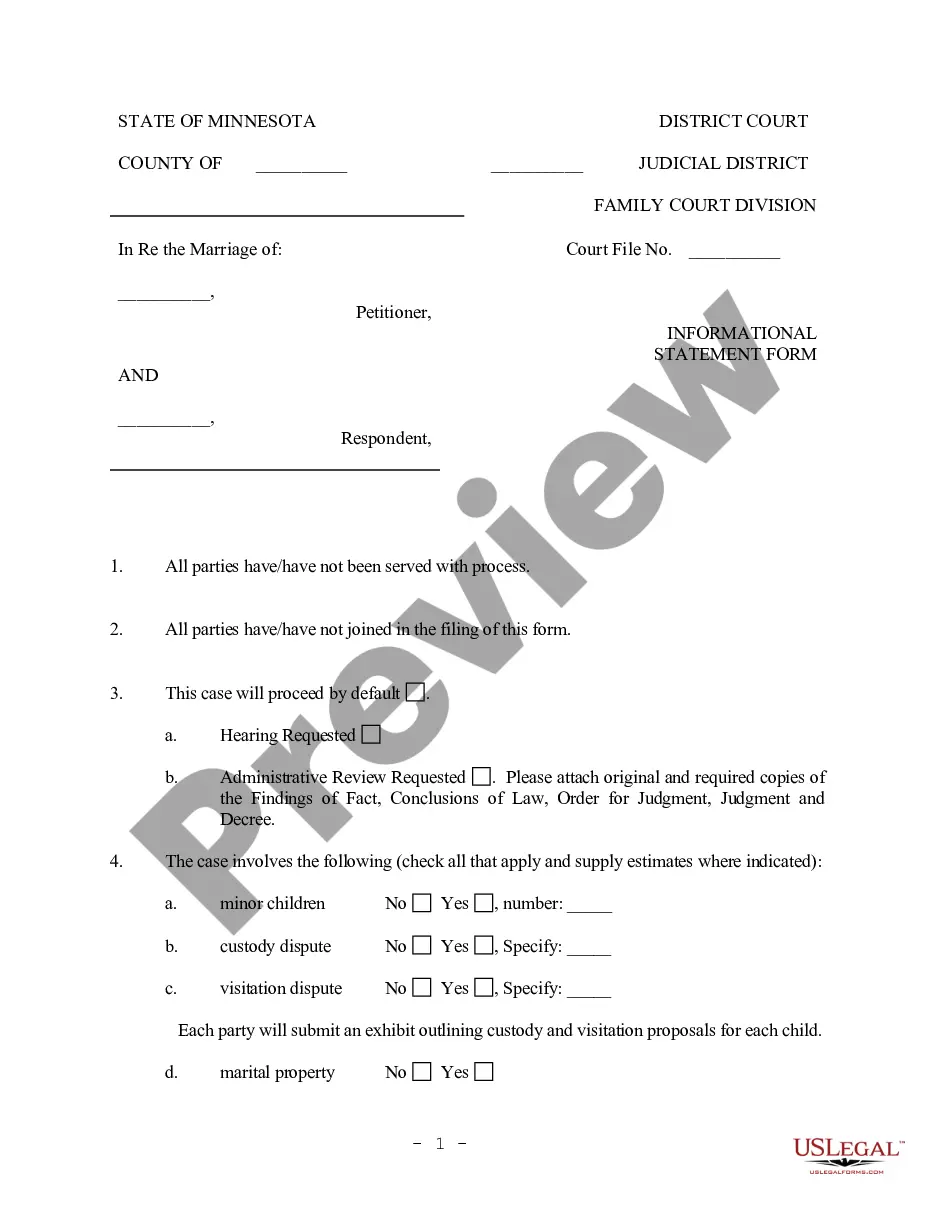

Rule 1920.33(f) - Pre-Hearing Statement Deadline (1) Pre-hearing statements shall be filed no later than 30 days from the date of filing of an application for non-record hearing by the master unless: (a) The moving party demands a 60 day deadline. (b) The non-moving party files a demand for a 60 day deadline.

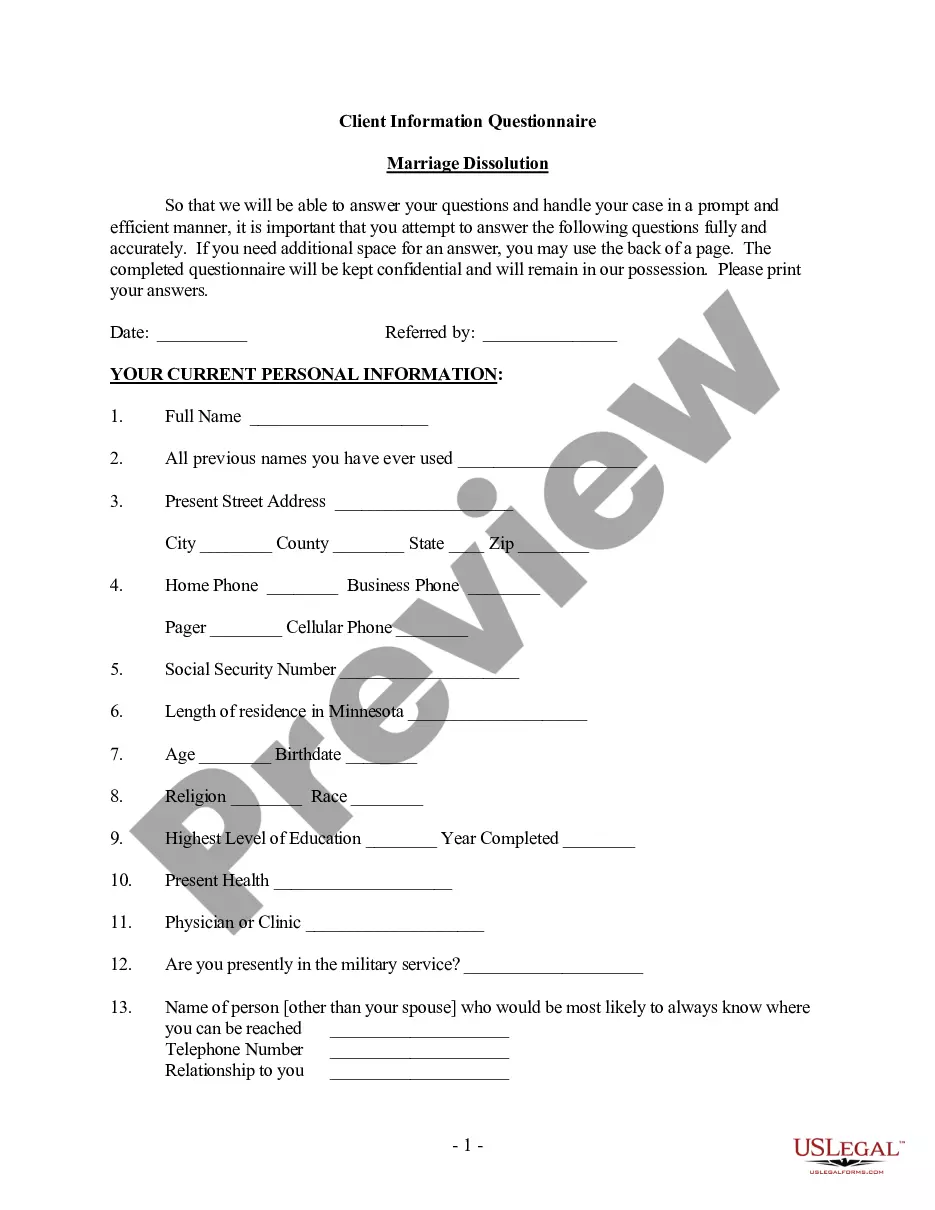

In simple terms, an estate inventory includes all of the assets of an estate belonging to someone who's passed away. This inventory can also include a listing of the person's liabilities or debts.

An estate asset is property that was owned by the deceased at the time of death. Examples include bank accounts, investments, retirement savings, real estate, artwork, jewellery, a business, a corporation, household furnishings, vehicles, computers, smartphones, and any debts owed to the deceased.

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

6 types of non probate assets Property. Most personal property, such as real estate, jewelry, or furniture will become probate assets by default.Bank accounts.Retirement benefits.Life insurance policies.Any other assets that are owned jointly with others.Any other assets that have post-death designation in place.

An estate inventory will include accounts like bank accounts, checking accounts, investment accounts, money market accounts, savings accounts, and CDs. They will also include real estate, household items, and personal effects. Business interests, copyrights, patents, and trademarks should be included if they exist.