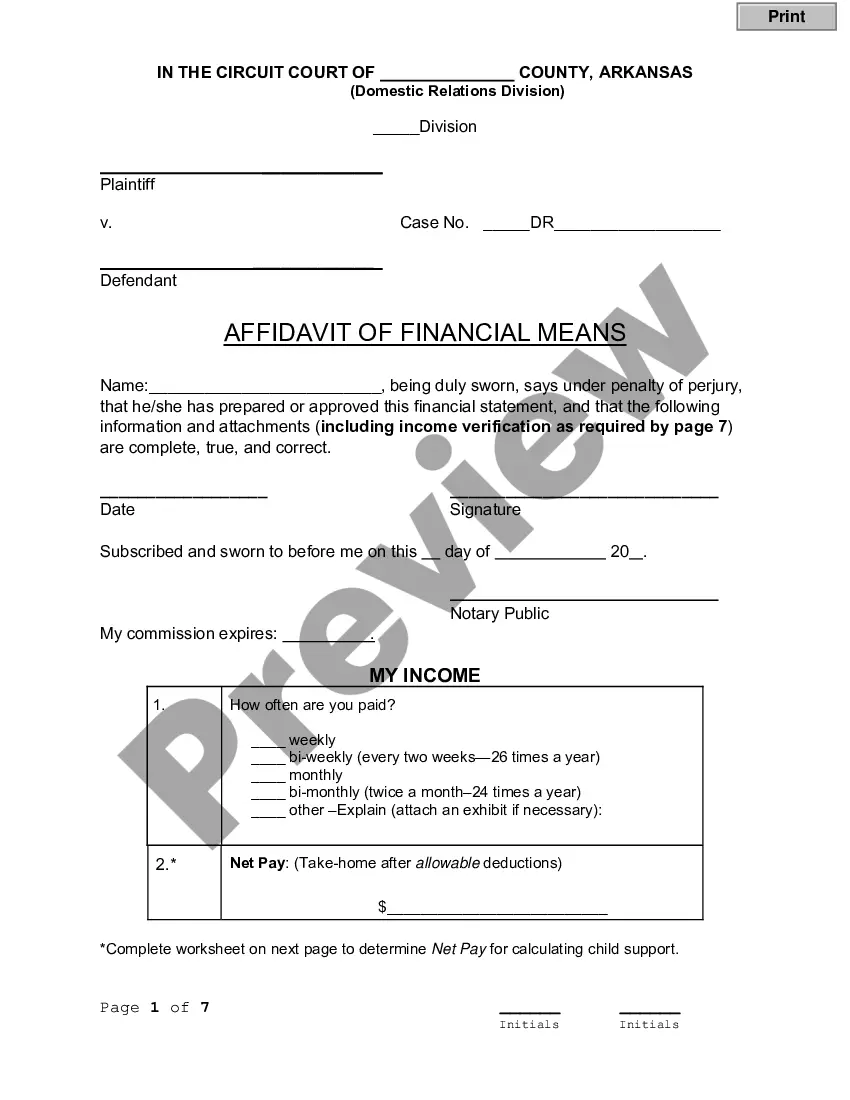

The Pennsylvania Notice of Intent to Attach Wages, Salary or Commissions is a legal document used by a creditor to demand payment from a debtor. The document is served to an employer and informs them that the debtor’s wages or salary will be attached to satisfy the debt. The document includes the creditor’s name, address, and a statement of the amount, and a description of the debt. The Notice of Intent to Attach Wages, Salary or Commissions must include the debtor’s name, address, and Social Security Number. There are two types of Pennsylvania Notice of Intent to Attach Wages, Salary or Commissions: a Notice of Intent to Attach Wages and a Notice of Intent to Attach Salary or Commissions. The Notice of Intent to Attach Wages is used to attach the debtor’s wages for payment of the debt. The Notice of Intent to Attach Salary or Commissions is used to attach the debtor’s salary or commissions for payment of the debt.

Pennsylvania Notice of Intent to Attach Wages, Salary or Commissions

Description

How to fill out Pennsylvania Notice Of Intent To Attach Wages, Salary Or Commissions?

How much time and resources do you normally spend on drafting official documentation? There’s a better opportunity to get such forms than hiring legal specialists or wasting hours searching the web for a suitable template. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Pennsylvania Notice of Intent to Attach Wages, Salary or Commissions.

To obtain and prepare a suitable Pennsylvania Notice of Intent to Attach Wages, Salary or Commissions template, adhere to these simple steps:

- Examine the form content to ensure it meets your state laws. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your requirements, find a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Pennsylvania Notice of Intent to Attach Wages, Salary or Commissions. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally reliable for that.

- Download your Pennsylvania Notice of Intent to Attach Wages, Salary or Commissions on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trusted web solutions. Join us today!

Form popularity

FAQ

Many consumers in Pennsylvania worry that their wages may be garnished for credit card debt. Luckily for Pennsylvanians, wages cannot be garnished to pay credit card debt. In fact, credit card companies and debt collectors in Pennsylvania cannot even threaten to garnish your wages.

Under state law, wages in Pennsylvania can only be garnished for the following types of debt: Back residential rent. Child support.

The Department of Revenue is authorized under Act 46 of 2003 to collect unpaid taxes by garnishing the wages of delinquent taxpayers. Under the act, the PA Department of Revenue can order an employer to withhold up to 10 percent of a taxpayer's gross wages and remit them to the department to pay delinquent state taxes.

Pennsylvania Wage Garnishment Process. A landlord, creditor, debt collector, or debt buyer must get a Pennsylvania court order with a judgment to garnish your wages. To get a court order, the creditor must go to court and start a lawsuit.

A "wage garnishment," sometimes called a "wage attachment," is an order requiring your employer to withhold a certain amount of money from your pay and send it directly to one of your creditors. In most cases, a creditor can't garnish your wages without first getting a money judgment from a court.

If the medical bill is yours, it is accurate, and you owe the money, then debt collectors can contact you to try to collect it. They may sue you to recover the money?and if they win the lawsuit, they could garnish your wages or place a lien on your home.

To repeat, spousal joint accounts are protected from garnishments unless the creditor is able to obtain a judgment against both spouses. On the other hand, a joint account with someone who is not your spouse can be garnished (only after a judgment is entered).

A "wage garnishment," sometimes called a "wage attachment," is an order requiring your employer to withhold a certain amount of money from your pay and send it directly to one of your creditors. In most cases, a creditor can't garnish your wages without first getting a money judgment from a court.