Pennsylvania Mortgage Foreclosure Conference Order (106.6 KiB) is a document issued by the Pennsylvania Supreme Court that requires lenders to participate in a foreclosure mediation conference prior to foreclosing on a residential property. The order requires that a mediation conference be held in order for a lender to proceed with foreclosure proceedings. The document also outlines the procedures and requirements for the conference, including the parties to be involved, the process for selecting a mediator, the timeline for the conference, and other details. There are two types of Pennsylvania Mortgage Foreclosure Conference Order (106.6 KiB): one for judicial foreclosure proceedings and one for non-judicial foreclosure proceedings.

Pennsylvania Mortgage Foreclosure Conference Order (106.6 KiB)

Description

How to fill out Pennsylvania Mortgage Foreclosure Conference Order (106.6 KiB)?

If you’re searching for a way to properly prepare the Pennsylvania Mortgage Foreclosure Conference Order (106.6 KiB) without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business scenario. Every piece of paperwork you find on our online service is created in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these straightforward guidelines on how to obtain the ready-to-use Pennsylvania Mortgage Foreclosure Conference Order (106.6 KiB):

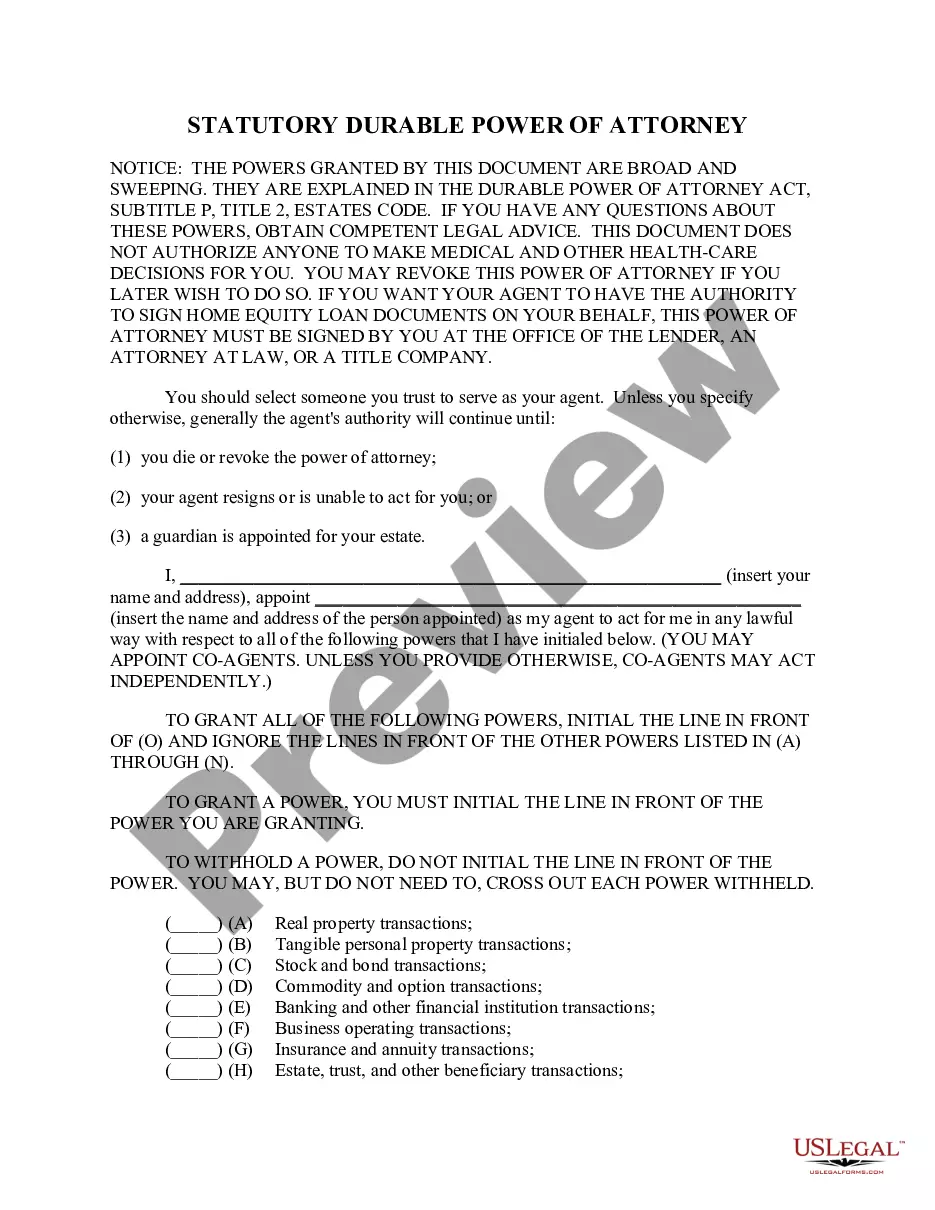

- Ensure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and choose your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Pennsylvania Mortgage Foreclosure Conference Order (106.6 KiB) and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

The state of Pennsylvania has no legal requirement for a mortgage lender to foreclose within a stipulated period after a default. However, it's argued that mortgages signed under seal should have a 20-year statute of limitations.

The statute of limitations for such documents is 20 years unless some other statute sets a different time. Mortgage loans. The state of Pennsylvania has no legal requirement for a mortgage lender to foreclose within a stipulated period after a default.

An Act 91 notice is the signal of the beginning stages of a mortgage foreclosure. Pennsylvania is a judicial state regarding mortgage foreclosures. This means that all paperwork from a mortgage servicer needs to be sent officially and through the court system.

There is no right of redemption in Pennsylvania for mortgage foreclosure properties. A property located in Philadelphia must be redeemed within nine months from the date the sheriff transfers the deed. Outside of Philadelphia, the right to redeem is lost once the sheriff transfers the deed.

Pennsylvania judgments are valid for 5 years. Judgments can be revived every 5 years and should be revived if a creditor is attempting to actively collect on the debt. Judgments also act as a lien against real property for up to 20 years or longer if properly revived.

Statute of Limitations in Pennsylvania Pennsylvania statute of limitations for a debt collector to take someone to court, is four years after the first missed payment. This doesn't mean, however, the debt collector has to stop seeking payment. It just means they can't sue for payment.

How Can I Stop a Foreclosure in Pennsylvania? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.

There is no set timeline for a foreclosure in PA. The specifics of your case and the court's agenda may add or subtract a few weeks from the timeline. Typically, you can expect 120 days to pass before an uncontested foreclosure is finalized.