The Pennsylvania List of 2017/2018 Audit Dates and Last Day to File Accounts includes dates for the filing of financial statements and other documents for various entities. The list is broken down into four categories: Corporations, Limited Partnerships, Charitable Organizations, and Professional Service Corporations. For Corporations, the Last Day to file financial statements and other documents is April 15, 2018. Audits for Corporations must be completed by April 30, 2018. For Limited Partnerships, the Last Day to file financial statements and other documents is April 15, 2018. Audits for Limited Partnerships must be completed by April 30, 2018. For Charitable Organizations, the Last Day to file financial statements and other documents is August 15, 2018. Audits for Charitable Organizations must be completed by August 31, 2018. For Professional Service Corporations, the Last Day to file financial statements and other documents is August 15, 2018. Audits for Professional Service Corporations must be completed by August 31, 2018. In all cases, the Pennsylvania List of 2017/2018 Audit Dates and Last Day to File Accounts is subject to change. It is important for entities to stay up-to-date with the latest filing requirements.

Pennsylvania List of 2017/2018 Audit dates and last day to file accounts

Description

How to fill out Pennsylvania List Of 2017/2018 Audit Dates And Last Day To File Accounts?

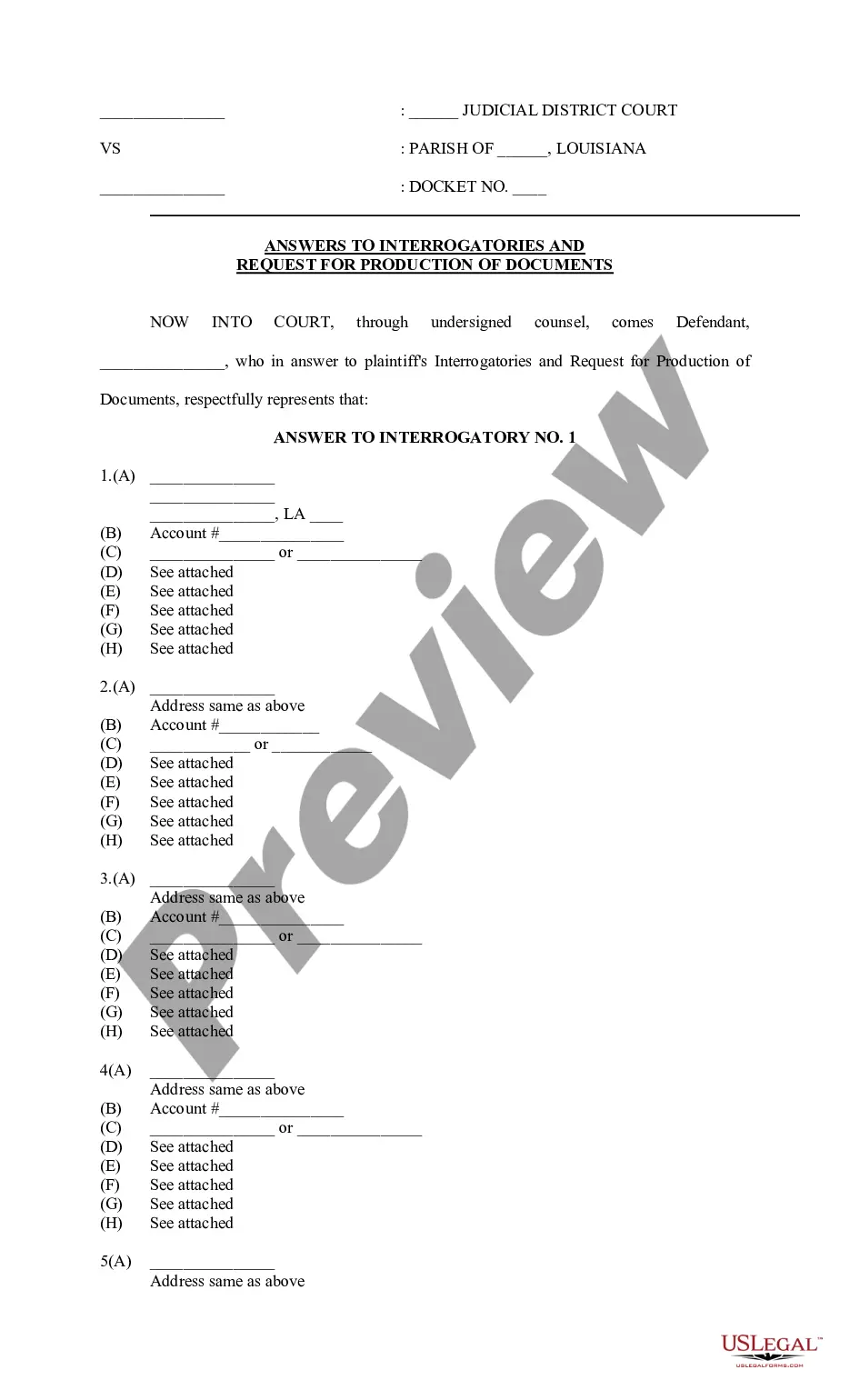

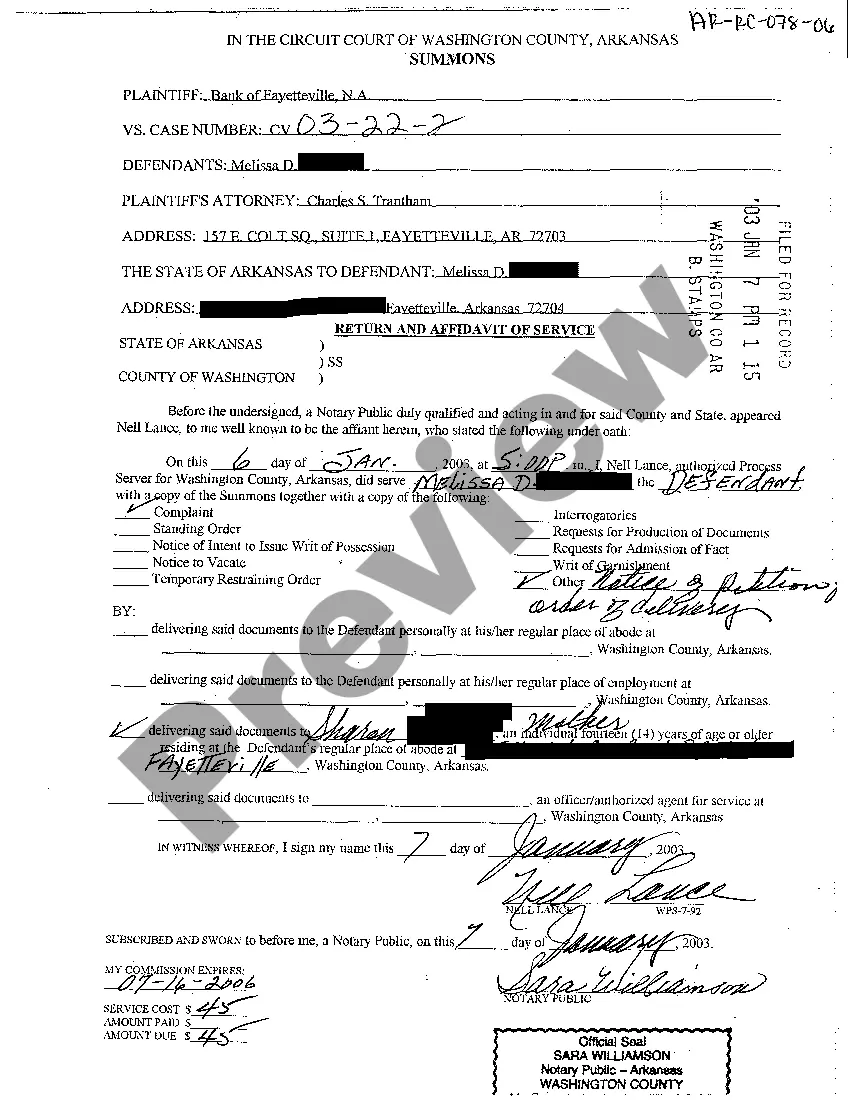

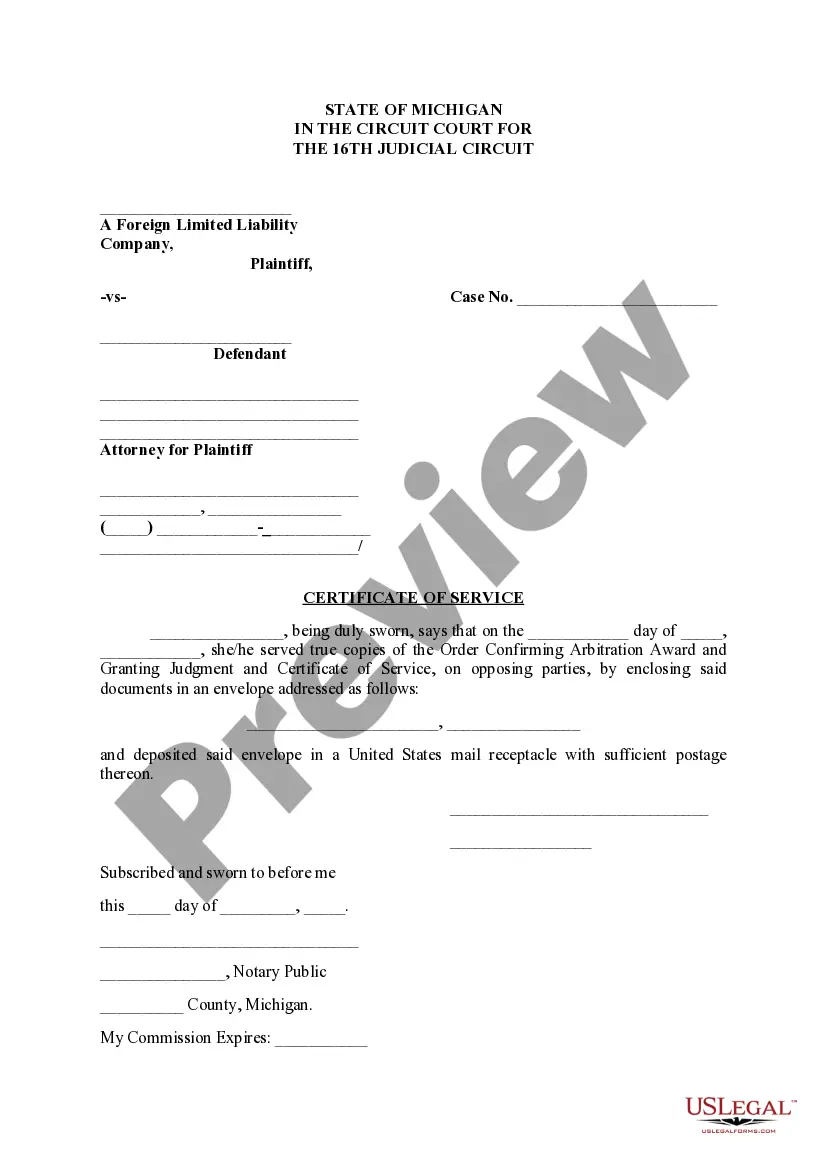

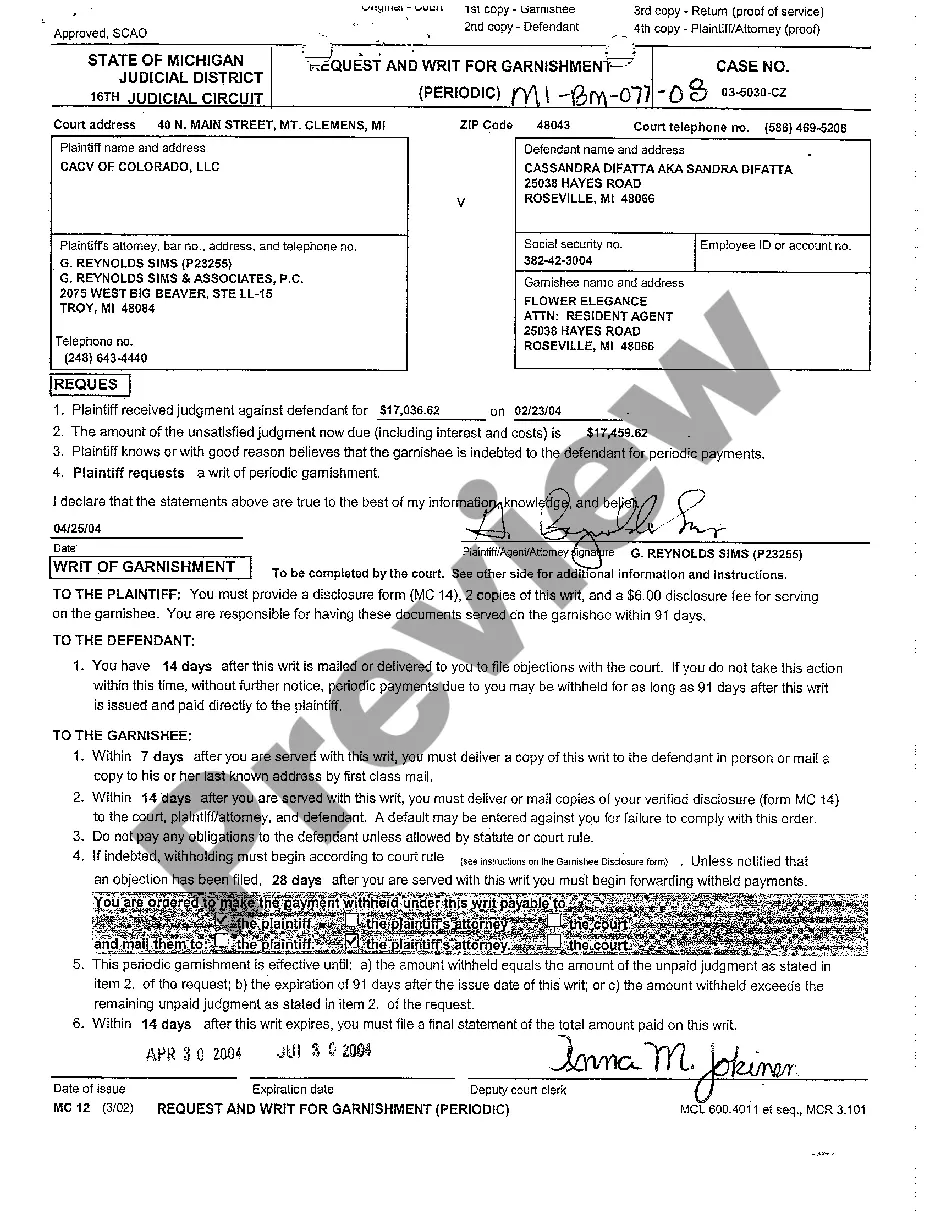

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state regulations and are examined by our specialists. So if you need to fill out Pennsylvania List of 2017/2018 Audit dates and last day to file accounts, our service is the perfect place to download it.

Obtaining your Pennsylvania List of 2017/2018 Audit dates and last day to file accounts from our catalog is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they locate the correct template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance verification. You should attentively examine the content of the form you want and make sure whether it satisfies your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now when you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Pennsylvania List of 2017/2018 Audit dates and last day to file accounts and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Pennsylvania has a 6.00 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.34 percent. Pennsylvania's tax system ranks 33rd overall on our 2023 State Business Tax Climate Index.

Flat rate (percentage): Multiply the flat rate by the employee's taxable wages. Dollar amount: Subtract the dollar amount from the employee's taxable income. Progressive rate: Use tax withholding tables to determine employee's local withholding.

Taxes in Pennsylvania State Income tax: 3.07% flat rate. Local Income tax: 0% - 3.79% Sales tax: 6% - 8% Property tax: 1.36% average effective rate. Gas tax: None.

An individual employee's local Earned Income Tax (EIT) Rate is determined by comparing the employee's ?Total Resident EIT Rate? (for the municipality in which the employee lives) to the ?Work Location Non-Resident EIT Rate? (for the municipality in which the employee works).

If the tax is withheld in another PA community where I work, do I also pay the PA District in which I live? No. Generally the tax withheld by your employer will be remitted to your resident jurisdiction. However, you are still required to file an annual tax return with your resident taxing jurisdiction.

Pennsylvania 72 P.S. 7258 defines the statute of limitations for sales tax assessment as 3 years from the later of the return filing date or the end of the year in which the liability arose.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a

PSD Codes (political subdivision codes) are six-digit numbers that uniquely identify each municipality?township, borough, city?in Pennsylvania.