Michigan Request And Writ for Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

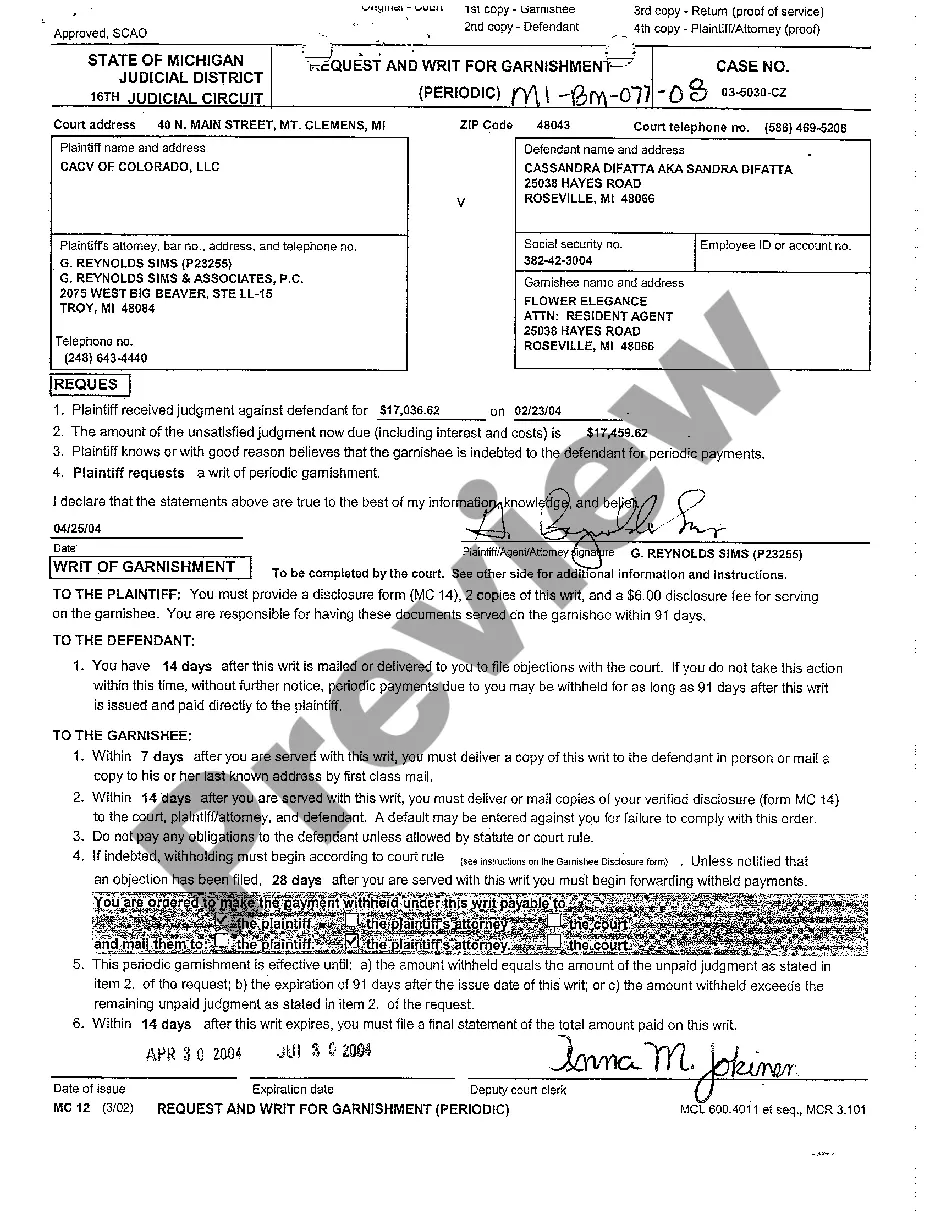

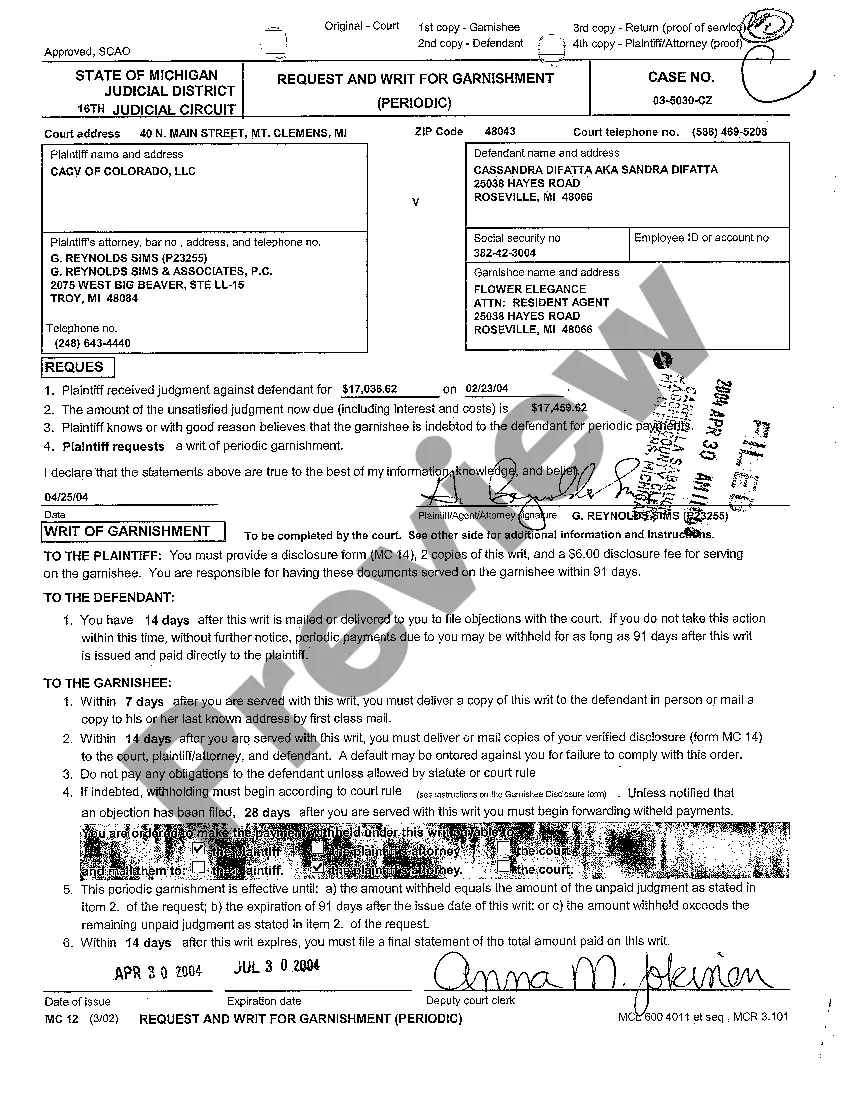

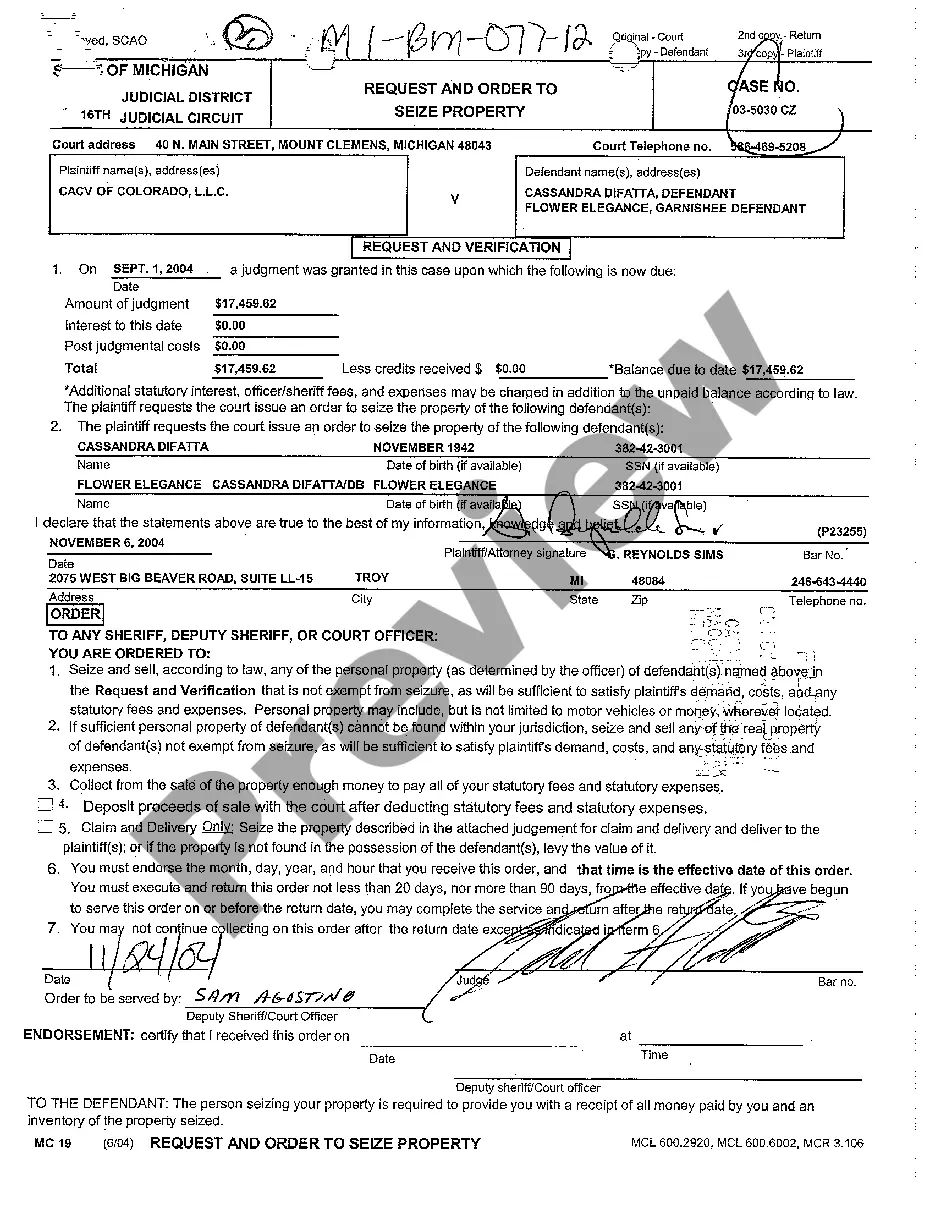

A08 Request and Writ for Garnishment: An A08 Request and Writ for Garnishment is a legal document that a creditor files with a court seeking permission to withhold a portion of a debtor's earnings or funds directly from a third party (usually an employer or bank). This action is typically taken to satisfy a debtor's outstanding obligations.

Step-by-Step Guide

- Filing the Request: The creditor must fill out the A08 form, providing details of the debtors identity, the amount owed, and the creditor's information.

- Court Review: The form is submitted to the court where the judge reviews the claim to ensure its validity.

- Issuing the Writ: If the court approves the request, a writ of garnishment is issued and sent to the third party holding the debtor's assets.

- Notification: The debtor and the garnishee (employer or bank) are notified about the garnishment order.

- Garnishment Process: The garnishee begins withholding funds from the debtors earnings or account as specified by the writ until the debt is paid or the court issues another order.

Risk Analysis

- Legal Risks: Incorrect filing or failure to adhere to state laws can lead to the dismissal of the garnishment or legal actions against the creditor.

- Financial Risks: Garnishment actions might lead the debtor to extreme financial hardship, potentially pushing them towards bankruptcy.

- Reputation Risks: Employers and creditors seen as aggressively using garnishment might face negative perceptions from the public or employees.

Key Takeaways

- Garnishment is a powerful tool for creditors but must be handled with care considering legal, financial, and ethical implications.

- Proper understanding and application of the process is essential to avoid legal complications and ensure compliance with state-specific laws.

FAQ

Q1: How long does the garnishment process take?

A: Typically, after filing, it might take a few weeks to a couple of months depending on court processing times and the specific details of the case.

Q2: Can a debtor stop a garnishment?

A: Yes, debtors can challenge the garnishment in court by proving it unjust or filing disputes under state exemptions laws.

How to fill out Michigan Request And Writ For Garnishment?

Access any template from 85,000 legal documents including Michigan Request And Writ for Garnishment online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you already possess a subscription, Log In. When you reach the form's page, click on the Download button and navigate to My documents to access it.

If you haven't subscribed yet, adhere to the following instructions.

After your reusable template is prepared, print it or save it on your device. With US Legal Forms, you will consistently have instant access to the appropriate downloadable template. The platform provides access to forms and organizes them into categories to streamline your search. Utilize US Legal Forms to obtain your Michigan Request And Writ for Garnishment quickly and effortlessly.

- Review state-specific regulations for the Michigan Request And Writ for Garnishment you wish to utilize.

- Examine the description and preview the template.

- Once you're confident that the sample meets your needs, click on Buy Now.

- Choose a subscription plan that fits your financial situation.

- Establish a personal account.

- Complete the payment using either a credit card or through PayPal.

- Select a format to download the document in; two formats are available (PDF or Word).

- Download the file to the My documents section.

Form popularity

FAQ

Once a writ of garnishment is filed in Michigan, the court will notify the garnishee, or the third party holding the debtor's assets. The garnishee is required to respond, typically within 14 days, providing information about the debtor's funds or income. Subsequently, the creditor will be able to collect the amount owed as stipulated in the Michigan Request And Writ for Garnishment. For a smooth process and clear instructions, consider using uslegalforms to assist you through these legal steps.

In Michigan, the garnishment process begins with a legal document called a writ of garnishment, which a creditor obtains after winning a judgment. The rules specify that garnishment can target wages, bank accounts, and other sources of income, but there are limits on the amount that can be garnished. Importantly, the debtor must be notified of the garnishment through a Michigan Request And Writ for Garnishment. For guidance and assistance with the garnishment process, uslegalforms offers valuable resources.

To file a writ of garnishment in Michigan, first obtain the appropriate forms from your local court or the Michigan court website. Complete the forms with accurate information about your debt and the individual or business you are garnishing. After filing with the court, you will need to serve the writ to the garnishee. If you require assistance navigating this process, US Legal Forms provides the necessary forms and instructions for your Michigan Request and Writ for Garnishment.

When writing a letter to a judge regarding a garnishment, start by clearly stating your case number and the nature of your request. Keep your letter concise and respectful, explaining why you believe the garnishment should be modified or dismissed. Detail your circumstances without excessive emotional language, staying focused on the facts of your situation. For templates and guidance, US Legal Forms offers resources that assist you in crafting a formal letter within the context of your Michigan Request and Writ for Garnishment.

To stop a wage garnishment immediately in Michigan, you can file a motion with the court that issued the garnishment. This motion should assert your reasons for stopping the garnishment, such as financial hardship or incorrect debt. You may also want to negotiate a payment plan with your creditor. If you need assistance, consider using US Legal Forms to access templates and guidance for your Michigan Request and Writ for Garnishment.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Requesting a GarnishmentTop Start a garnishment by filing a Request and Writ for Garnishment with the court that entered the judgment. The writ is a court order. It tells the garnishee to give you the money it holds for the debtor (like money in a bank account) or would have paid to the debtor (like a paycheck).

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

It is valid for 91 days or until the judgment, interest and costs are paid off, whichever occurs first. As such, the garnishment will continue each pay period for the 91 days or until the debt is paid off. Non-Periodic Garnishment: This is used to remove money from your bank account or other property.