The Pennsylvania Revocation of Letters Granted Checklist is a document used by Pennsylvania probate courts to revoke letters granted to an executor or administrator of an estate. This document outlines the procedures required for the court to officially revoke the letters of appointment from an executor or administrator. There are two types of Pennsylvania Revocation of Letters Granted Checklist: one for revoking Letters Testamentary (granted to an executor) and one for revoking Letters of Administration (granted to an administrator). Both forms list the requirements to be met for a successful revocation including: filing an application for revocation, providing notice to interested parties, and submitting the original document that served as the basis for the letters of appointment. Once completed, the court will review the application and, if approved, the letters of appointment will be revoked.

Pennsylvania Revocation of Letters Granted Checklist

Description

How to fill out Pennsylvania Revocation Of Letters Granted Checklist?

How much time and resources do you normally spend on composing formal paperwork? There’s a better option to get such forms than hiring legal experts or wasting hours searching the web for an appropriate template. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, like the Pennsylvania Revocation of Letters Granted Checklist.

To get and complete an appropriate Pennsylvania Revocation of Letters Granted Checklist template, adhere to these simple steps:

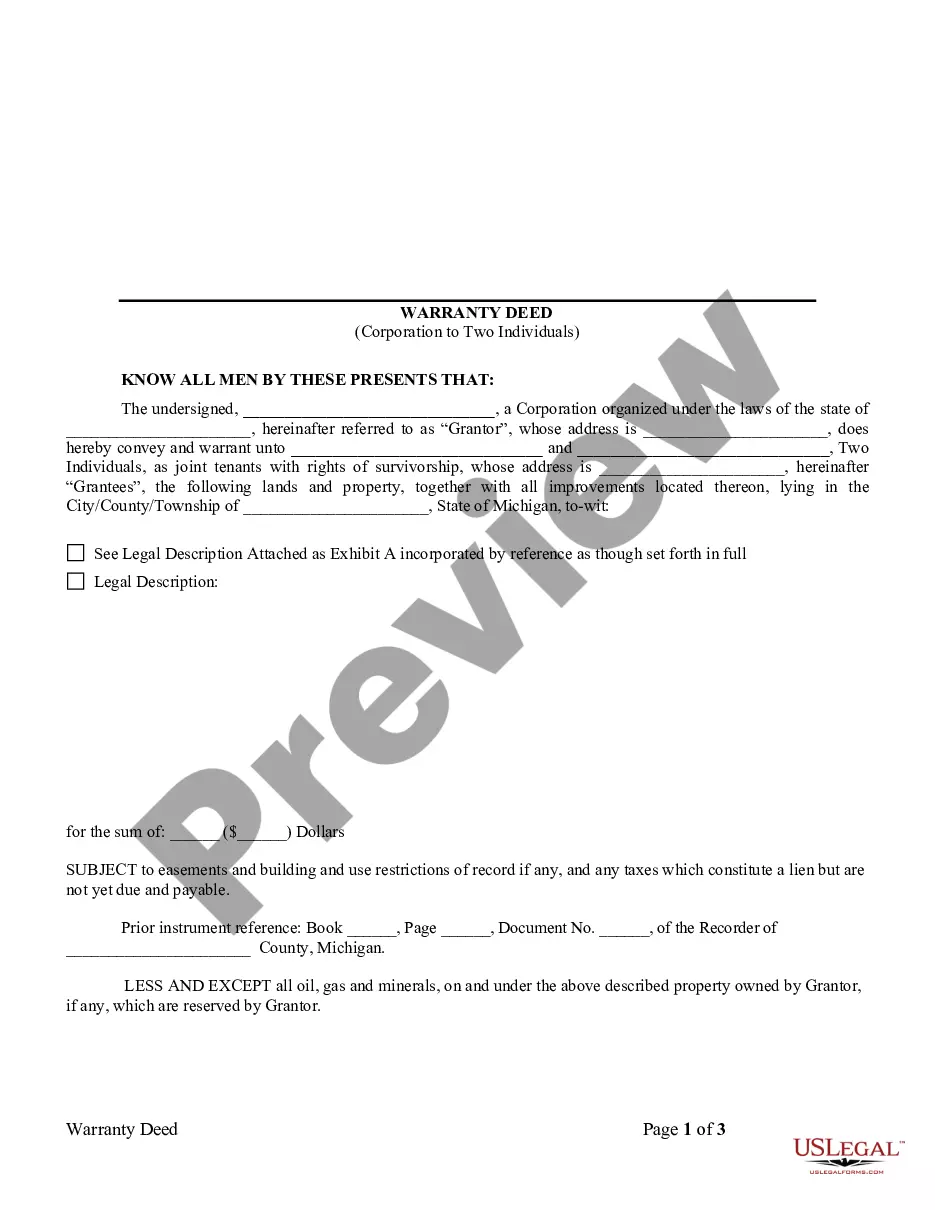

- Examine the form content to make sure it complies with your state regulations. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, locate another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Pennsylvania Revocation of Letters Granted Checklist. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Pennsylvania Revocation of Letters Granted Checklist on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

In Pennsylvania, there is no set deadline for filing probate. However, the law requires that the inheritance tax be wholly paid within nine months after the person's passing unless there has been a request for an extension.

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

The grant of letters is the most common estate proceeding in Pennsylvania. The grant of letters is a full administration proceeding when a decedent dies with a will (testate) or without a will (intestate). When a decedent dies without a will, the proceeding is referred to as a grant of letters of administration.

When a person dies owning assets in his or her name alone, an estate must be ?opened? by a personal representative to handle the assets and to settle the decedent's affairs. The estate is opened by filing a Petition for Grant of Letters with a death certificate with the local Register of Wills.

If the decedent and his or her current spouse are their parents, the children are entitled to an inheritance only after the surviving spouse inherits $30,000 and half of the balance of the estate. But if the children were born out of marriage or during a previous relationship, their share shifts to half of the estate.

Under 20 Pa. C.S.A. § 3323, whenever it shall be proposed to compromise any claim by an estate, the Court, on petition by the personal representative setting forth all of the facts and circumstances and after such notice as the Court shall direct, may enter a Decree authorizing the compromise or settlement to be made.

Any assets that are titled in the decedent's sole name, not jointly owned, not payable-on-death, don't have any beneficiary designations, or are left out of a Living Trust are subject to probate. Such assets can include: Bank or investment accounts. Stocks and bonds.

The court shall have exclusive power to remove a personal representative when he: (1) is wasting or mismanaging the estate, is or is likely to become insolvent, or has failed to perform any duty imposed by law; or (2) Deleted.