Pennsylvania Compensation And Reimbursement of Expenses is a set of laws and regulations that govern how employers must compensate and reimburse employees for expenses incurred while performing their job duties. This includes both wages and salary payments, as well as reimbursement for business-related expenses. The three main types of Pennsylvania Compensation and Reimbursement of Expenses are: 1. Wages and Salaries: All employees must be paid at least the minimum wage, and employers are required to provide overtime pay for hours worked beyond 40 in a given week. 2. Reimbursement for Business Expenses: Employers must reimburse employees for any business-related expenses they incur, including travel and other out-of-pocket expenses. 3. Employee Benefits: Employers must provide certain employee benefits, such as health insurance and paid leave.

Pennsylvania Compensation And Reimbursement of Expenses

Description

How to fill out Pennsylvania Compensation And Reimbursement Of Expenses?

Coping with legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Pennsylvania Compensation And Reimbursement of Expenses template from our library, you can be sure it meets federal and state regulations.

Dealing with our service is straightforward and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your Pennsylvania Compensation And Reimbursement of Expenses within minutes:

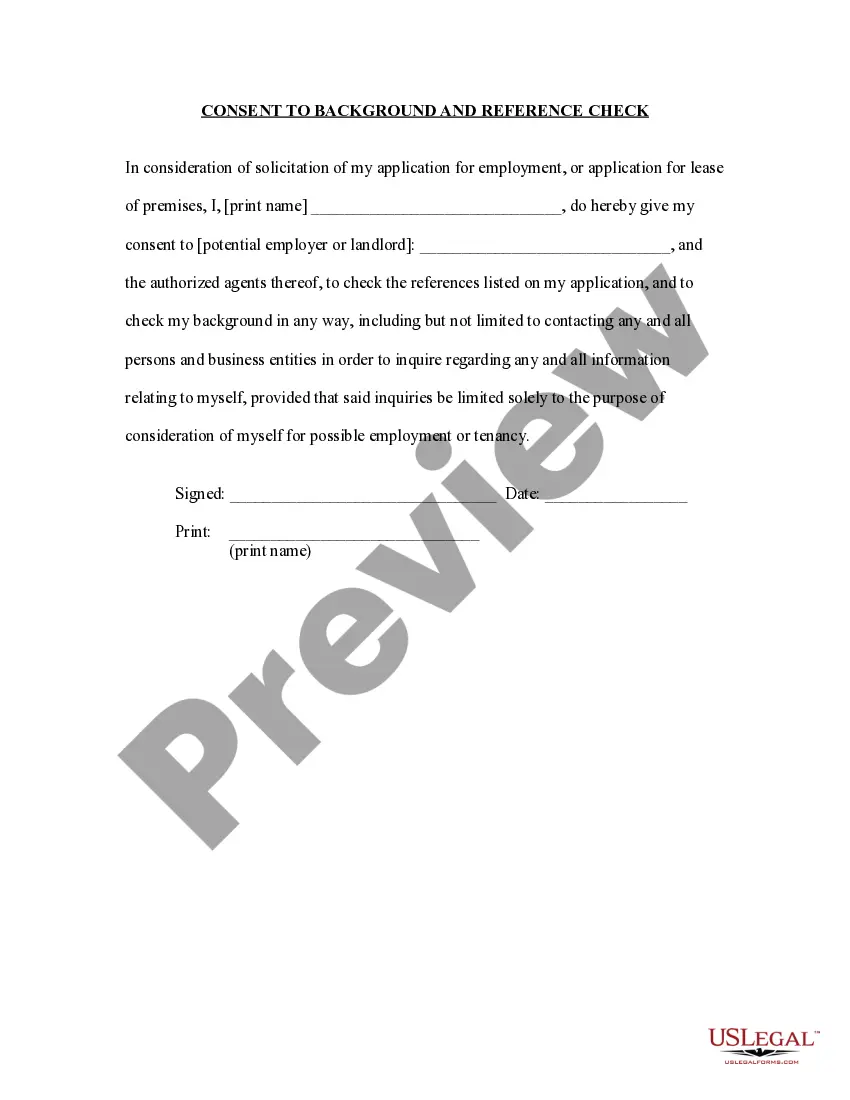

- Make sure to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Pennsylvania Compensation And Reimbursement of Expenses in the format you prefer. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Pennsylvania Compensation And Reimbursement of Expenses you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Several states, including California, the District of Columbia, Illinois, Iowa, Massachusetts, Montana and New York, do require employers to reimburse employees for necessary business-related expenses.

Income Items Taxable as Pennsylvania Compensation Based on Facts and Circumstances. Sick pay and sick leave are taxable compensation when representing regular wages. The employer must include them as compensation and withhold Pennsylvania tax.

You can claim a deduction for an unreimbursed employee business expense by filing a PA Schedule UE, Allowable Employee Business Expenses form along with your PA-40 Personal Income Tax Return.

What Is An Expense Reimbursement? The expense must be for deductible business expenses that are paid or incurred by an employee in the course of performing services for your organization. The employee must be required to substantiate the amount, time, use, and business purpose of the reimbursed expenses.

California law requires employers to reimburse employees for all necessary work-related expenses.

PA-40 C (09?04) PA DEPARTMENT OF REVENUE. Overview. Use PA Schedule C to report income or loss from a business you operate, or a profession you practice, as a sole proprietor.

9. How long do companies have to reimburse expenses? Generally, employees can request reimbursement for work-related expenses within three years of purchase. That said, some employers have specific policies that require employees to make reimbursement requests within a set period time (i.e., within a few days).

You can either file a wage claim with the Division of Labor Standards Enforcement (the Labor Commissioner's Office), or bring an action in court against your former employer to recover the wages if they are still due you, and to claim the waiting time penalty.