Pennsylvania Notice of Workers' Compensation Benefit Offset for Workers' Compensation

Description

How to fill out Pennsylvania Notice Of Workers' Compensation Benefit Offset For Workers' Compensation?

The work with papers isn't the most easy job, especially for those who rarely work with legal paperwork. That's why we recommend using correct Pennsylvania Notice of Workers' Compensation Benefit Offset for Workers' Compensation templates created by skilled attorneys. It allows you to stay away from troubles when in court or working with formal organizations. Find the files you require on our site for high-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the template page. Soon after accessing the sample, it’ll be saved in the My Forms menu.

Users without an active subscription can easily get an account. Use this brief step-by-step guide to get the Pennsylvania Notice of Workers' Compensation Benefit Offset for Workers' Compensation:

- Make sure that the sample you found is eligible for use in the state it is needed in.

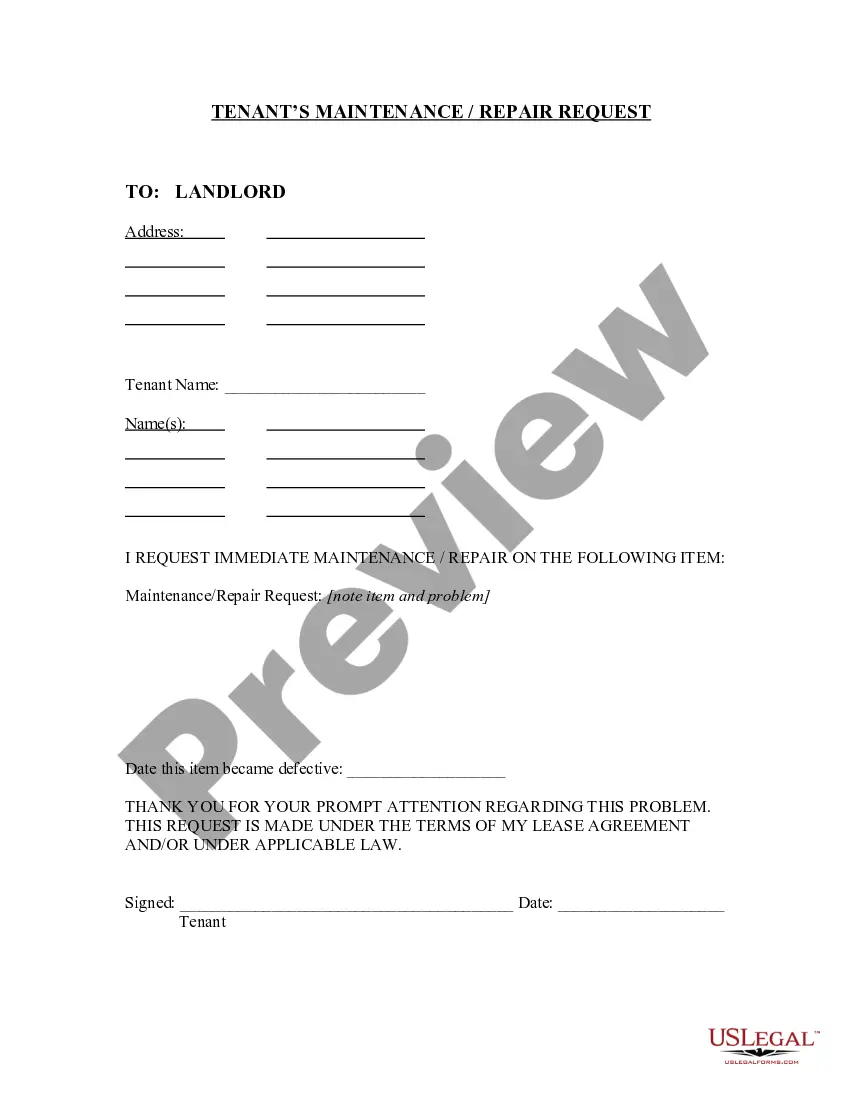

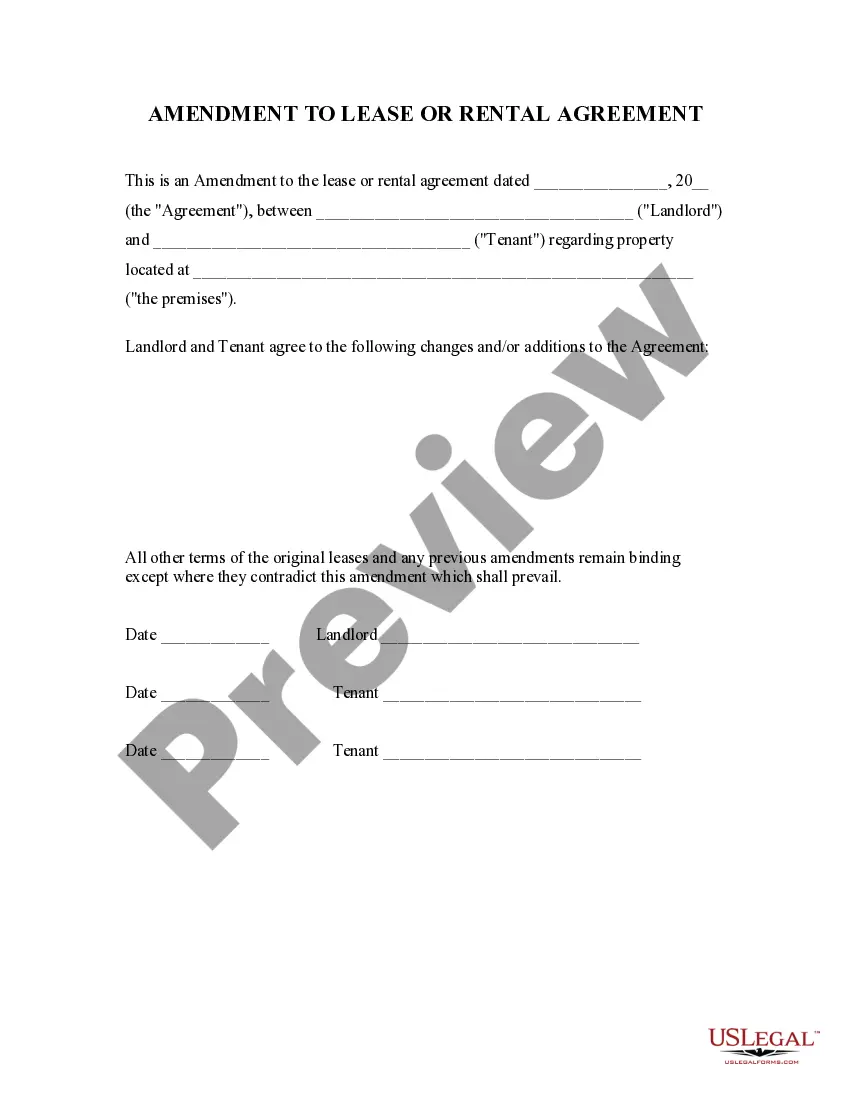

- Confirm the file. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this template is what you need or return to the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these simple steps, you can fill out the form in your favorite editor. Recheck filled in info and consider requesting an attorney to review your Pennsylvania Notice of Workers' Compensation Benefit Offset for Workers' Compensation for correctness. With US Legal Forms, everything gets easier. Give it a try now!

Form popularity

FAQ

Do all worker's comp cases end in a settlement? Most worker's compensation cases end in a settlement, meaning the insurance company offers either a lump sum of money or weekly payments for a specified period. The money may cover: Past and future medical care.

While in most states, the workers' compensation offset works to reduce the person's SSDI, 16 states have adopted a reverse offset program. In these states, the person's workers' comp, rather than their SSDI benefit, will be reduced to meet the SSA's prescribed formulas.

4. Can Workers' Comp Stop Payments Without Notice? To stop or lower your wage loss benefits, your employer has to a Notice of Suspension after you return to work at full wages or file a petition to modify, suspend or end your benefits. When they file it, you'll receive a notification.

In NSW, a worker for workers compensation purposes is 'a person who has entered into or works under a contract of service or a training contract with an employer2026'.If you are a small employer, your premium will not be impacted by the costs of your workers compensation claims.

If you've been injured as a result of your work, you should be able to collect workers compensation benefits.Your employer or its workers' comp insurance company does not have to agree to settle your claim, and you do not have to agree with a settlement offer proposed by your employer or its insurance company.

Any change in the amount of these benefits is likely to affect the amount of your Social Security benefits. If you get a lump-sum workers' compensation or other disability payment in addition to, or instead of a monthly benefit, the amount of the Social Security benefits you and your family receive may be affected.

The short answer is yes, you can receive both Workers Compensation and Social Security Disability Insurance (SSDI) benefits if you qualify for both disability benefits and workers' compensation. They are separate programs.Workers Compensation programs are run by your home state.

The offset provision in your LTD policy means that your LTD insurance company may be entitled to most or all of this backpay. The rationale is that the company has overpaid you for those months during which you received the full amounts of LTD and Social Security benefits (in the form of backpay).

Under the workers' compensation offset, created by Congress in 1965, the total amount from SSDI and workers' comp cannot exceed 80 percent of the person's average current earning, or the total SSDI received by the recipient's entire family during the first month receiving workers' comp, whichever is higher.