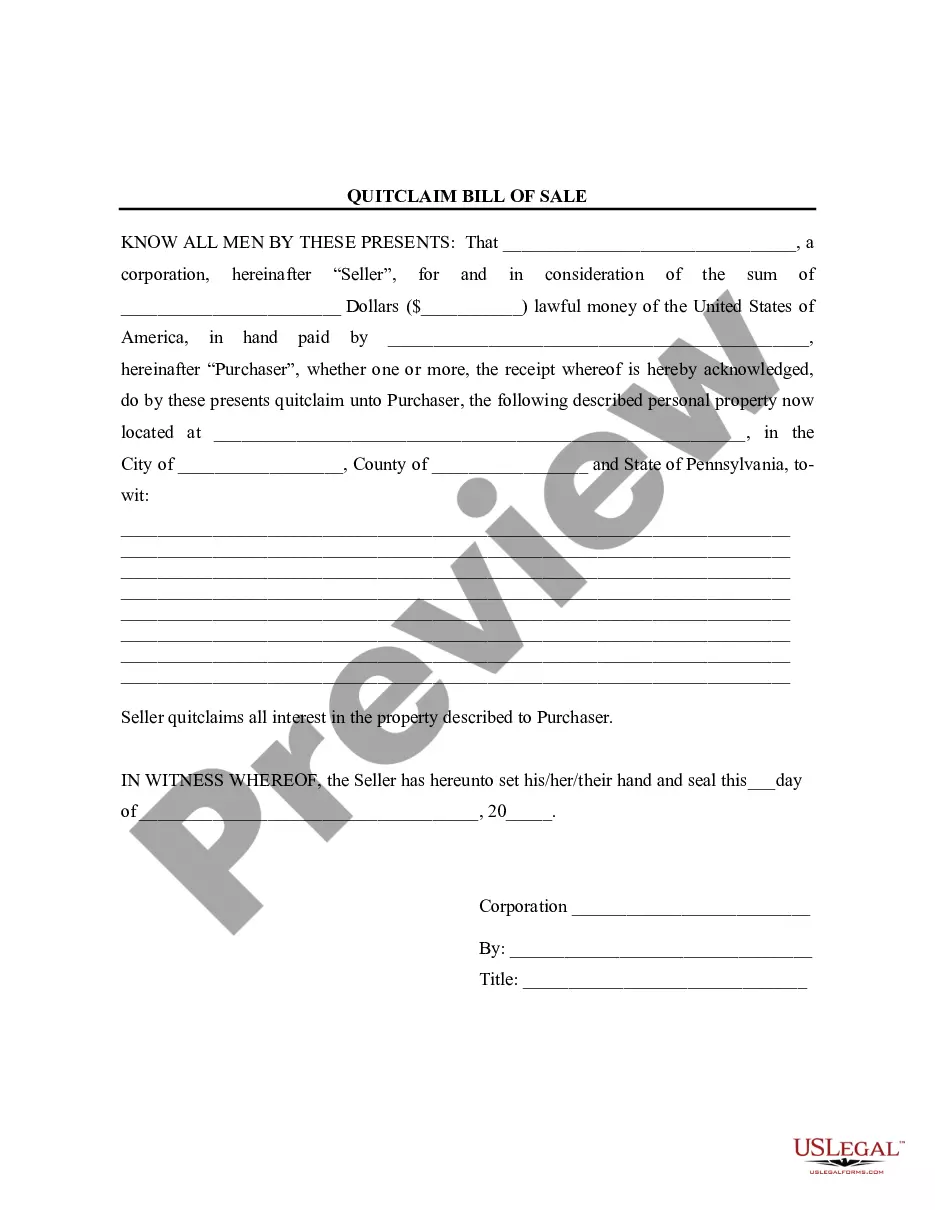

Pennsylvania Bill of Sale without Warranty by Corporate Seller

Description

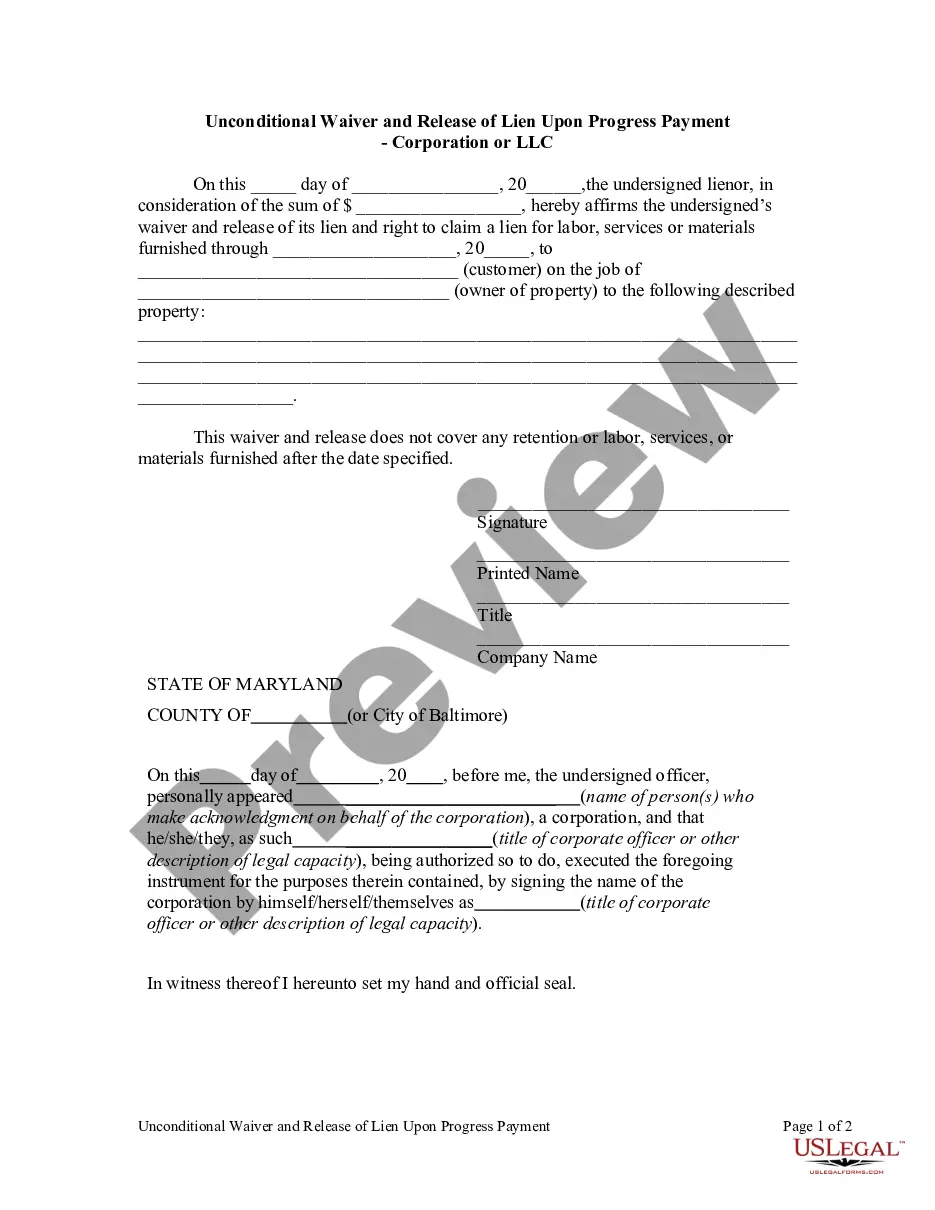

How to fill out Pennsylvania Bill Of Sale Without Warranty By Corporate Seller?

Creating documents isn't the most straightforward task, especially for those who almost never work with legal paperwork. That's why we recommend using correct Pennsylvania Bill of Sale without Warranty by Corporate Seller templates made by professional lawyers. It allows you to stay away from troubles when in court or dealing with official institutions. Find the samples you require on our website for top-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the template page. After getting the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can quickly create an account. Use this simple step-by-step guide to get the Pennsylvania Bill of Sale without Warranty by Corporate Seller:

- Make certain that the sample you found is eligible for use in the state it is necessary in.

- Confirm the file. Make use of the Preview option or read its description (if available).

- Click Buy Now if this sample is the thing you need or use the Search field to get another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After finishing these easy steps, it is possible to fill out the form in a preferred editor. Check the filled in information and consider asking a lawyer to review your Pennsylvania Bill of Sale without Warranty by Corporate Seller for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

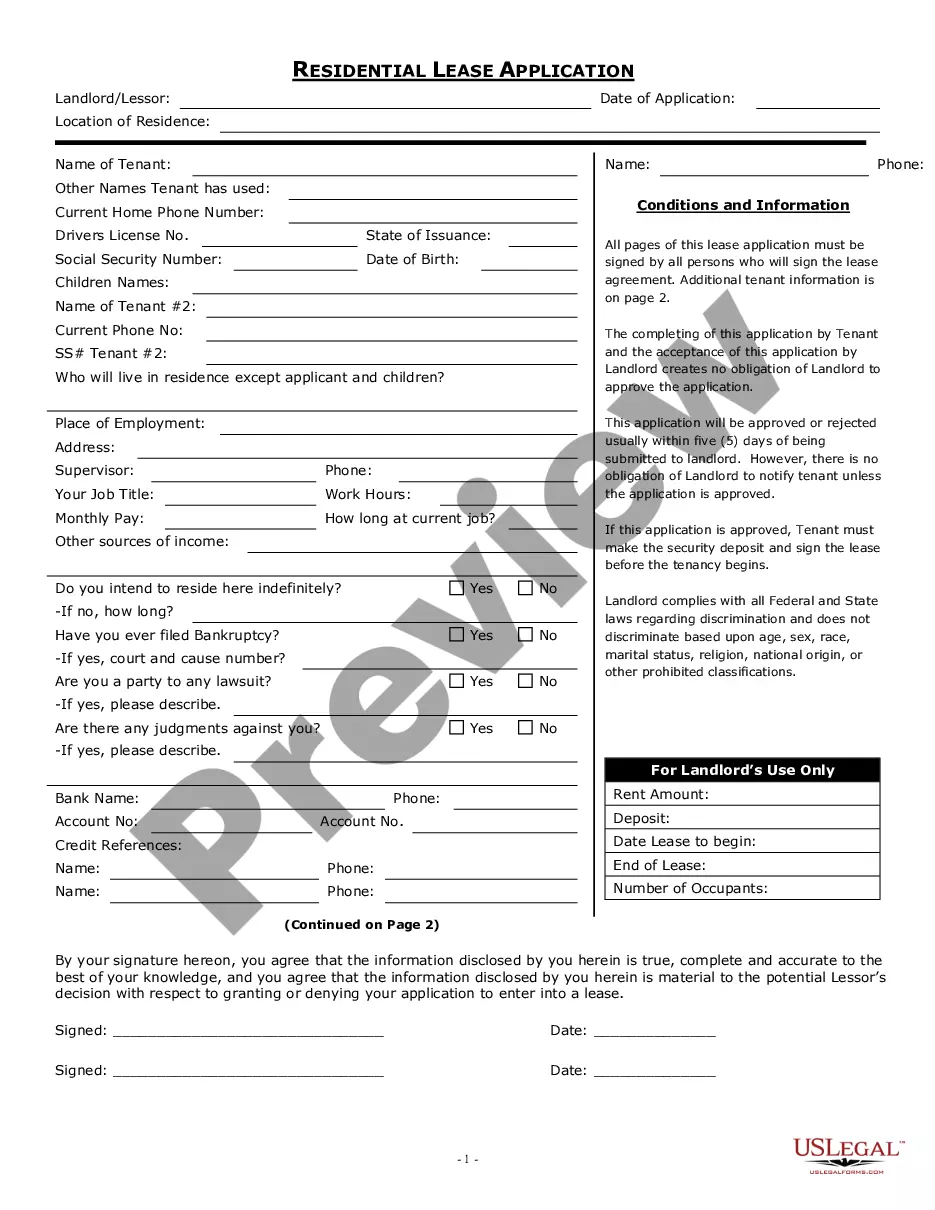

In the Commonwealth of Pennsylvania when you buy or sell a vehicle a Bill of Sale Form is not required but it's strongly recommended. This serves as a legal receipt from the buyer to the seller documenting both the change in ownership and the purchase price.

In simple terms, a bill of sale agreement is nothing more than a contract for the purchase of a vehicle between a buyer and a seller.In most cases, the contract is legally binding between buyer and seller as long as the bill of sale follows guidelines required in the state where the sale or transfer takes place.

Both the buyer and seller should receive copies of the bill of sale form. It's important for the buyer to keep the bill of sale with the title of the vehicle for registration and licensing purposes, if necessary. However, all parties should keep them for their own personal records.

A bill of sale has been defined as a legal document made by the seller to a purchaser, reporting that on a specific date at a specific locality and for a particular sum of money or other value received, the seller sold to the purchaser a specific item of personal property, or parcel of real property of which he had

A bill of sale does not serve as proof of ownership. Only a title has that legal authority. Bills of sale serve as proof of title transfer, which buyers and sellers need for personal financial and tax records.

Can a bill of sale be handwritten? If your state does not provide a bill of sale form, yes, you can handwrite one yourself. As long as the document includes all of the necessary parts of a bill of sale and is signed by both parties and a notary, it is valid. Some states require a bill of sale while others don't.

You should not sign anything before you get your money. If the buyer says the buyer would be back later with your money and you sign the title over to the buyer, you likely will never see your money...

Vehicles received as gifts are not subject to sales tax.In many instances, taxpayers are incorrectly informed by licensing agents that a minimal purchase price (e.g. $1) must be reported on the MV-4ST, even if the vehicle is a gift. This is not correct.

In simple terms, a bill of sale agreement is nothing more than a contract for the purchase of a vehicle between a buyer and a seller.In most cases, the contract is legally binding between buyer and seller as long as the bill of sale follows guidelines required in the state where the sale or transfer takes place.