Pennsylvania Warranty Deed from Trust to an Individual

Description

How to fill out Pennsylvania Warranty Deed From Trust To An Individual?

The work with papers isn't the most easy process, especially for those who rarely work with legal papers. That's why we advise making use of accurate Pennsylvania Warranty Deed from Trust to an Individual samples made by skilled attorneys. It gives you the ability to eliminate difficulties when in court or dealing with formal organizations. Find the documents you require on our website for high-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will automatically appear on the template page. After downloading the sample, it’ll be stored in the My Forms menu.

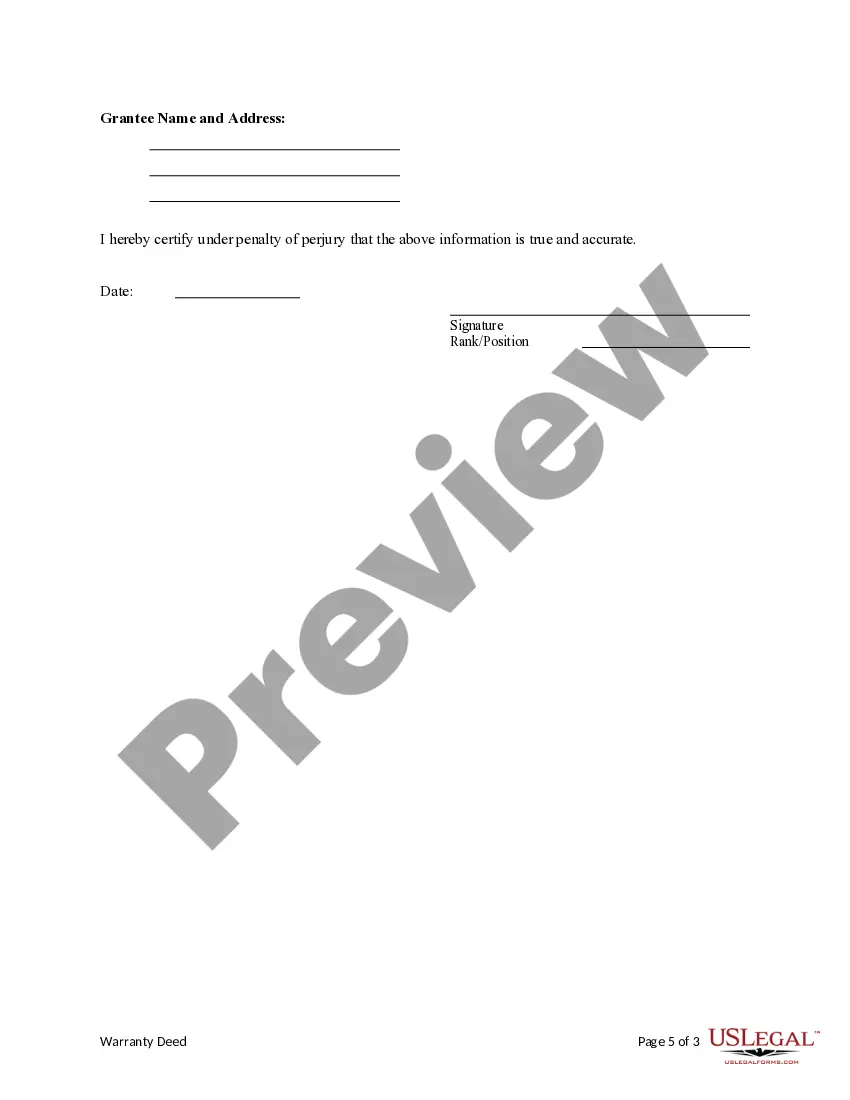

Users with no an activated subscription can easily create an account. Use this brief step-by-step help guide to get the Pennsylvania Warranty Deed from Trust to an Individual:

- Make certain that file you found is eligible for use in the state it’s required in.

- Verify the file. Utilize the Preview option or read its description (if offered).

- Click Buy Now if this sample is the thing you need or return to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these simple actions, it is possible to complete the sample in a preferred editor. Check the completed details and consider asking a legal professional to review your Pennsylvania Warranty Deed from Trust to an Individual for correctness. With US Legal Forms, everything gets much easier. Test it now!

Form popularity

FAQ

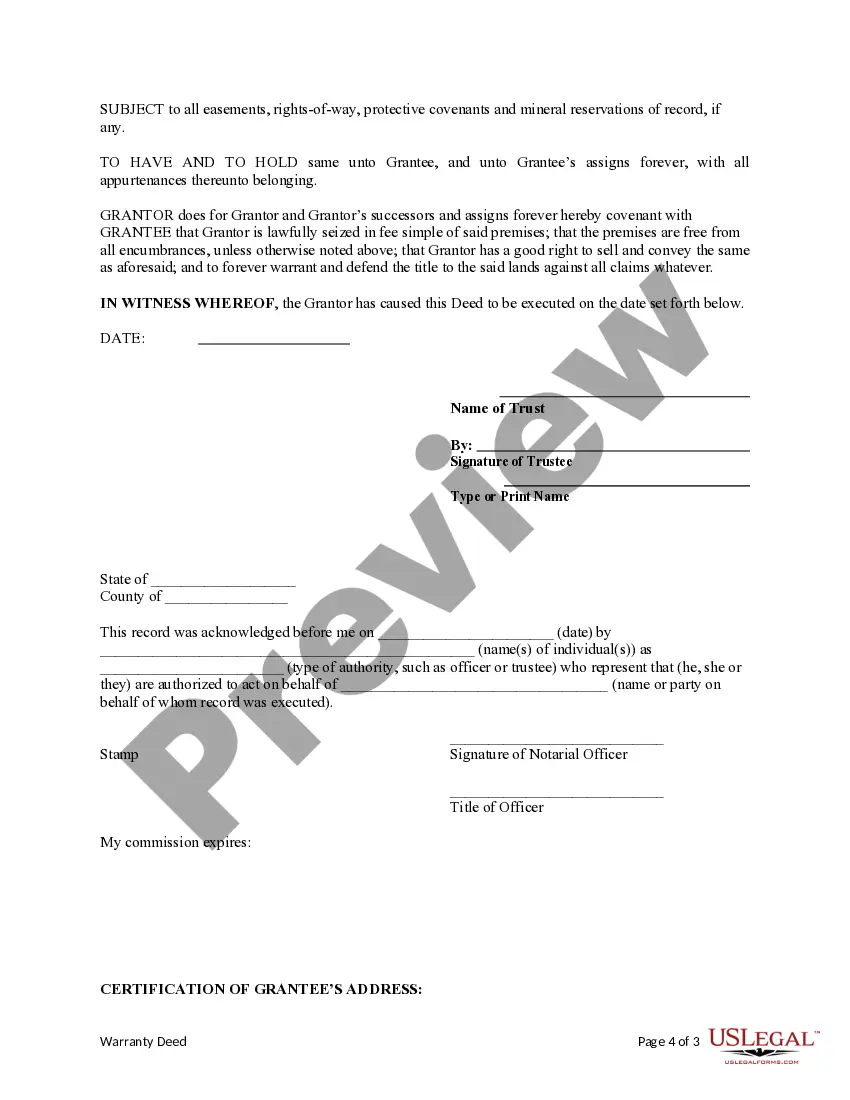

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A trustee deed offers no such warranties about the title.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

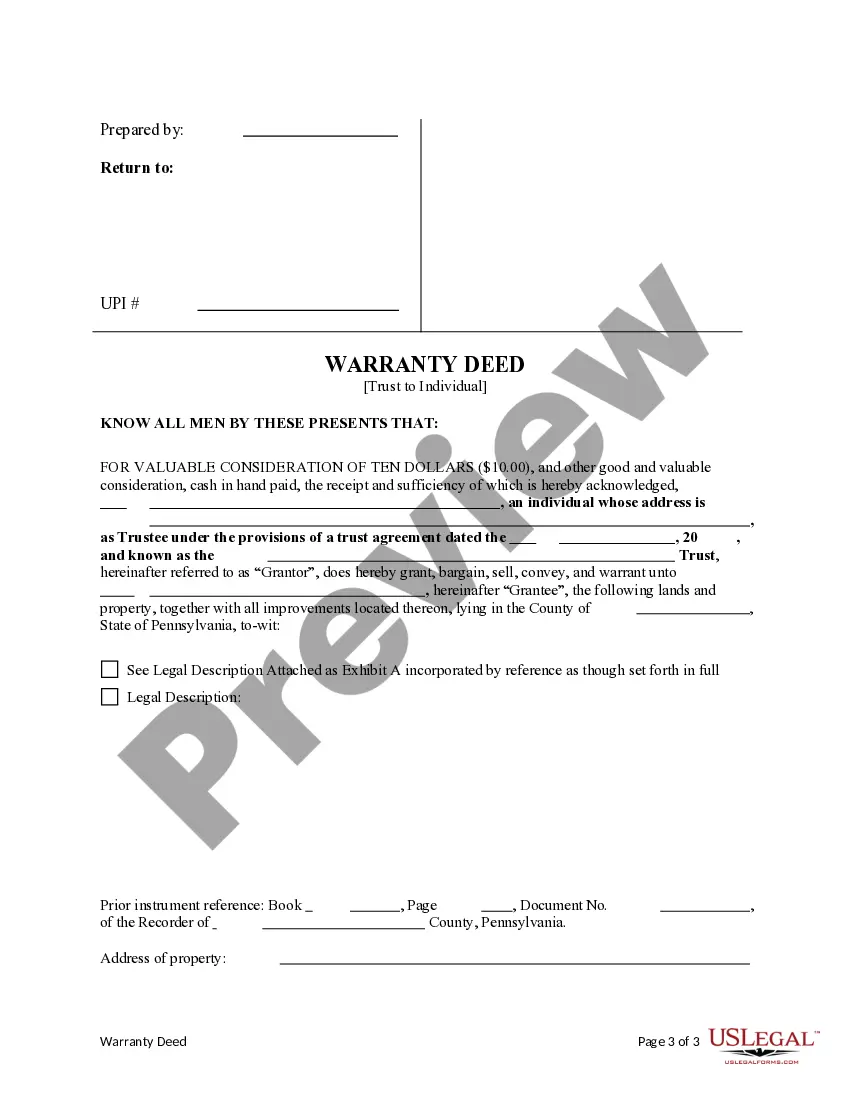

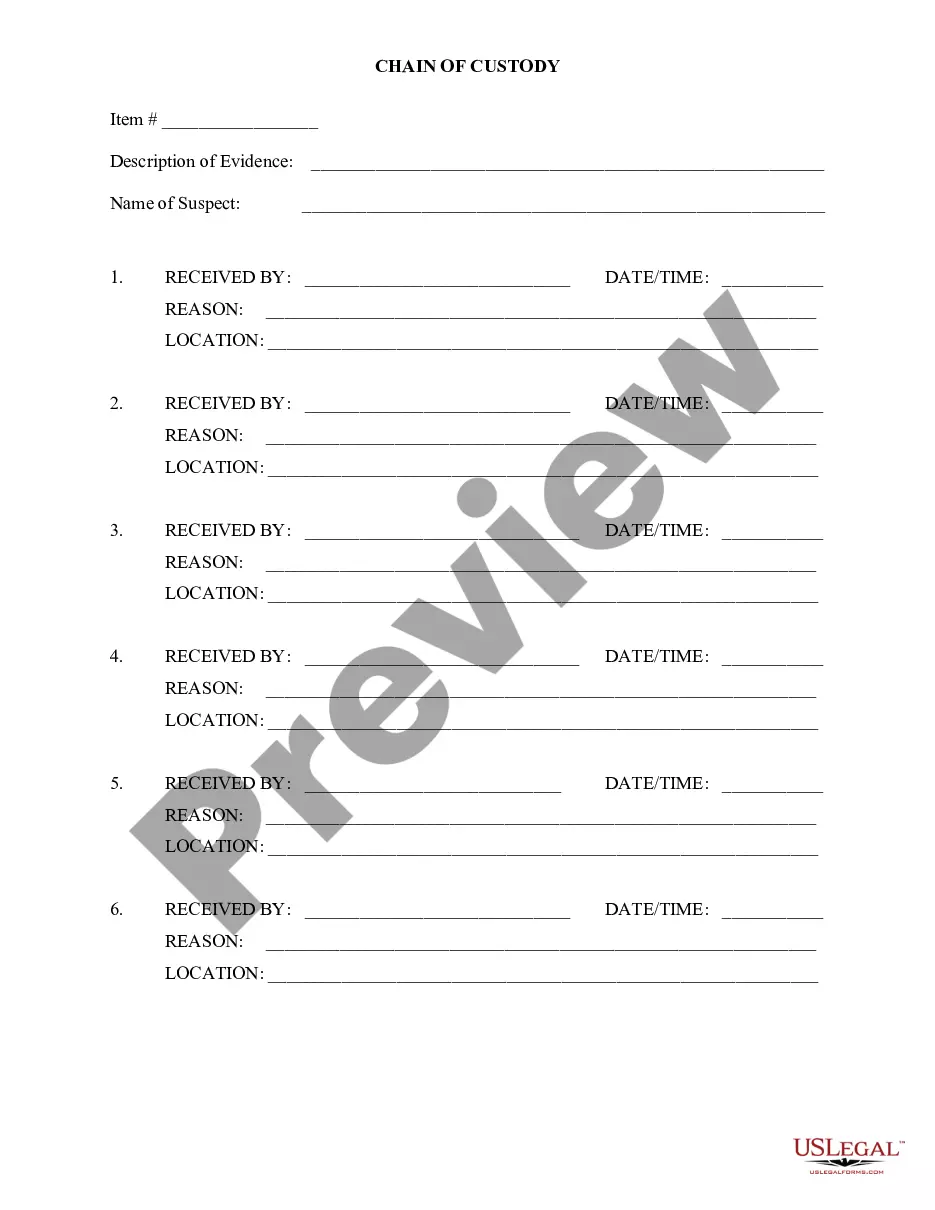

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.