Pennsylvania Executor's Deed - Co-Executors to Two or More Grantees

Definition and meaning

The Pennsylvania Executor's Deed - Co-Executors to Two or More Grantees is a legal document used by executors to transfer property from a deceased person's estate to two or more designated grantees. This deed is crucial during the estate settlement process, ensuring that co-executors can act on behalf of the estate in conveying ownership of real property to multiple beneficiaries.

How to complete a form

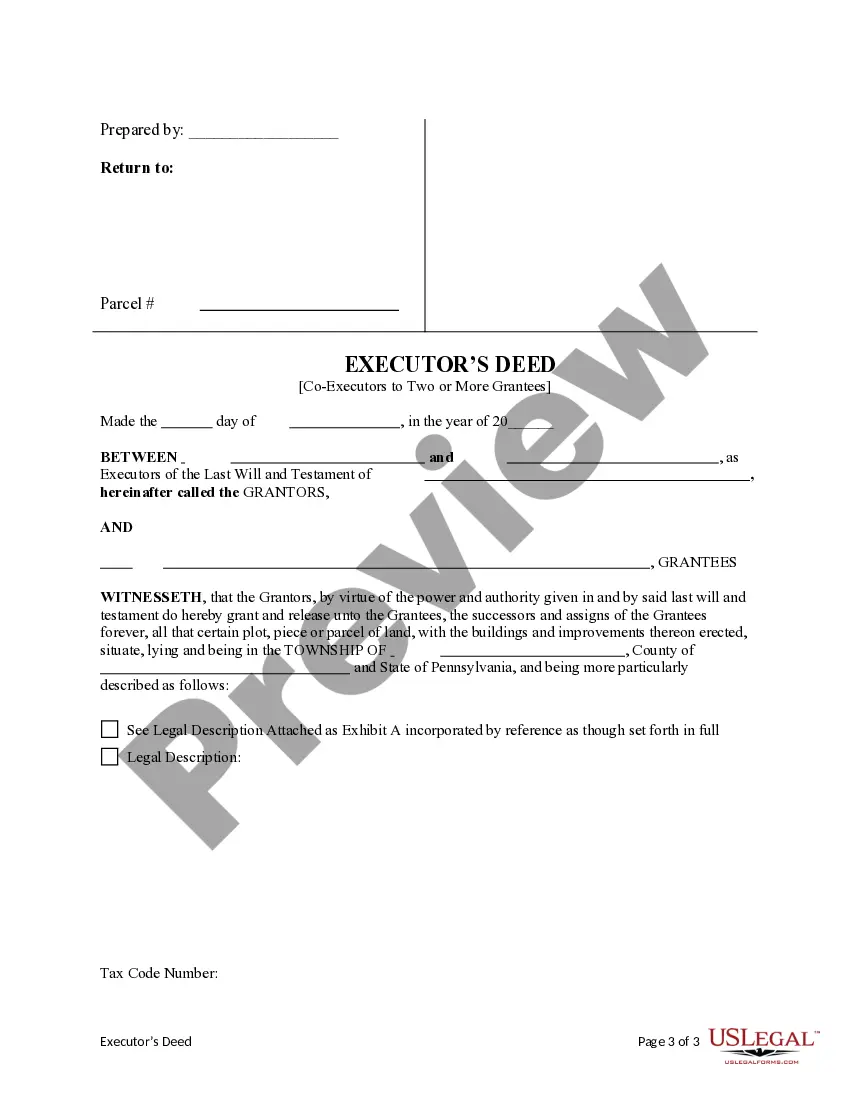

To correctly fill out the Pennsylvania Executor's Deed, follow these steps:

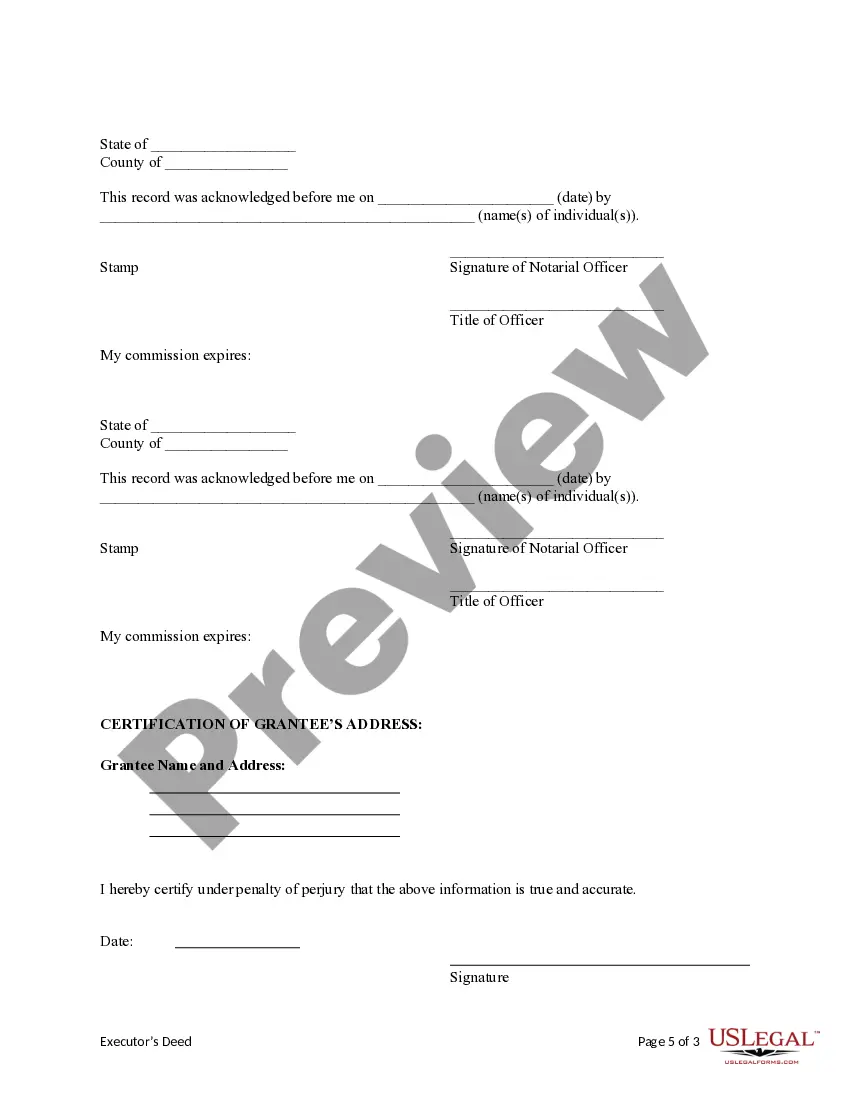

- Begin by entering the date of execution at the beginning of the form.

- Identify the grantors, which are the co-executors acting on behalf of the estate.

- Clearly list the grantees who will receive the property.

- Include a detailed legal description of the property, as provided in Exhibit A.

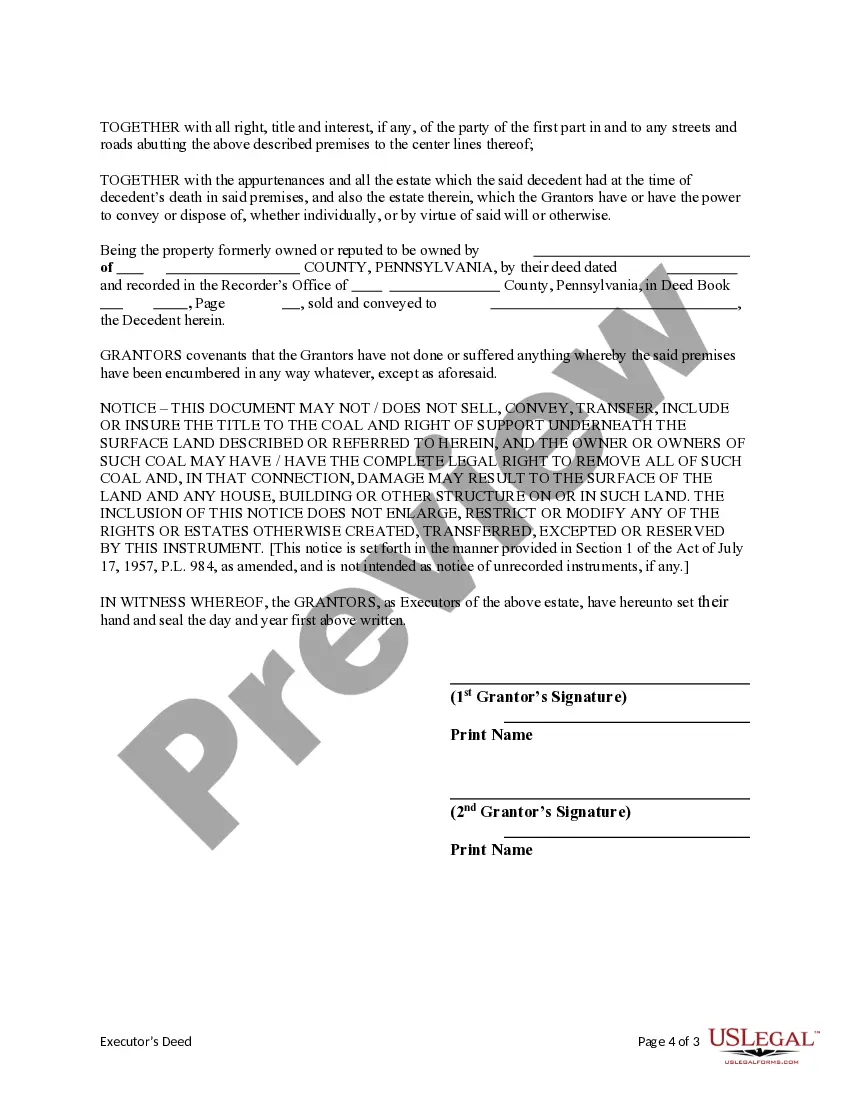

- Sign and date the deed in the presence of a notary public.

Who should use this form

This form is intended for use by co-executors managing an estate in Pennsylvania. It is particularly relevant in situations where property is being distributed among multiple beneficiaries, ensuring that all parties have legal claim to the property conveyed. Executors should have the authority to act under the deceased person's will when utilizing this form.

Legal use and context

The Executor's Deed is utilized within the context of probate law, enabling the transfer of real estate after the owner’s death. It serves as a record of the executors' authority to convey property and limits liability for the executors regarding rights that may remain with the deceased's estate. Properly executing this deed is essential to ensure the transfer is legally valid and recognized by local authorities.

Common mistakes to avoid when using this form

When completing the Pennsylvania Executor's Deed, be aware of the following common pitfalls:

- Failing to provide a complete legal description of the property, which can lead to issues with title clarity.

- Inaccurate or missing signatures from both grantors, which may invalidate the document.

- Not having the deed notarized, as notarization is a legal requirement for it to be enforceable.

What to expect during notarization or witnessing

During the notarization process, the grantors must be present to sign the Executor's Deed in front of a notary public. The notary will verify the identity of the signers and ensure that they are signing willingly. It is advisable to bring valid identification and any accompanying documents that may clarify the co-executors' authority.

Form popularity

FAQ

When you and someone else are named as co-executors in a Will, that essentially means that you must execute the Will together. You must both apply to Probate the Will together. You must both sign checks and title transfers together. Basically, neither of you may act independently of the other.

A sole Executor is usually able to act alone during Probate, although there are some important factors to consider. A joint Executor will not usually be able to act alone unless the other Executors formally agree to this.

If one of the co-executors does not agree, then the estate cannot take the action. So, each co executor should be working together with the other co executor to administer the estate.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Pennsylvania does not allow real estate to be transferred with transfer-on-death deeds.

Both executors must sign the initial petition with the probate court. Typically, both executors will have to sign checks and other estate paperwork. Both executors may be responsible for filing tax returns. You have a duty to monitor the actions of the other executor and to report any unethical or illegal behavior.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Can I start the estate process without them? Co-Executors in Pennsylvania must serve jointly.