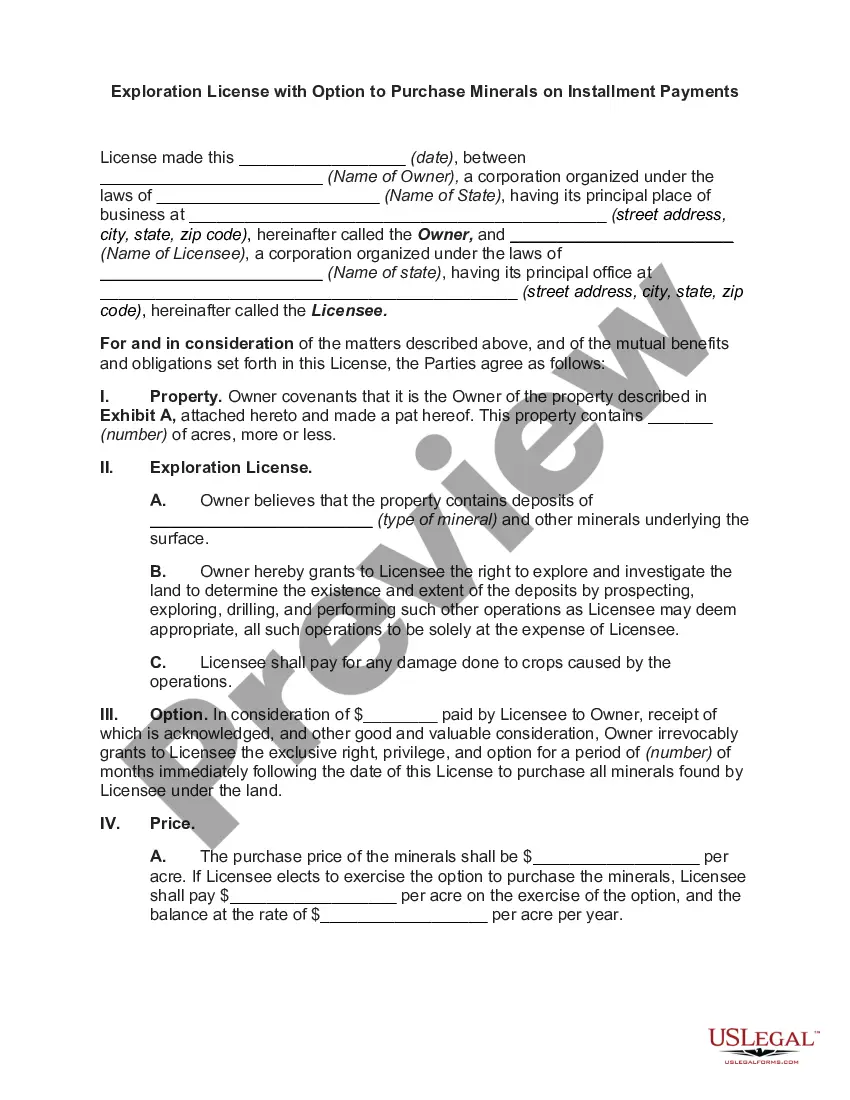

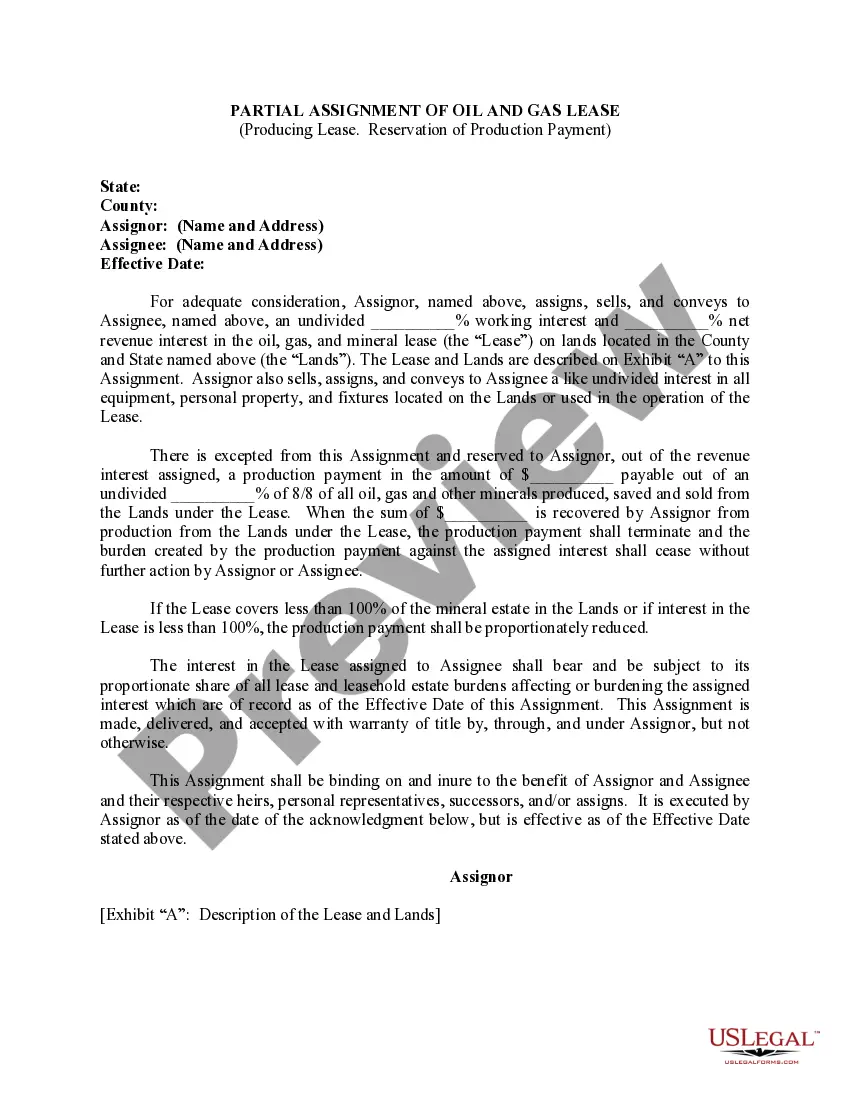

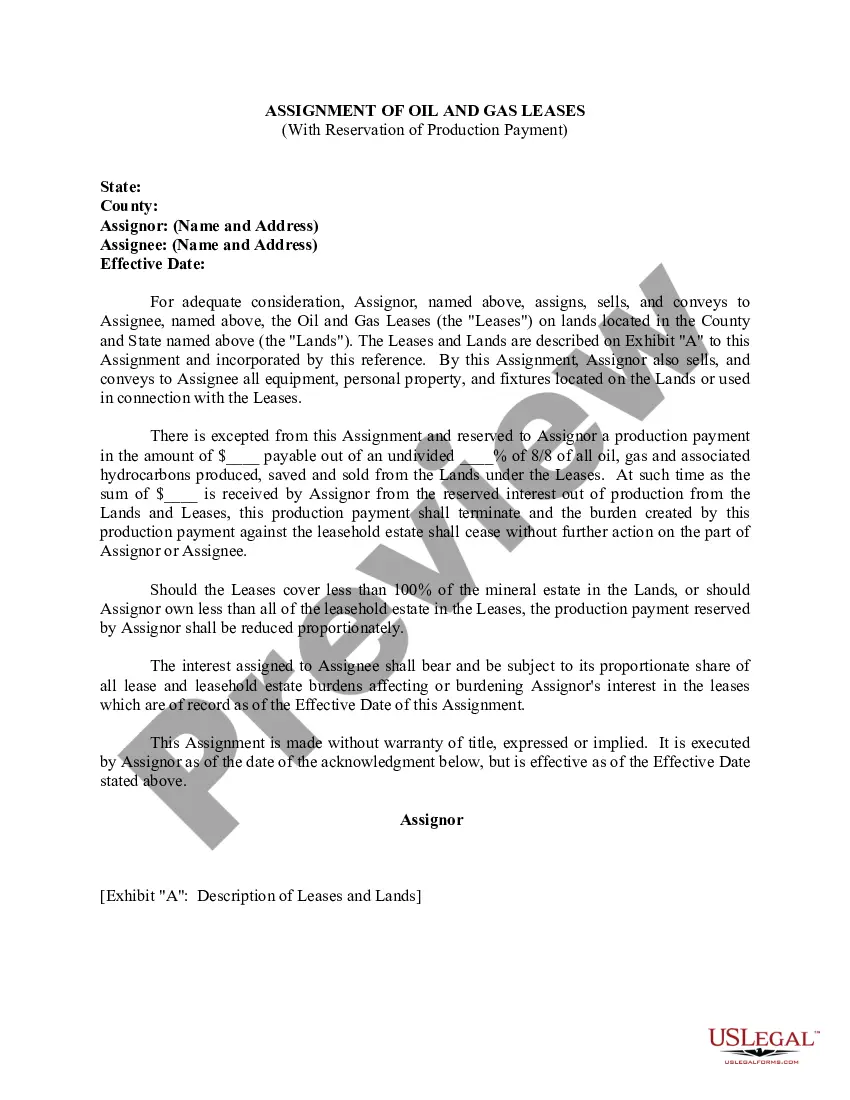

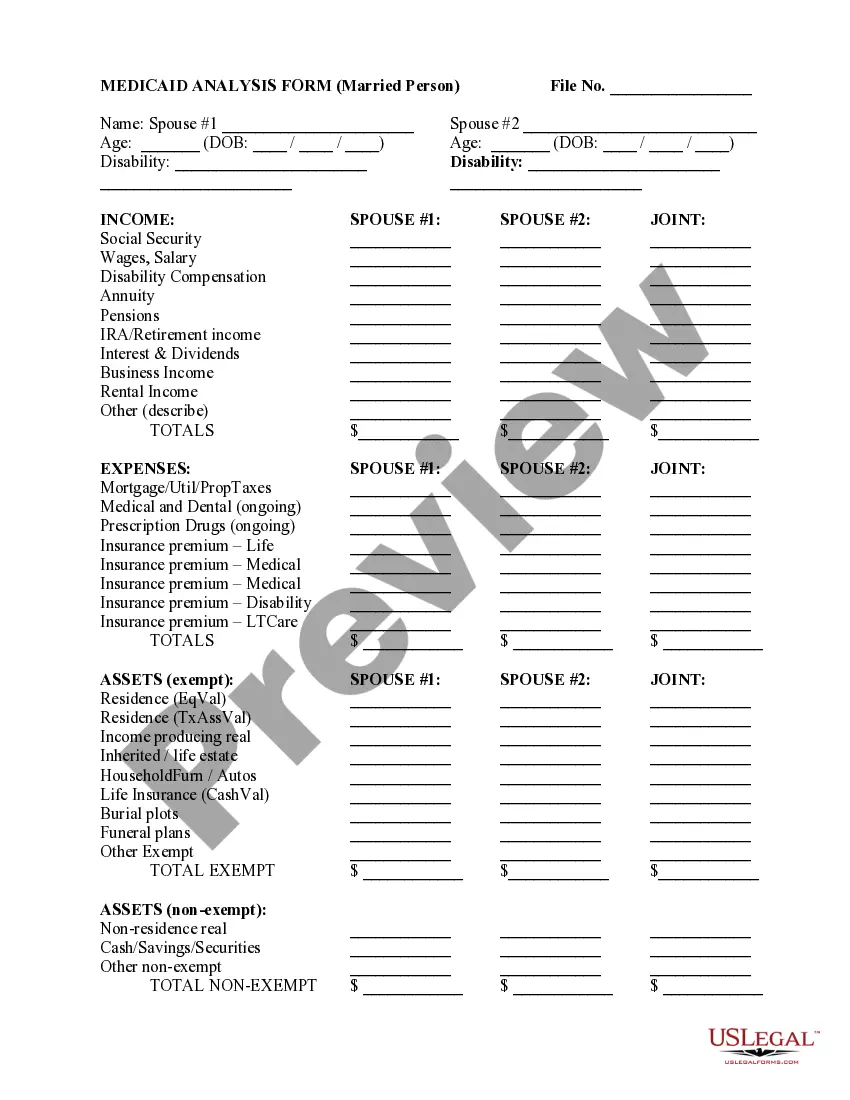

Oregon Reservation of Production Payment

Description

How to fill out Reservation Of Production Payment?

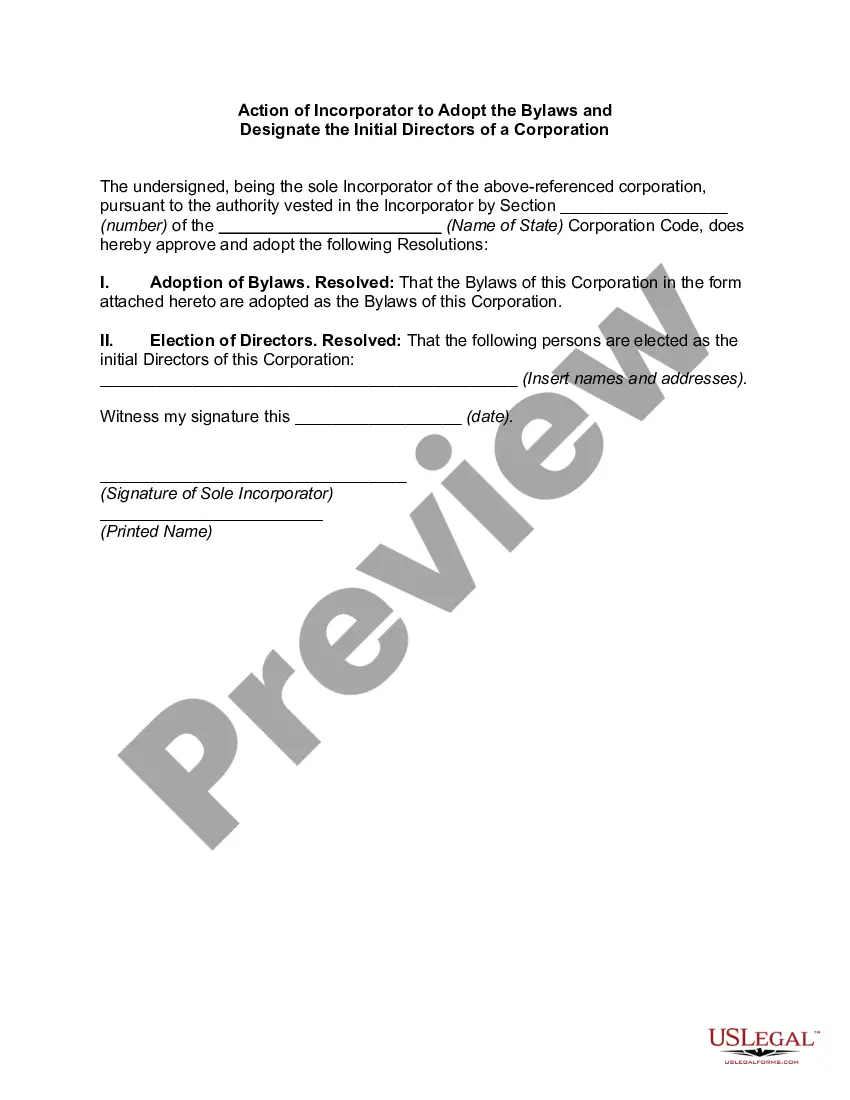

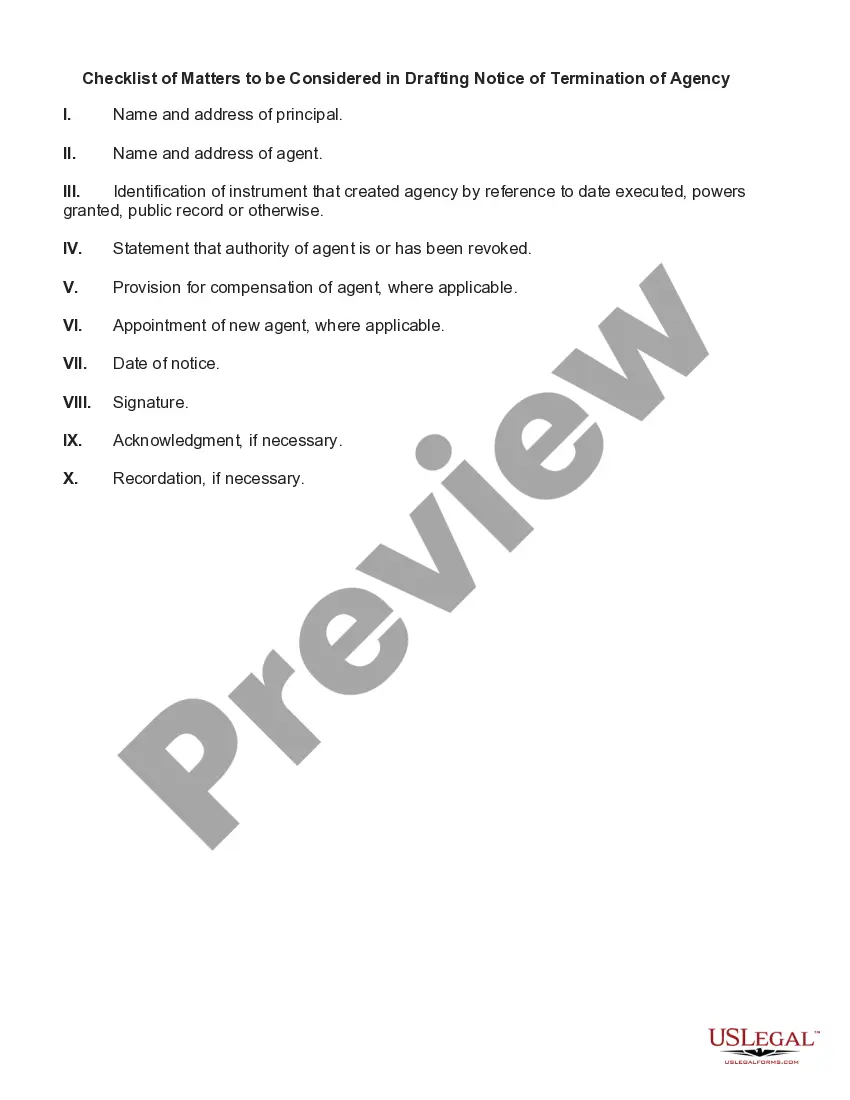

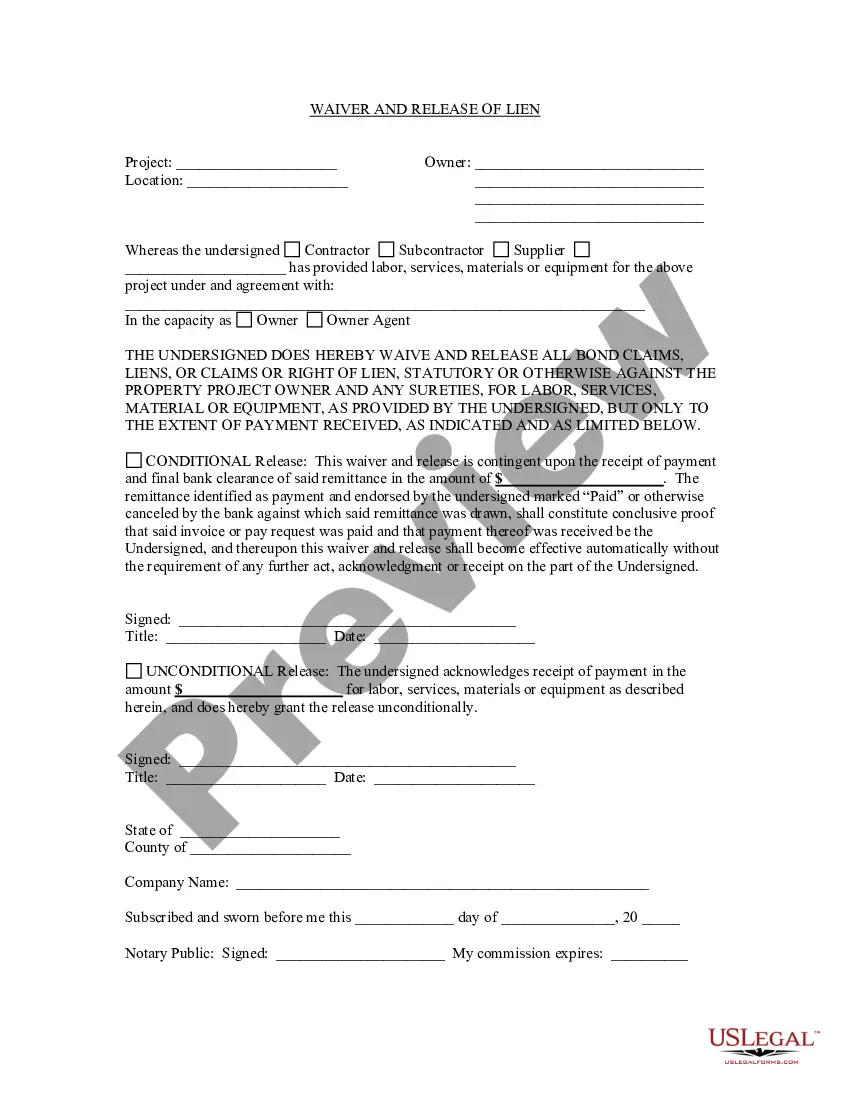

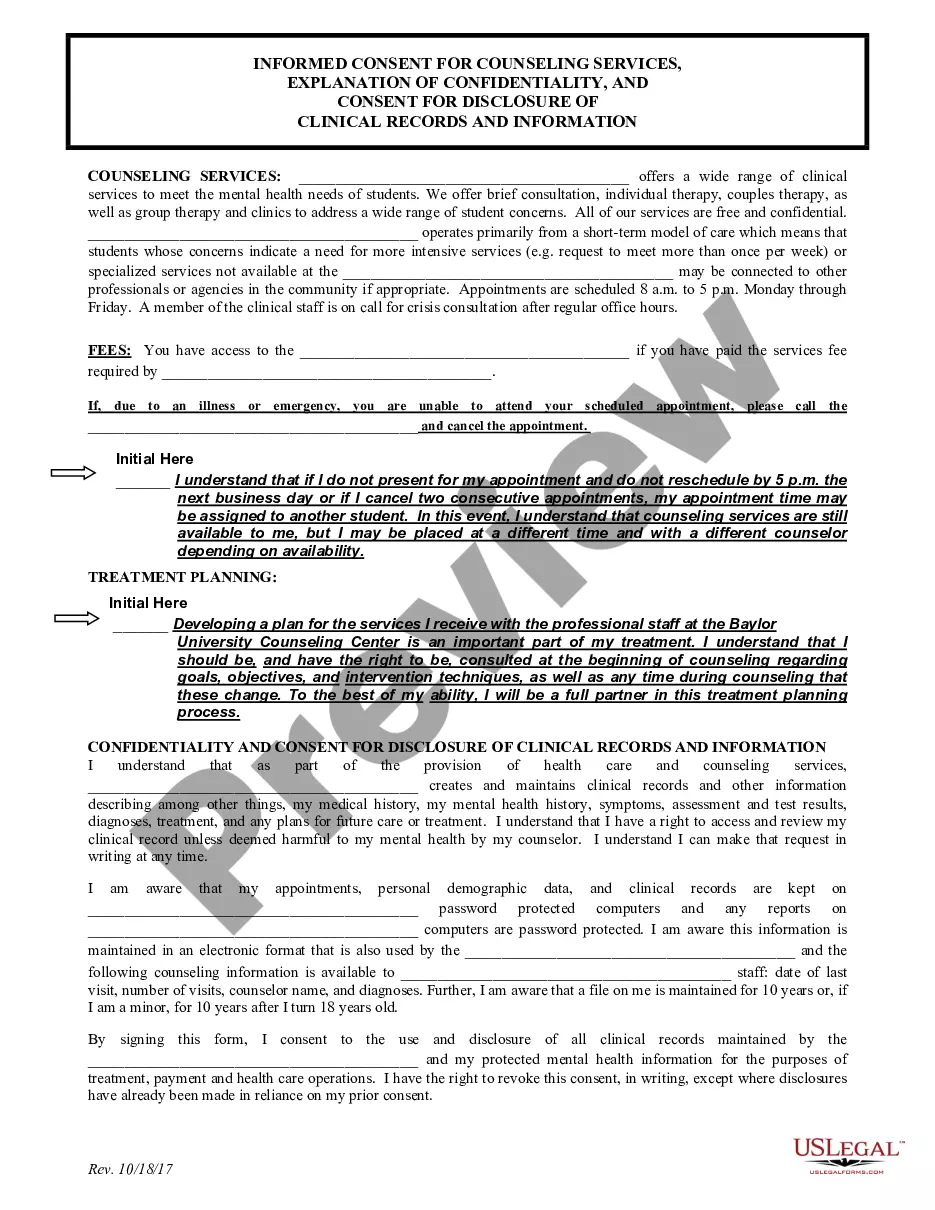

Discovering the right legal record format could be a have difficulties. Needless to say, there are a lot of web templates available online, but how would you find the legal form you require? Utilize the US Legal Forms internet site. The assistance gives a huge number of web templates, including the Oregon Reservation of Production Payment, that you can use for business and private requirements. Each of the kinds are examined by professionals and meet state and federal specifications.

In case you are already signed up, log in for your profile and then click the Acquire switch to find the Oregon Reservation of Production Payment. Use your profile to check throughout the legal kinds you have ordered previously. Visit the My Forms tab of your respective profile and get yet another copy of your record you require.

In case you are a new end user of US Legal Forms, listed here are easy guidelines for you to follow:

- Initially, make certain you have selected the correct form for your metropolis/state. You may examine the shape while using Preview switch and browse the shape explanation to make certain this is the right one for you.

- In the event the form does not meet your requirements, take advantage of the Seach area to find the right form.

- When you are certain that the shape is suitable, click on the Purchase now switch to find the form.

- Pick the prices prepare you would like and type in the required information and facts. Create your profile and pay for the order using your PayPal profile or Visa or Mastercard.

- Select the submit format and down load the legal record format for your gadget.

- Complete, revise and print and indicator the obtained Oregon Reservation of Production Payment.

US Legal Forms may be the greatest local library of legal kinds for which you will find different record web templates. Utilize the service to down load appropriately-made papers that follow condition specifications.

Form popularity

FAQ

(2) Items of income, gain, loss and deduction derived from or connected with sources within this state are those items attributable to: (a) The ownership or disposition of any interest in real or tangible personal property in this state; (b) A business, trade, profession or occupation carried on in this state; and (c) ...

?Oregon-source distributive income? is the portion of the entity's distributive income that is derived from or connected with Oregon sources, and includes modifications provided in Oregon Revised Statutes (ORS) Chapter 316 and other Oregon laws that directly relate to the PTE.

Oregon's state and local governments receive revenue from numerous sources including federal transfer payments; tuition, hospital and other charges; Lottery revenue; and taxes. Of all these sources, half of total state revenue is from taxation.

All wages and any other compensation for services performed in the United States are generally considered to be from sources in the United States.

About the payments The Oregon Department of Revenue has completed distribution of One-Time Assistance Payments to eligible households who qualified under House Bill 4157 (2022). These were one-time $600 payments, per tax return, required to be delivered by July 31, 2022.

?Any person, business, or unitary group of businesses doing business in Oregon may have obligations under the CAT. This includes such business entities as C and S corporations, partnerships, sole proprietorships, and other entities.

(a) Residents: An Oregon resident is allowed a credit for taxes paid to another state on mutually taxed income if the other state does not allow the credit.

Oregon-source income only If you have tangible or intangible property or other assets being used in Oregon, any income you receive is Oregon-source income. Your company must file an Oregon Corporation Income Tax Return, Form OR-20-INC. There are exceptions to this requirement in federal Public Law 86-272.