Oregon Assignment and Conveyance of Net Profits Interest

Description

How to fill out Assignment And Conveyance Of Net Profits Interest?

It is possible to commit several hours online attempting to find the authorized record format that fits the state and federal needs you want. US Legal Forms gives 1000s of authorized types which are analyzed by specialists. It is possible to obtain or produce the Oregon Assignment and Conveyance of Net Profits Interest from my services.

If you have a US Legal Forms account, you may log in and click on the Down load button. Next, you may total, edit, produce, or indicator the Oregon Assignment and Conveyance of Net Profits Interest. Each authorized record format you acquire is yours eternally. To obtain one more duplicate of the acquired develop, check out the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms web site the very first time, follow the basic instructions below:

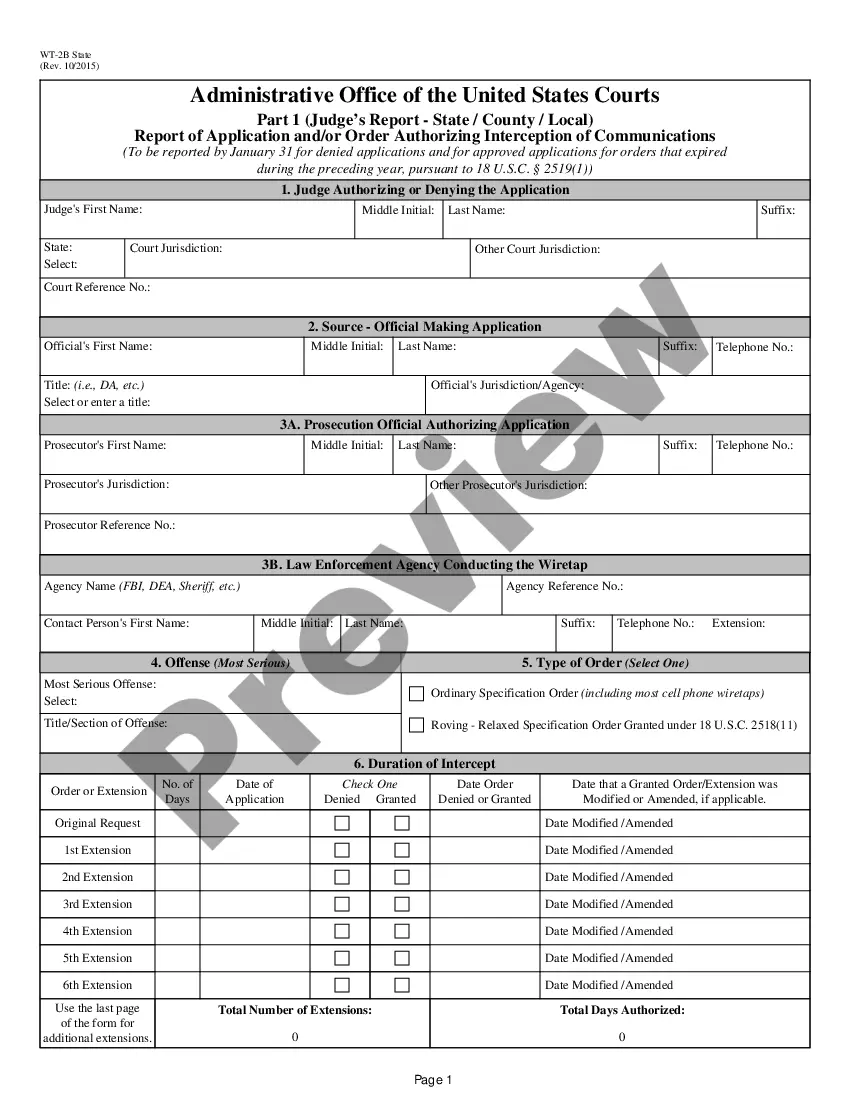

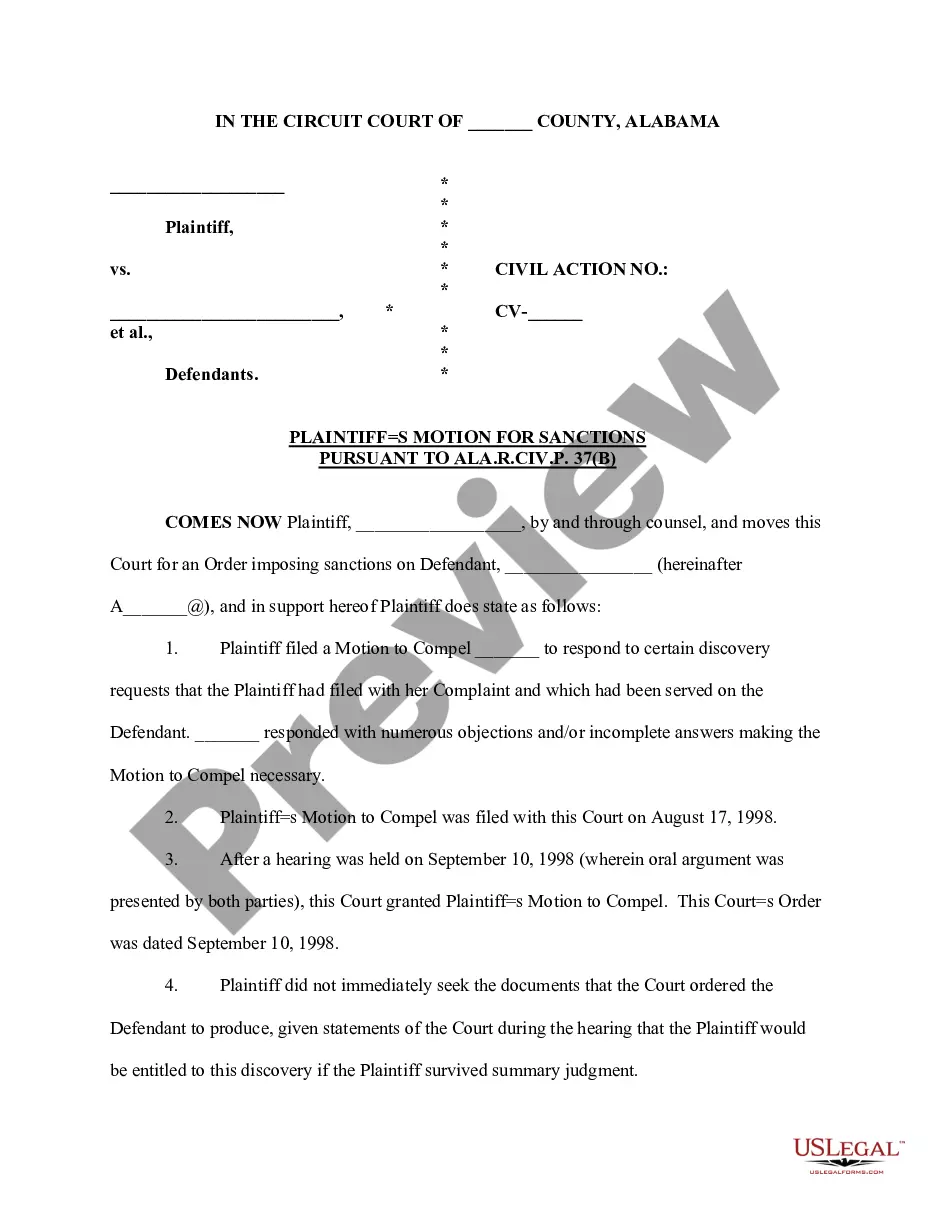

- Initial, make certain you have chosen the best record format for your area/area of your liking. Browse the develop description to ensure you have selected the appropriate develop. If offered, use the Review button to search with the record format as well.

- If you want to find one more edition in the develop, use the Look for field to get the format that meets your requirements and needs.

- After you have found the format you want, click on Get now to carry on.

- Choose the costs strategy you want, type in your qualifications, and sign up for a free account on US Legal Forms.

- Complete the purchase. You can use your bank card or PayPal account to purchase the authorized develop.

- Choose the structure in the record and obtain it in your system.

- Make changes in your record if necessary. It is possible to total, edit and indicator and produce Oregon Assignment and Conveyance of Net Profits Interest.

Down load and produce 1000s of record themes utilizing the US Legal Forms site, which offers the greatest assortment of authorized types. Use skilled and condition-particular themes to tackle your company or person requirements.

Form popularity

FAQ

Apportionment is the assignment of a portion of a corporation's income to a particular state for the purposes of determining the corporation's income tax in that state. The state determines how much of your earnings are a result of business done in that state so it can charge you the right amount of income tax.

Schedule OR?AP is used for all corporations and partner? ships that are doing business in more than one state and may be used with Forms OR?20, OR?20?INC, OR?20?INS, OR?20?S, and OR?65. Oregon income is the total of the business entity's appor? tioned and allocated income assigned to Oregon.

Certain types of non-apportionable income are allocable to Oregon under state law. Examples of income allocable to Oregon include rents and royalties from real or tangible personal property, capital gains, interest, dividends, and patent or copyright royalties.

Oregon has a single sales factor corporate apportionment formula. Business income is multiplied by 100% of the sales factor.

Apportionable income is apportioned to Oregon by multiplying the income by a multiplier equal to Oregon sales and other receipts as determined by Schedule OR-AP, part 1, divided by total sales and other receipts from the federal return (ORS 314.650).

Apportionable income is apportioned to Oregon by multiplying the income by a multiplier equal to Oregon sales and other receipts as determined by Schedule OR-AP, part 1, divided by total sales and other receipts from the federal return (ORS 314.650).

Oregon adopted the single sales factor apportionment method in 2005, as many states were moving toward giving the sales factor extra weight. The goal of apportionment as adopted by most states is to divide 100 percent of income among states that have jurisdiction to tax the income.

The apportionment formula calculates the percentage of the property, payroll and sales of the unitary business, which are attributable to California. The total business income of the unitary business is multiplied by this percentage to derive the amount of business income apportioned to this state.

In order to apportion the cost of electricity to one specific department, you simply multiply the amount of the overhead by the number of employees in that department, then divide that by your total number of employees.

This publication supplements the Oregon income tax instruction booklet and the Internal Revenue Service (IRS) Tax Guide: Publication 17, Your Federal Income Tax (For Individuals). This is a guide, not a complete statement of Oregon laws and rules. Law or rules may have changed after printing.