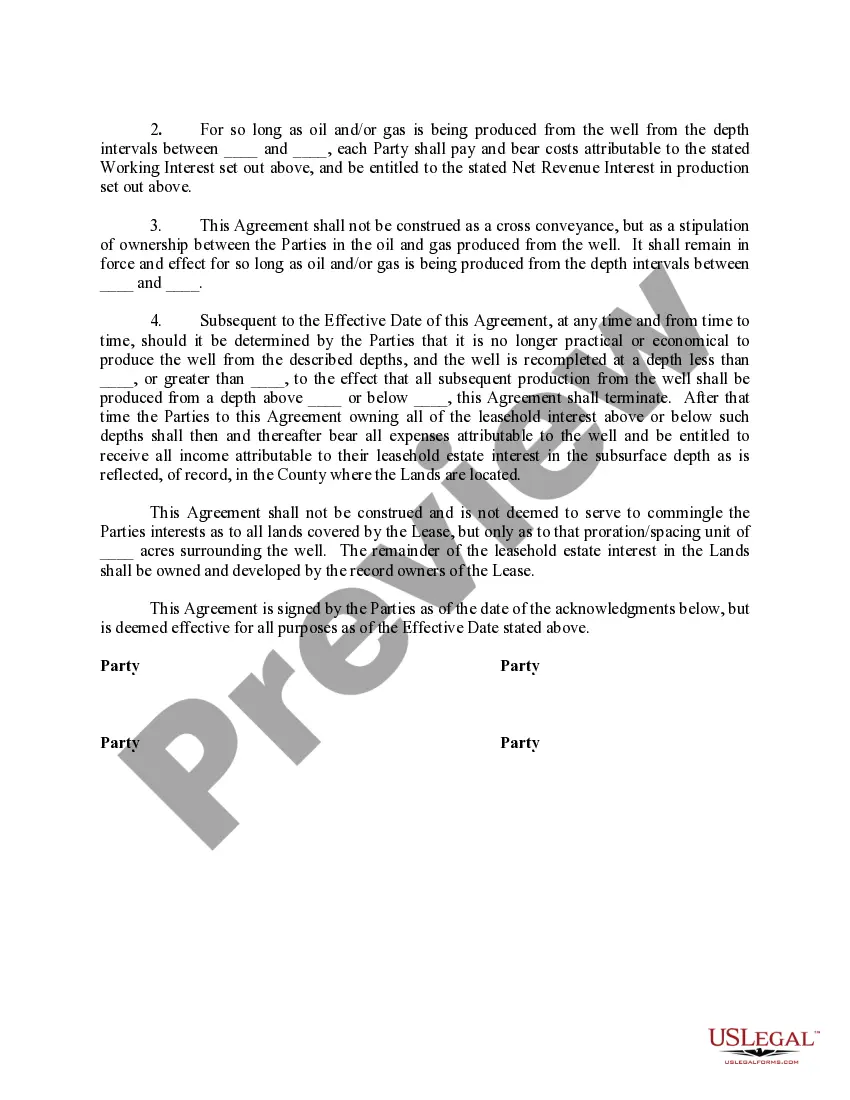

This form is used when the parties own undivided leasehold interests in the Lease as to depths from the surface of the ground to a Specific Depth. The parties acknowledge that the production from a well on the leasehold interest will be obtained from depths in which the ownership is not common. Thus, the parties find it necessary to enter into this Agreement to enable the parties to each be paid a proportionate part of the commingled production from the separate depths in which they own interests.

Oregon Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth

Description

How to fill out Commingling Agreement Among Working Owners As To Production From Different Formations Out Of The Same Well Bore, Where Leasehold Ownership Varies As To Depth?

If you need to comprehensive, acquire, or printing lawful record themes, use US Legal Forms, the greatest variety of lawful varieties, which can be found on the web. Take advantage of the site`s basic and hassle-free search to find the papers you need. Numerous themes for organization and personal functions are categorized by types and claims, or keywords. Use US Legal Forms to find the Oregon Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth within a couple of clicks.

If you are presently a US Legal Forms consumer, log in to the account and click on the Download option to obtain the Oregon Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth. Also you can accessibility varieties you earlier downloaded within the My Forms tab of your own account.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the form to the correct city/land.

- Step 2. Use the Review solution to examine the form`s articles. Never forget about to learn the outline.

- Step 3. If you are unsatisfied using the type, use the Research area near the top of the display screen to discover other variations of the lawful type template.

- Step 4. When you have found the form you need, go through the Buy now option. Opt for the prices program you favor and add your qualifications to sign up to have an account.

- Step 5. Procedure the transaction. You should use your charge card or PayPal account to perform the transaction.

- Step 6. Pick the formatting of the lawful type and acquire it on the gadget.

- Step 7. Total, modify and printing or indicator the Oregon Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth.

Each and every lawful record template you purchase is yours for a long time. You possess acces to every single type you downloaded inside your acccount. Click on the My Forms portion and pick a type to printing or acquire once again.

Be competitive and acquire, and printing the Oregon Commingling Agreement Among Working Owners As to Production from Different Formations Out of the Same Well Bore, Where Leasehold Ownership Varies As to Depth with US Legal Forms. There are thousands of skilled and express-specific varieties you can use for your personal organization or personal requires.