Oregon Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage)?

Finding the right authorized file web template might be a have difficulties. Obviously, there are tons of layouts available online, but how can you find the authorized form you want? Take advantage of the US Legal Forms internet site. The assistance provides thousands of layouts, including the Oregon Subordination of Lien (Deed of Trust/Mortgage), that can be used for business and personal requires. Every one of the forms are examined by experts and fulfill federal and state demands.

If you are currently authorized, log in to the bank account and then click the Obtain switch to have the Oregon Subordination of Lien (Deed of Trust/Mortgage). Make use of your bank account to search through the authorized forms you may have purchased in the past. Proceed to the My Forms tab of your respective bank account and get one more duplicate in the file you want.

If you are a whole new consumer of US Legal Forms, allow me to share easy recommendations for you to follow:

- Very first, be sure you have chosen the correct form for your area/county. You can check out the shape making use of the Review switch and look at the shape outline to guarantee this is the right one for you.

- In the event the form will not fulfill your expectations, take advantage of the Seach area to find the right form.

- When you are certain the shape would work, click on the Get now switch to have the form.

- Opt for the costs prepare you need and type in the required info. Make your bank account and buy an order using your PayPal bank account or credit card.

- Select the file formatting and obtain the authorized file web template to the device.

- Comprehensive, revise and printing and indicator the acquired Oregon Subordination of Lien (Deed of Trust/Mortgage).

US Legal Forms may be the largest library of authorized forms for which you can discover different file layouts. Take advantage of the company to obtain expertly-made files that follow status demands.

Form popularity

FAQ

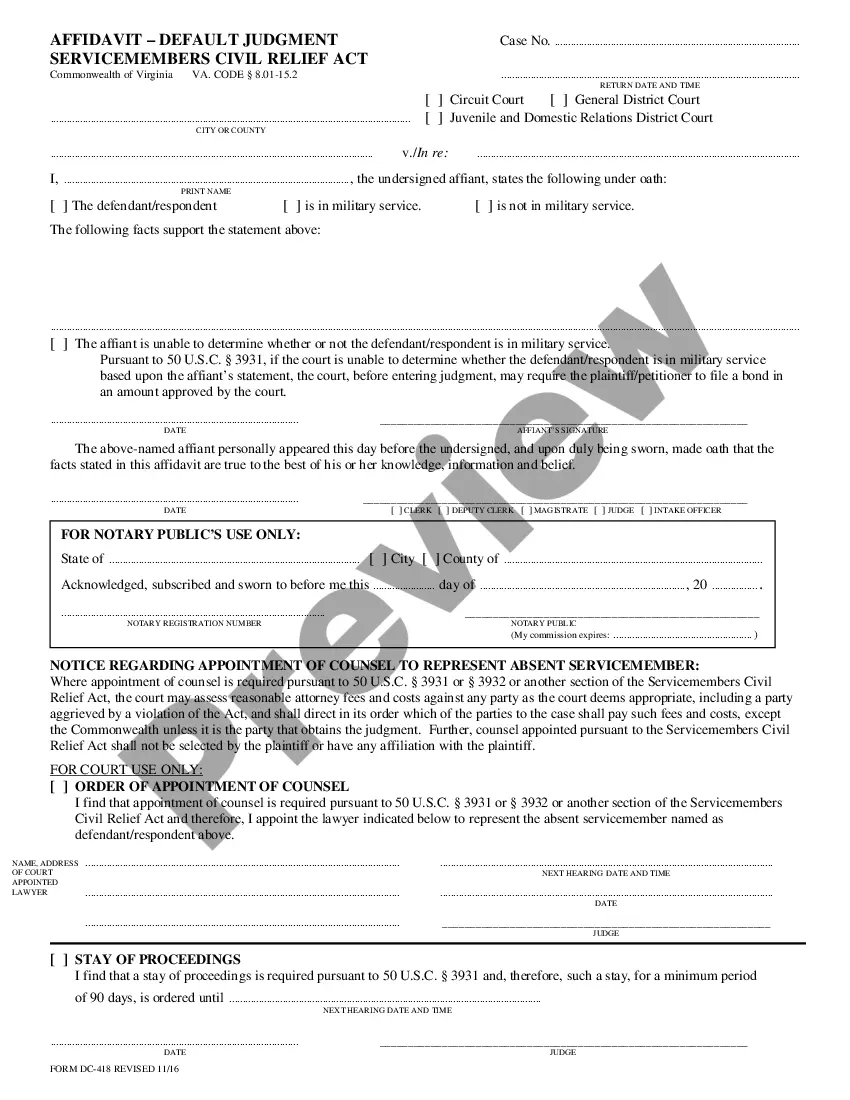

(8) "Trust deed" means a deed executed in conformity with ORS 86.705 to 86.815 that conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.

This Security Instrument secures to Lender (i) the. repayment of the Loan, and all renewals, extensions, and modifications of the Note, and (ii) the performance. of Borrower's covenants and agreements under this Security Instrument and the Note.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Since Oregon is a tax deed state, that means the county seizes properties for nonpayment of property taxes and sells them at auction.

Virtually all voluntary liens secured by Oregon real estate are trust deeds and are therefore governed by the Oregon Trust Deed Act, ORS 86.705 ? 86.795, which has been in existence since 1959.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.