Oregon Architect Agreement - Self-Employed Independent Contractor

Description

How to fill out Architect Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal form templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent versions of forms such as the Oregon Architect Agreement - Self-Employed Independent Contractor in moments.

If you already have an account, Log In and download the Oregon Architect Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Edit. Fill out, modify, and print or sign the downloaded Oregon Architect Agreement - Self-Employed Independent Contractor.

Every template you added to your account does not expire and is yours indefinitely. So, if you need to download or create another copy, just go to the My documents section and click on the form you need. Access the Oregon Architect Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

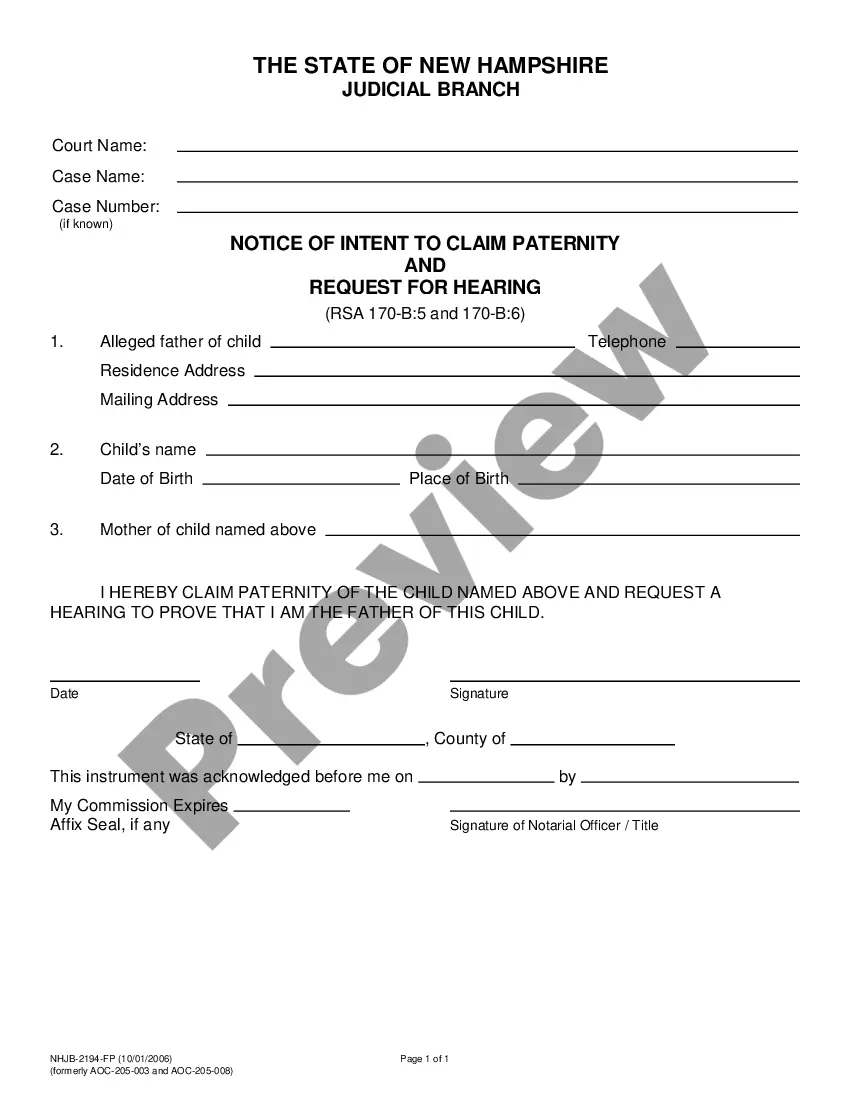

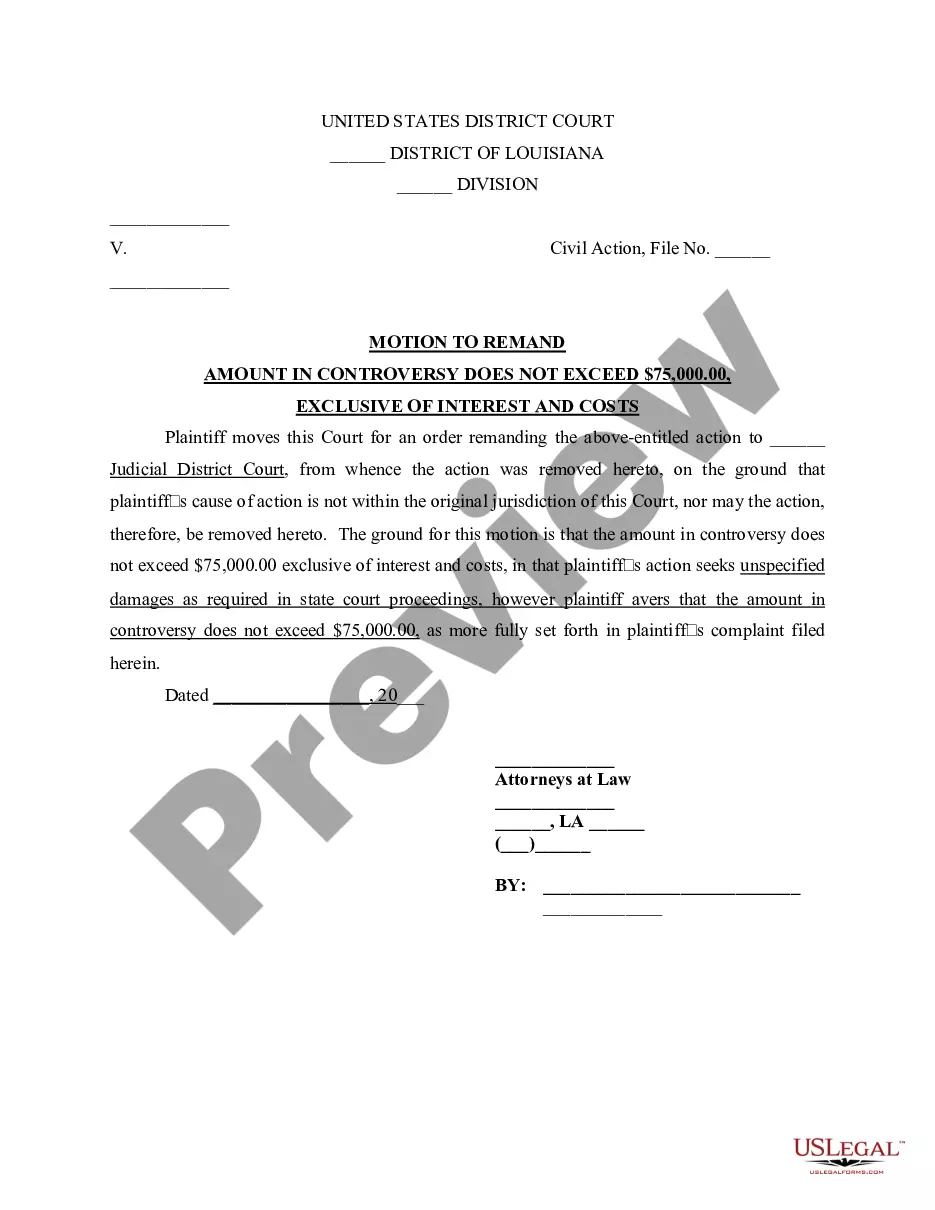

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s content. Check the form summary to confirm you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Writing an independent contractor agreement starts with defining the relationship between you and your client. Include key elements such as scope of work, payment details, and project deadlines. The Oregon Architect Agreement - Self-Employed Independent Contractor can serve as a useful template to ensure you encompass all vital clauses. Remember to keep your language clear and straightforward so both parties understand their responsibilities fully.

Filling out an independent contractor form involves providing basic information about yourself and the services you offer. Ensure you include your name, address, and tax identification number. It’s important to specify the terms of service and payment to avoid misunderstandings later. Using an Oregon Architect Agreement - Self-Employed Independent Contractor format can streamline this process and help you cover all necessary points diligently.

To fill out an independent contractor agreement, start by entering your personal information as the contractor and the client’s information. Clearly outline the payment terms, including rates and deadlines, as well as the nature of the services you will provide. For an Oregon Architect Agreement - Self-Employed Independent Contractor, include specifics about project deliverables and timelines to ensure clarity. Always review the agreement to confirm all details are accurate before signing.

To create an Oregon Architect Agreement - Self-Employed Independent Contractor, you should start by defining the scope of work, including specific tasks and responsibilities. Next, outline payment terms, such as compensation rates and payment schedules, ensuring clarity around invoicing procedures. You should also include confidentiality clauses to protect sensitive information and detail the duration of the agreement. Consider using the US Legal Forms platform for comprehensive templates that simplify this process and ensure compliance with Oregon laws.

The purpose of an independent contractor agreement is to establish clear terms between the contractor and the client. It helps define the work scope, payment arrangements, and project timelines. For architects, having an Oregon Architect Agreement - Self-Employed Independent Contractor is particularly important. This agreement not only protects both parties but also minimizes misunderstandings during the project.

In Oregon, an independent contractor must earn $600 or more in a calendar year from a single client to receive a 1099 form. This income threshold is standard for reporting tax obligations. If you are working as a self-employed architect, make sure to keep clear records of your earnings for your Oregon Architect Agreement - Self-Employed Independent Contractor. This practice will ease any tax-related concerns.

An independent contractor in Oregon typically manages their own work, sets their own hours, and has control over how to complete tasks. These workers operate under a contract, like the Oregon Architect Agreement - Self-Employed Independent Contractor. It is essential to meet specific criteria to maintain this classification. Understanding these requirements helps prevent misclassification.

The recent federal rule on independent contractors affects how workers are classified. It emphasizes a multi-factor test to determine if a worker is truly independent or an employee. This change can impact architects operating under an Oregon Architect Agreement - Self-Employed Independent Contractor. Be aware of these federal guidelines to ensure compliance.

An independent contractor agreement in Oregon outlines the working relationship between a contractor and a client. This document specifies the scope of work, payment terms, and deadlines. For architects, having a well-drafted Oregon Architect Agreement - Self-Employed Independent Contractor is crucial. It protects both parties and clarifies expectations.

Yes, architects can work as independent contractors. Many self-employed architects choose to offer their services through an Oregon Architect Agreement - Self-Employed Independent Contractor. This arrangement gives them the flexibility to manage multiple projects and clients. It also allows them to operate their own business while providing professional architectural services.