Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Herd Health Specialist Agreement - Self-Employed Independent Contractor?

If you require to complete, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Take advantage of the site's user-friendly and convenient search to locate the documents you need. A range of templates for business and personal use are organized by categories and states, or keywords.

Use US Legal Forms to find the Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Compete and download, and print the Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your specific city/state.

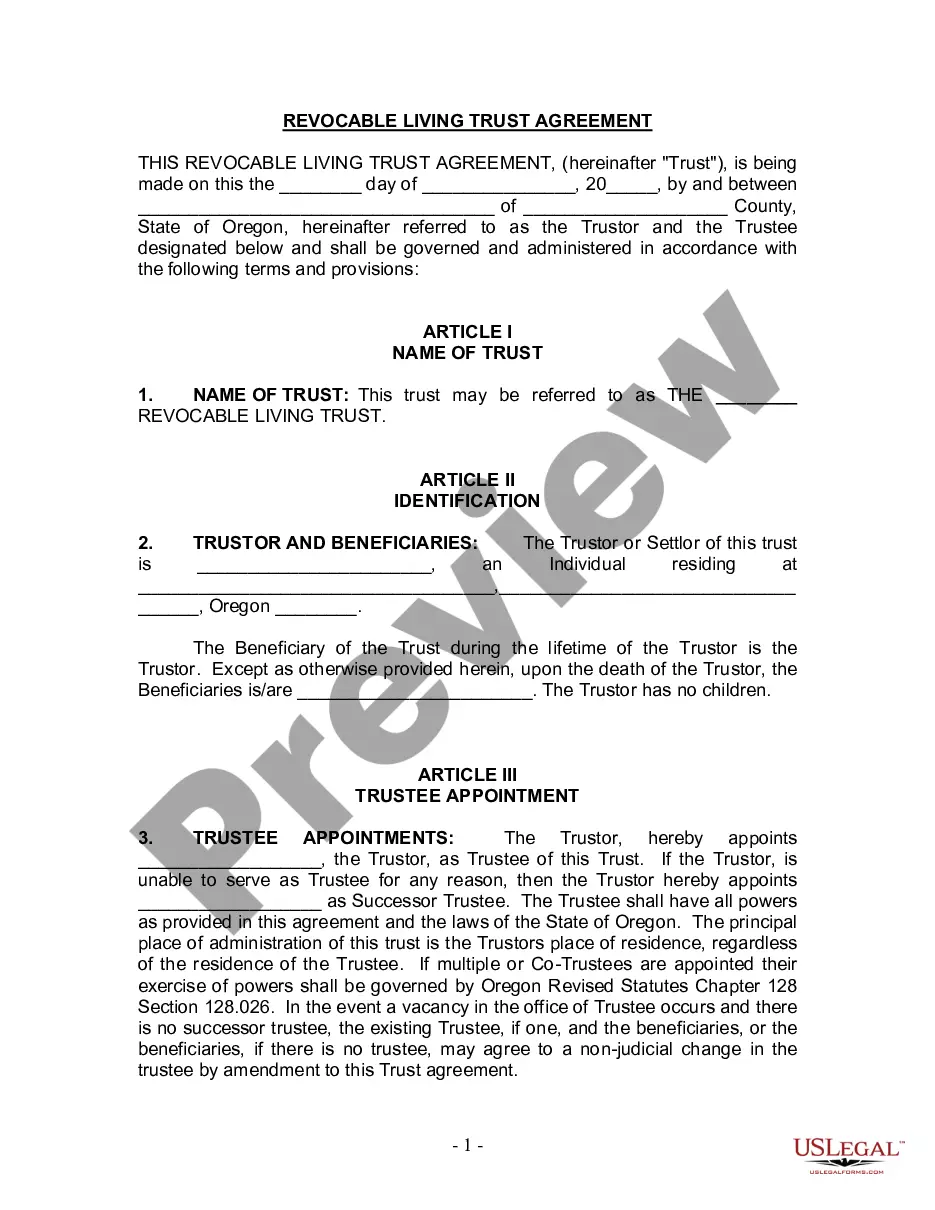

- Step 2. Utilize the Review option to assess the form's content. Don't forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After identifying the form you require, click on the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Creating an independent contractor agreement involves several key steps, beginning with clearly defining the services to be provided. Next, outline payment terms, deadlines, and any specific clauses relevant to the job. You can streamline this process by using platforms like uslegalforms to generate professional, legally-compliant documents, especially when drafting an Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor.

A basic independent contractor agreement outlines the terms and conditions of the working relationship between the contractor and the employer. It typically includes details such as payment, scope of work, and confidentiality. For those entering into an Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor, this document serves as a crucial foundation to protect both parties and ensure clarity in the partnership.

In Oregon, an independent contractor is defined by the level of control they have over their work and the independence of their business operations. Generally, if a worker can decide how and when to perform their tasks, they likely qualify as an independent contractor. This classification is crucial for those engaging in an Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor, as it dictates tax obligations and benefits eligibility.

The new federal rule on independent contractors clarifies how workers are classified and emphasizes the importance of the nature of the working relationship. Under this rule, the classification impacts benefits and protections that workers are entitled to. For those entering an Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor, understanding this rule helps ensure compliance with both federal and state laws.

Independent contractors can obtain health benefits, but typically not through their clients. They often need to seek health insurance independently or through marketplaces. Ensuring you have proper health coverage is essential, and resources like the Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor can support you in understanding your options.

Yes, an independent contractor is considered self-employed in Oregon. This classification means you operate your own business and are responsible for managing all aspects of your work, including taxes. The Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor aligns with this status, reinforcing your independence and business ownership.

Certain workers in Oregon are exempt from minimum wage laws, including independent contractors. As a self-employed individual, you determine your rates and payment structure. However, confirming this exemption through resources like the Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor can help you avoid any misunderstandings.

The independent contractor agreement in Oregon is a legal document that outlines the terms and conditions of the contractor-client relationship. This agreement specifies payment terms, scope of work, and any other vital details that protect both parties. Utilizing the Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor ensures that you have a solid foundation for working as an independent contractor while minimizing disputes.

Labor laws in Oregon generally do not apply to 1099 independent workers. As independent contractors, you are exempt from many of the protections afforded to employees, such as minimum wage and overtime laws. However, it is crucial to understand your rights and obligations through the Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor, helping you navigate this landscape confidently.

Independent contractors in Oregon must meet certain legal requirements to operate correctly. They need to register their business, adhere to tax guidelines, and may need specific licenses depending on their work. The Oregon Herd Health Specialist Agreement - Self-Employed Independent Contractor can provide clarity on these legal obligations, ensuring you comply with state and federal laws.