Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed

Description

How to fill out Hardware, Locks And Screens Installation And Services Contract - Self-Employed?

Are you presently in a situation where you need documents for either business or personal purposes frequently.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, such as the Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed, designed to comply with federal and state regulations.

Once you find the correct form, click Acquire now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase with your PayPal or credit card. Select a suitable paper format and download your copy. You can find all the document templates you have purchased in the My documents section. You can access an additional copy of the Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed whenever necessary. Just select the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

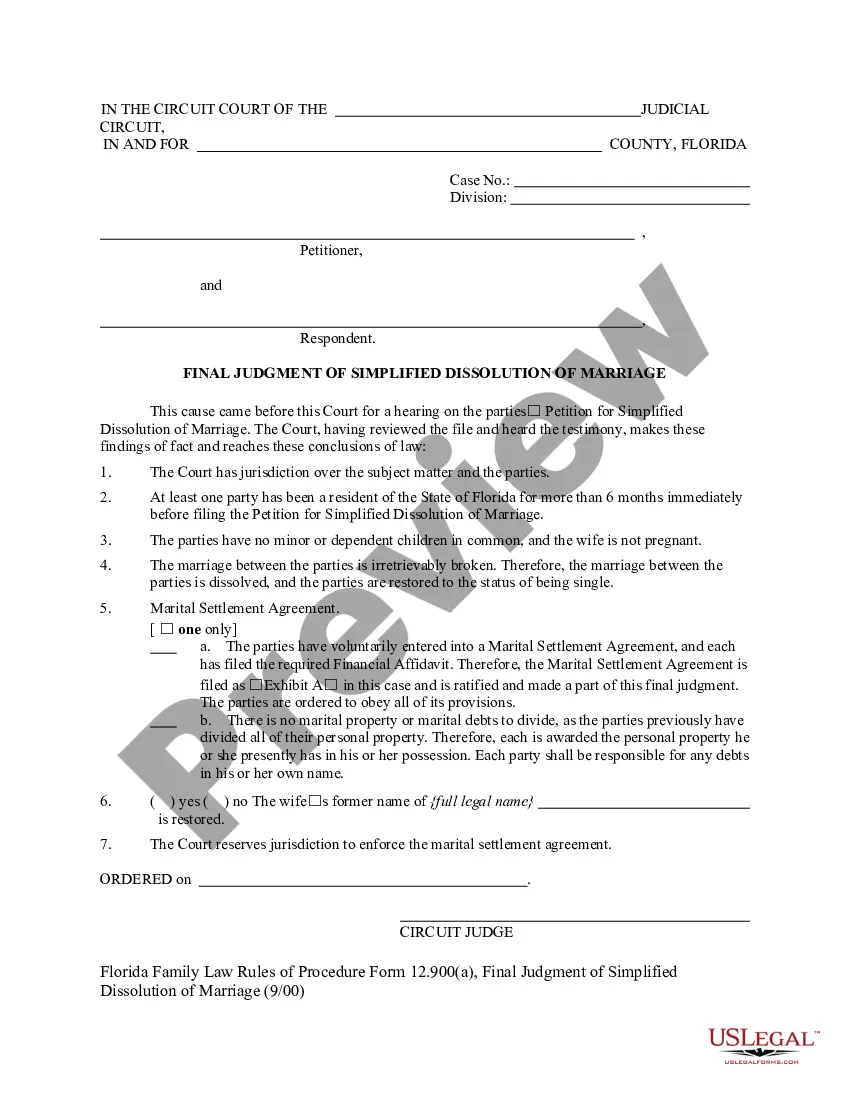

- Use the Review button to examine the form.

- Review the summary to ensure you have selected the right form.

- If the form is not what you're looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

The new federal rule on independent contractors emphasizes the importance of assessing the nature of the work relationship. Specifically, it looks into the degree of control an employer has over a contractor’s work. Understanding this rule is vital for those engaged in the Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed to ensure compliance and safeguard their independent contractor status.

Yes, Arkansas does require specific licenses for contractors, including those working under the Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed. You will need to check the local laws to determine what types of licenses are necessary for your services. To avoid complications, consider using ulegalforms to help obtain the correct documentation.

Starting a business is not strictly necessary to be an independent contractor, but it can offer advantages. With the Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed, having a formal business structure can help you manage your finances better and enhance your professional reputation. However, it's wise to consult with local regulations to ensure you meet all requirements.

To become an independent contractor under the Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed, you need to fulfill several criteria. You should have a clear agreement with clients that specifies the services you offer. Additionally, maintaining your own business insurance and necessary licenses is essential for legal compliance and to establish trust with clients.

Legal requirements for independent contractors can vary but typically include obtaining the necessary licenses and complying with tax regulations. For those focused on Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed, understanding these requirements protects you from potential legal issues. Platforms like uslegalforms can assist in clarifying necessary steps and documents.

While technically possible to issue a 1099 to someone without a business license, it's not advisable. For those involved in Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed, having a business license can safeguard both parties and demonstrate compliance with regulations. Ensure anyone you work with has the necessary licenses to protect your interests.

Yes, labor laws do apply to 1099 independent workers in Oregon, but the application may differ from traditional employees. This affects various aspects such as wages and working conditions, especially for those engaged in Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed. Ensure you understand your rights and obligations to maintain a fair working environment.

In Oregon, the amount of work you can do without a contractor license varies, but generally, significant contracts for services like Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed are prohibited without one. Be mindful of limits on financial thresholds, as exceeding them may necessitate a license. To be on the safe side, it's best to consult local regulations.

To set up as a self-employed contractor, start by choosing a business structure and then register it with the state. It's crucial to obtain the necessary permits for Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed. Resources like uslegalforms can guide you through the paperwork and requirements to ensure you're compliant.

Certainly, having a business license is typically necessary for independent contractors in Oregon. This applies to those involved in Oregon Hardware, Locks And Screens Installation And Services Contract - Self-Employed. A business license not only legitimizes your work but also opens opportunities for you to bid for more significant contracts.