Oregon General Home Repair Services Contract - Long Form - Self-Employed

Description

How to fill out General Home Repair Services Contract - Long Form - Self-Employed?

Selecting the appropriate legal document format can be challenging. Naturally, there are numerous templates available online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The service offers thousands of templates, such as the Oregon General Home Repair Services Contract - Long Form - Self-Employed, which can be utilized for both business and personal purposes. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Oregon General Home Repair Services Contract - Long Form - Self-Employed. Use your account to verify the legal forms you have purchased previously. Visit the My documents tab in your account and download another copy of the document you need.

Complete, modify, print, and sign the received Oregon General Home Repair Services Contract - Long Form - Self-Employed. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to download professionally-created paperwork that adheres to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

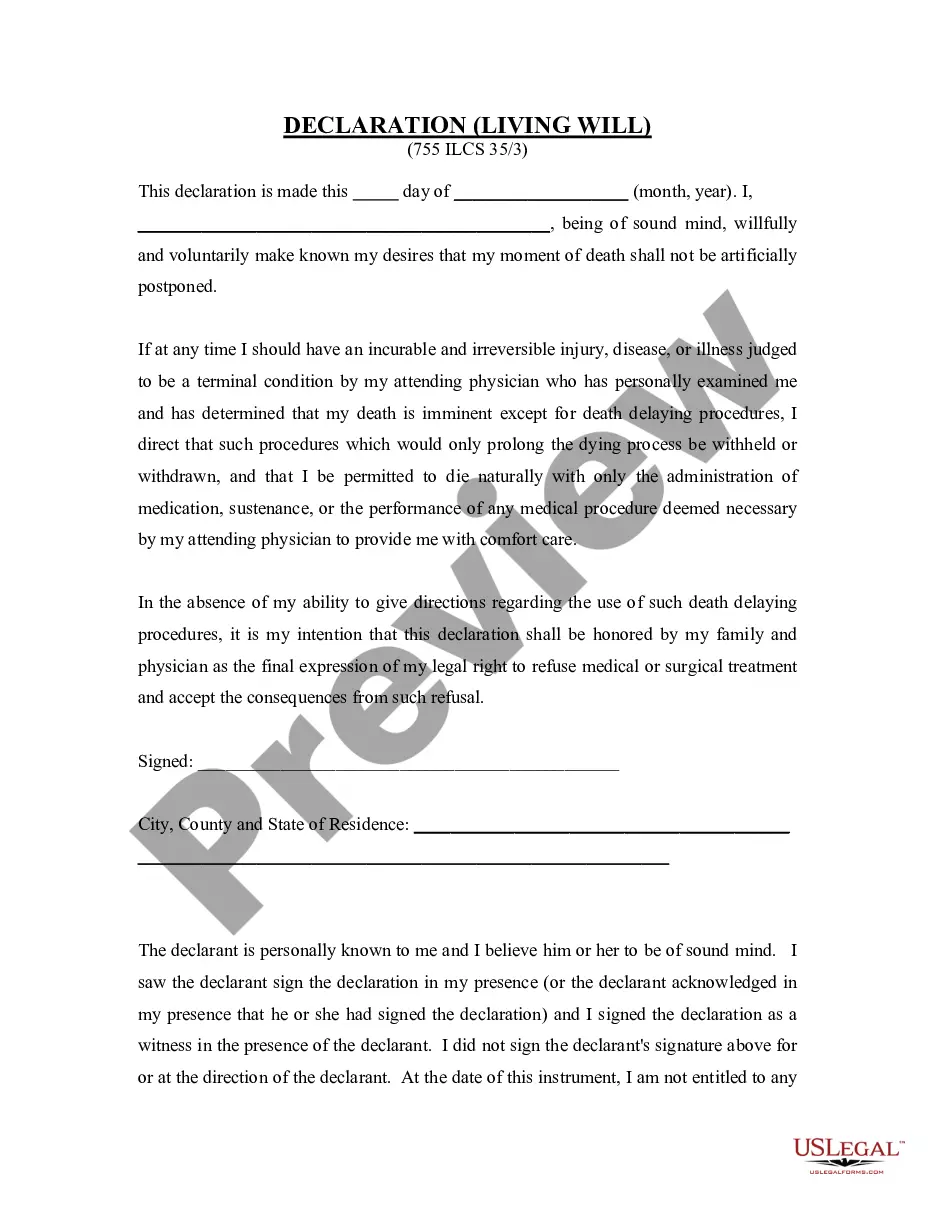

- First, make sure you have selected the correct form for your area/state. You can preview the form using the Preview button and review the form details to ensure it is the right one for you.

- If the form does not satisfy your needs, use the Search field to find the correct form.

- Once you are confident that the form is suitable, click the Buy now button to acquire the form.

- Choose the pricing plan you desire and enter the required information. Create your account and complete the transaction using your PayPal account or credit card.

- Select the file format and download the legal document to your device.

Form popularity

FAQ

The primary difference between a contractor and a handyman lies in the scope of work and licensing. Contractors typically handle more extensive projects and often require licenses and bonding, while handymen handle smaller repairs and maintenance tasks. An Oregon General Home Repair Services Contract - Long Form - Self-Employed can be a valuable tool for handymen, as it helps clearly define the services provided and the expectations for both parties.

To establish yourself as an independent contractor in Oregon, start by choosing a business structure that suits your needs. Obtaining an Oregon General Home Repair Services Contract - Long Form - Self-Employed will help formalize your business agreements with clients. Additionally, ensure you have the necessary insurance coverage, and promote your services through networking and online platforms to build your client base.

To become a handyman in Oregon, you typically need to understand the legal requirements and complete any necessary training. While a license is not always required for smaller jobs, obtaining an Oregon General Home Repair Services Contract - Long Form - Self-Employed can help you outline your services and protect your interests. Consider taking courses in basic repairs, business management, and customer service to enhance your skills and credibility.

To protect yourself as an independent contractor, ensure you have a clear contract that defines the scope of work and payment terms. Gather relevant documentation and keep accurate records of your services. It is also wise to consider liability insurance for extra security. An Oregon General Home Repair Services Contract - Long Form - Self-Employed can help you establish these protective measures in writing.

In Oregon, an independent contractor must meet specific criteria, including the degree of control they have over their work. They usually provide their tools and operate independently, without employer control. Ensuring compliance with these standards helps avoid misclassification disputes. A solid Oregon General Home Repair Services Contract - Long Form - Self-Employed outlines these qualifications clearly.

The primary difference lies in control over work and tax responsibilities. Independent contractors have more freedom to choose how and when to work, while employees typically follow directives and have taxes withheld from their paychecks. Understanding this distinction is crucial for compliance with Oregon laws. An Oregon General Home Repair Services Contract - Long Form - Self-Employed clearly defines this relationship for both parties.

Typically, 1099 independent contractors do not qualify for unemployment benefits because they are self-employed. However, specific programs may be available, especially during extraordinary circumstances, like the pandemic. It is vital to stay informed about any changes or available options in Oregon. Consulting legal forms for an Oregon General Home Repair Services Contract - Long Form - Self-Employed can aid in understanding your rights and responsibilities.

Yes, labor laws do apply to 1099 independent contractors, but in different ways than to traditional employees. As a self-employed individual, you may enjoy certain freedoms, but you are also responsible for your taxes and benefits. Understanding these regulations is essential to operate correctly in Oregon. Utilizing an Oregon General Home Repair Services Contract - Long Form - Self-Employed can help clarify the terms of your engagement.

In Oregon, handymen do not always require a license, but certain tasks may need specific licensing. A handyman should be knowledgeable about state regulations and consider obtaining a license to enhance credibility. Being bonded offers clients added security, ensuring that they can have peace of mind. Using an Oregon General Home Repair Services Contract - Long Form - Self-Employed can formalize agreements and clarify responsibilities.

Yes, you can be your own general contractor in Oregon. This allows you to manage your own home repair projects and direct your renovations or repairs. However, keep in mind that you still must adhere to permitting and licensing laws. Using an Oregon General Home Repair Services Contract - Long Form - Self-Employed can help you organize your plans and responsibilities effectively.