Oregon Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

Have you ever faced a scenario where you require documentation for either professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding trustworthy versions can be challenging.

US Legal Forms offers a vast selection of template documents, such as the Oregon Carrier Services Contract - Self-Employed Independent Contractor, which can be tailored to comply with federal and state requirements.

Once you find the correct template, click on Purchase now.

Choose the pricing plan you prefer, provide the necessary details to create your account, and complete your purchase using PayPal or a credit card.

- If you're already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the format for the Oregon Carrier Services Contract - Self-Employed Independent Contractor.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Obtain the template you need and confirm that it corresponds to the correct state/region.

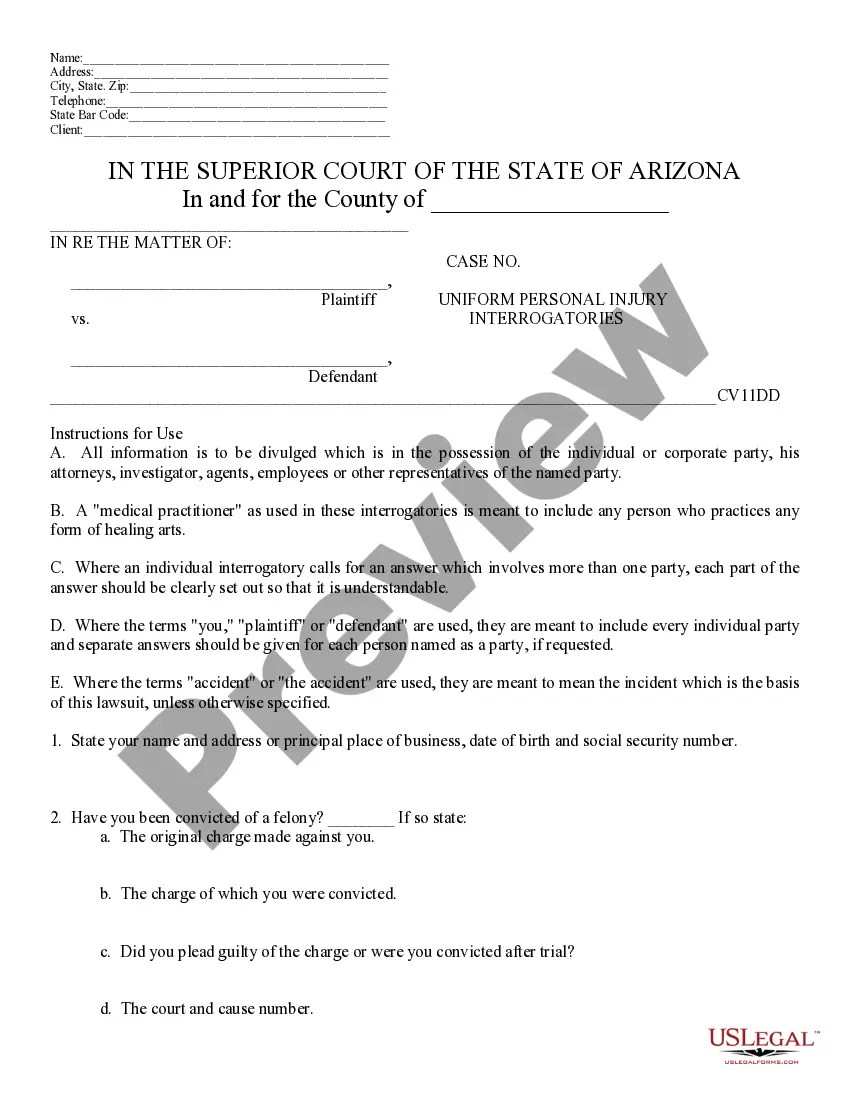

- Use the Review button to examine the form.

- Check the description to make sure you have selected the right template.

- If the template does not meet your needs, utilize the Research field to find the document that matches your requirements.

Form popularity

FAQ

Filling out an independent contractor agreement involves detailing the parties' names, the scope of work, and payment terms. Make sure to specify deadlines and any conditions for the contract's termination. For additional clarity and compliance, consider using templates available on uslegalforms, especially those tailored to the Oregon Carrier Services Contract - Self-Employed Independent Contractor.

To write an independent contractor agreement, start with a clear title followed by the date and contact information of both parties. Outline the services being provided, payment structure, and timelines. Referencing an Oregon Carrier Services Contract - Self-Employed Independent Contractor can provide a solid framework for your agreement, ensuring you include all essential details.

Yes, you can write your own service agreement as an independent contractor. When doing so, ensure that you include essential elements such as scope of work, payment details, and termination clauses. It's wise to refer to established contracts, like the Oregon Carrier Services Contract - Self-Employed Independent Contractor, to ensure that your agreement covers all necessary components.

To fill out an independent contractor form, start by entering your legal name and business name if applicable. Include your Taxpayer Identification Number, as required, and make sure to sign and date the form. Utilize platforms like uslegalforms to access templates that guide you through specifics, especially for Oregon Carrier Services Contract - Self-Employed Independent Contractor.

An independent contractor typically needs to fill out a W-9 form to provide their Taxpayer Identification Number to the hiring company. Additionally, if you are entering into an Oregon Carrier Services Contract - Self-Employed Independent Contractor arrangement, you may need to draft a service agreement. This document outlines your services, payment terms, and responsibilities.

In Oregon, registering your business as an independent contractor is not always required unless specific circumstances apply. If you are operating under a business name, or if you have employees, registering may be beneficial. Familiarizing yourself with the Oregon Carrier Services Contract can provide valuable insight into whether you need to take this step.

In Oregon, if you are working as an independent contractor, there is no specific limit to the amount of work you can perform without a contractor license, as long as the services you provide do not require one. However, it's important to ensure your work complies with local regulations. Utilizing the Oregon Carrier Services Contract can help clarify your role and obligations.

An independent contractor in Oregon is someone who provides services under a contract and operates their business independently. They are not considered employees, which means they have more control over how, when, and where they work. Understanding your rights and responsibilities under the Oregon Carrier Services Contract can help you navigate this relationship effectively.

Yes, independent contractors file taxes as self-employed individuals. In Oregon, this means that you must report your income on Schedule C along with Form 1040. Diligently keeping track of your income and expenses is crucial to ensure you comply with IRS regulations while benefiting from tax deductions available to self-employed independent contractors.

Creating an independent contractor contract involves outlining the project details, payment terms, and duration of the agreement. Be sure to include clauses related to confidentiality and termination. For those needing assistance, platforms like uslegalforms can provide templates tailored to an Oregon Carrier Services Contract - Self-Employed Independent Contractor, ensuring legal compliance and clarity in your agreements.