Oregon Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

It is feasible to invest numerous hours online looking for the valid document template that complies with the state and federal requirements you need.

US Legal Forms offers thousands of valid templates that can be reviewed by professionals.

You can acquire or create the Oregon Hardship Letter to Mortgagor or Lender to Prevent Foreclosure with my assistance.

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- Subsequently, you can complete, modify, create, or sign the Oregon Hardship Letter to Mortgagor or Lender to Prevent Foreclosure.

- Every valid document template you receive is yours indefinitely.

- To retrieve another copy of any purchased document, go to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the area/city of your selection.

- Review the document description to confirm you have selected the appropriate document.

Form popularity

FAQ

Avoid including emotional outbursts or unverified claims in your hardship letter. Focus on presenting factual information regarding your situation. Steer clear of assigning blame to others for your financial difficulties. This Oregon Hardship Letter to Mortgagor or Lender to Prevent Foreclosure should remain professional and focused on your need for help.

To write a proof of hardship letter, start by clearly stating your situation. Explain the reasons for your financial difficulties, such as job loss or medical emergencies. Include specific details to support your claims and provide documentation, when possible. This Oregon Hardship Letter to Mortgagor or Lender to Prevent Foreclosure must be clear and concise while expressing your need for assistance.

The Oregon foreclosure avoidance program is designed to assist homeowners facing foreclosure by providing resources and support. This program offers access to counseling services, legal guidance, and various options to help you keep your home. Engaging with this program allows you to better understand your choices and may lead to successfully submitting an Oregon Hardship Letter to Mortgagor or Lender to Prevent Foreclosure. Explore uslegalforms to find the templates and tools you need for this process.

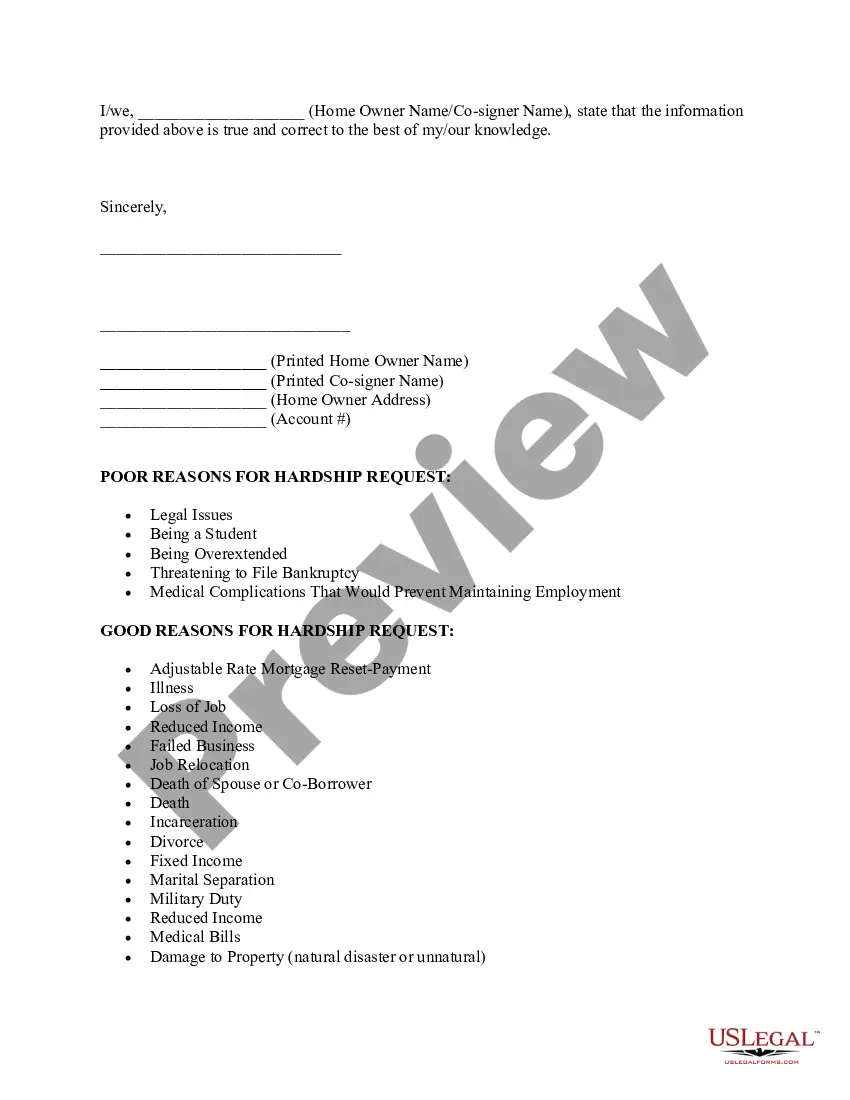

A "hardship letter" is a letter that you write to your lender explaining the circumstances of your hardship. The letter should give the lender a clear picture of your current financial situation and explain what led to your financial difficulties. The hardship letter is a normal part of the loss mitigation process.

How to Write an Effective Hardship LetterPart 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.More items...?

The state's foreclosure moratorium ended on Dec. 31. So now, Oregon homeowners who used this protection may be expected to resume mortgage payments and catch up on those missed. The moratorium was established to prevent foreclosures for people who lost income or couldn't pay their mortgage due to the COVID-19 pandemic.

How Can I Stop a Foreclosure in Oregon? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

A hardship letter explains to a lender the circumstances that have made you unable to keep up with your debt payments. It provides specific details such as the date the hardship began, the cause and how long you expect it to continue.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

The definition of hardship is adversity, or something difficult or unpleasant that you must endure or overcome. An example of hardship is when you are too poor to afford proper food or shelter and you must try to endure the hard times and deprivation.