Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

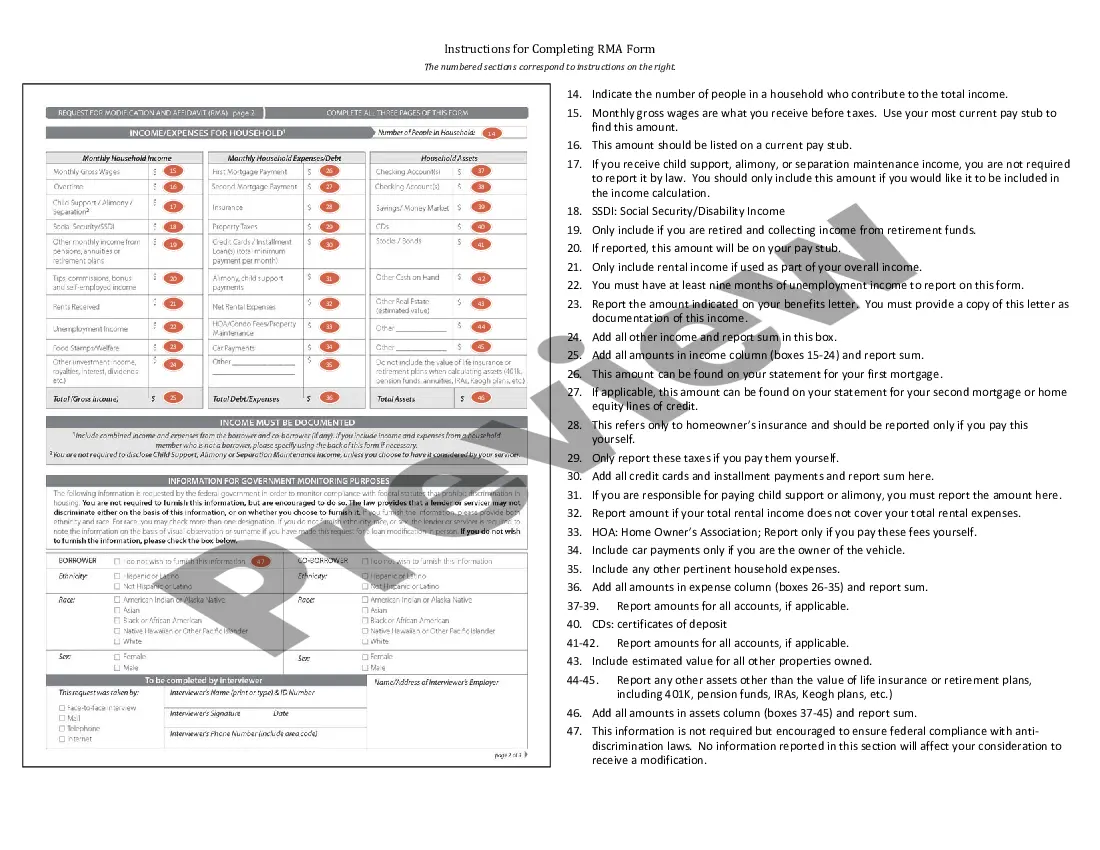

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates you can purchase or print.

While navigating the website, you can access a vast array of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form in just a few minutes.

Check the form details to ensure you’ve chosen the right one.

If the form does not meet your requirements, use the Search field at the top of the screen to locate the one that does.

- If you currently possess a subscription, Log In and retrieve the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form from the US Legal Forms library.

- The Download button will be available on every form you view.

- You have access to all previously retrieved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form’s content.

Form popularity

FAQ

Underwriters evaluate your financial circumstances and assess whether you qualify for a loan modification. They usually look at your income, expenses, and the current state of your mortgage. Understanding the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form will help you present your information effectively. Tools provided by platforms like uslegalforms can assist you in preparing a compelling case.

Loan modification requirements typically involve demonstrating financial hardship, providing relevant income documentation, and completing initiation forms correctly. You must follow the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form carefully to meet these requirements. The clearer you present your situation, the better your chances for approval. Uslegalforms offers templates and resources to ease your documentation efforts.

Several factors can disqualify you from receiving a loan modification, including insufficient income or lack of documentation. Additionally, not meeting the lender's specific criteria can be a barrier. Familiarizing yourself with the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form can help you understand these qualifications better. Using resources from uslegalforms can clarify what disqualifies applicants.

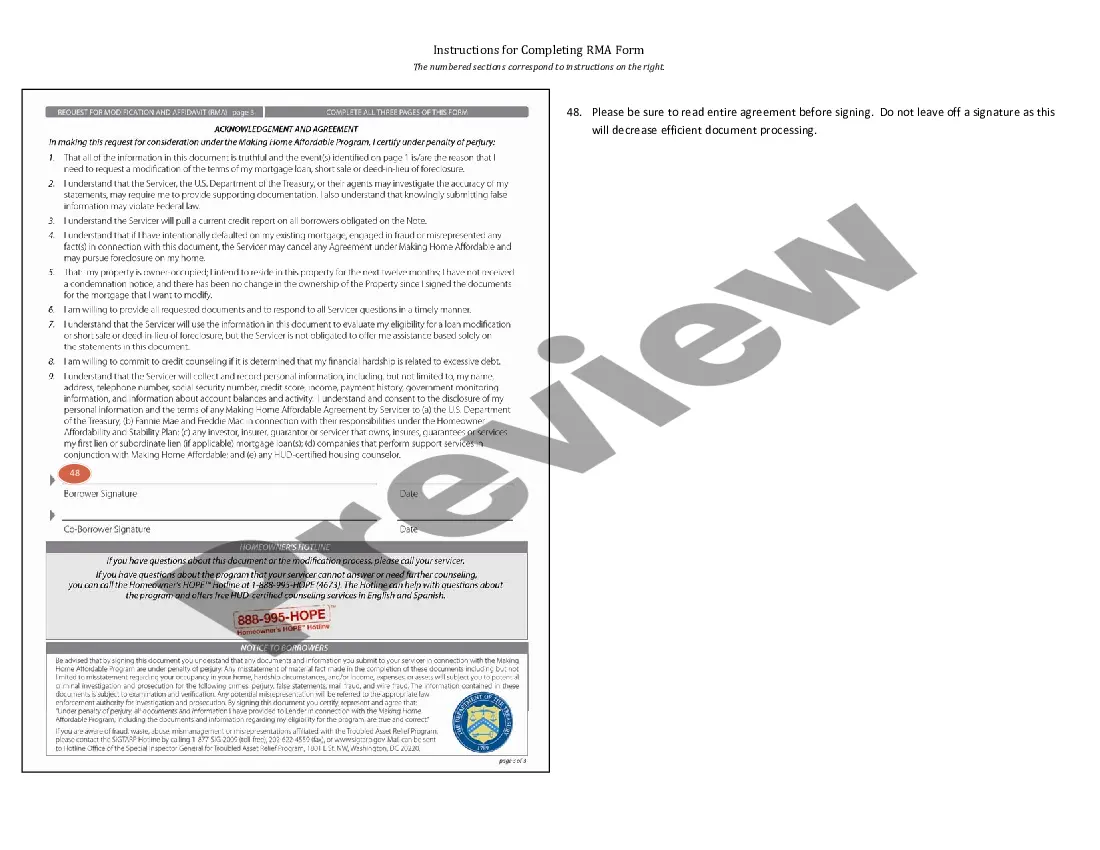

The RMA mortgage form, or Request for Loan Modification and Affidavit, is a critical document in the loan modification process. It collects vital information about your financial condition to assess your eligibility for modifications. Understanding how to fill this form properly is essential, which is why the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form are so important. Utilizing platforms like uslegalforms can provide the necessary guidance.

Getting approved for a loan modification can vary based on your financial situation. Many homeowners successfully navigate the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form with the right preparation. Presenting a strong case with necessary documentation can greatly enhance your chances. Resources, such as those offered by uslegalforms, can help streamline this process.

A hardship letter for a mortgage explains your current financial struggles and why you cannot meet your mortgage obligations. When crafting this letter, reference the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form for guidance. Include specific details about your circumstances, such as job loss or medical expenses, to make your case clearer. A well-crafted hardship letter improves your chances of receiving the assistance you need.

To apply for a loan modification, you typically need your mortgage statement, proof of income, a hardship letter, and other financial documents. It is important to follow the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form closely to ensure you provide the necessary information. Each of these documents helps your lender assess your situation accurately. Preparing these in advance can streamline the process and improve your chances of success.

RMA in mortgage generally refers to the Request for Mortgage Assistance, a form that borrowers submit to their lenders. This is an essential tool when faced with financial hardship, allowing you to seek a loan modification. Completing this documentation according to the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form helps you present your case clearly. By being thorough and precise, you can enhance your chances of finding a suitable solution.

In real estate, RMA stands for Request for Mortgage Assistance. This request is critical for homeowners seeking relief from financial hardship. By following the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can properly submit your RMA to your mortgage servicer. A well-prepared RMA can lead to options such as loan modifications, making it a crucial step in seeking assistance.

A hardship affidavit letter details your financial difficulties affecting your mortgage payments. For your letter, include information about job loss, medical emergencies, or other circumstances as guided by the Oregon Instructions for Completing Request for Loan Modification and Affidavit RMA Form. This letter helps your servicer understand your situation and provides context to your request. Ensuring it is clear and comprehensive can significantly impact your loan modification process.