Oregon Convertible Note Subscription Agreement

Description

How to fill out Convertible Note Subscription Agreement?

You are able to commit hours online attempting to find the authorized record format that meets the state and federal requirements you will need. US Legal Forms offers thousands of authorized varieties which are reviewed by professionals. It is possible to download or produce the Oregon Convertible Note Subscription Agreement from our support.

If you have a US Legal Forms bank account, you can log in and click the Obtain key. After that, you can total, change, produce, or signal the Oregon Convertible Note Subscription Agreement. Every single authorized record format you acquire is yours permanently. To have another copy of any acquired form, visit the My Forms tab and click the related key.

Should you use the US Legal Forms site the first time, stick to the easy recommendations listed below:

- Initial, make certain you have chosen the right record format to the area/city of your choosing. Browse the form outline to ensure you have picked out the proper form. If accessible, make use of the Review key to appear through the record format also.

- If you want to get another edition of the form, make use of the Look for field to obtain the format that fits your needs and requirements.

- When you have found the format you would like, click on Purchase now to move forward.

- Choose the rates plan you would like, type your credentials, and sign up for an account on US Legal Forms.

- Full the transaction. You can use your Visa or Mastercard or PayPal bank account to purchase the authorized form.

- Choose the format of the record and download it for your product.

- Make modifications for your record if needed. You are able to total, change and signal and produce Oregon Convertible Note Subscription Agreement.

Obtain and produce thousands of record layouts using the US Legal Forms web site, which provides the biggest variety of authorized varieties. Use specialist and state-distinct layouts to tackle your business or person demands.

Form popularity

FAQ

While a CLN is a loan, an ASA is an investment in shares which will be issued at a later date. When the shares are later issued (usually at the next Qualifying Financing Round), they will often be done so at a discounted price.

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

Convertible loan notes (?CLN?) and advance subscription agreements (?ASA?) are ways of companies getting a cash injection which may later convert into shares, rather than being paid back in cash. ASAs tend to be shorter agreements than CLNs and therefore involve less negotiation.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section.

The shareholders' agreement, on the other hand, stipulates the terms for the future partnership and is not directly related to the investment itself. The subscription agreement refers to the shareholders' agreement and typically they are signed at the same time.

SPA is always executed after the incorporation of the company and there is a protocol for price valuation because consideration is the key in such an agreement whereas Share Subscription Agreement (?SSA?) is an agreement that is executed between the investors and the company in a share acquisition that involves the ...

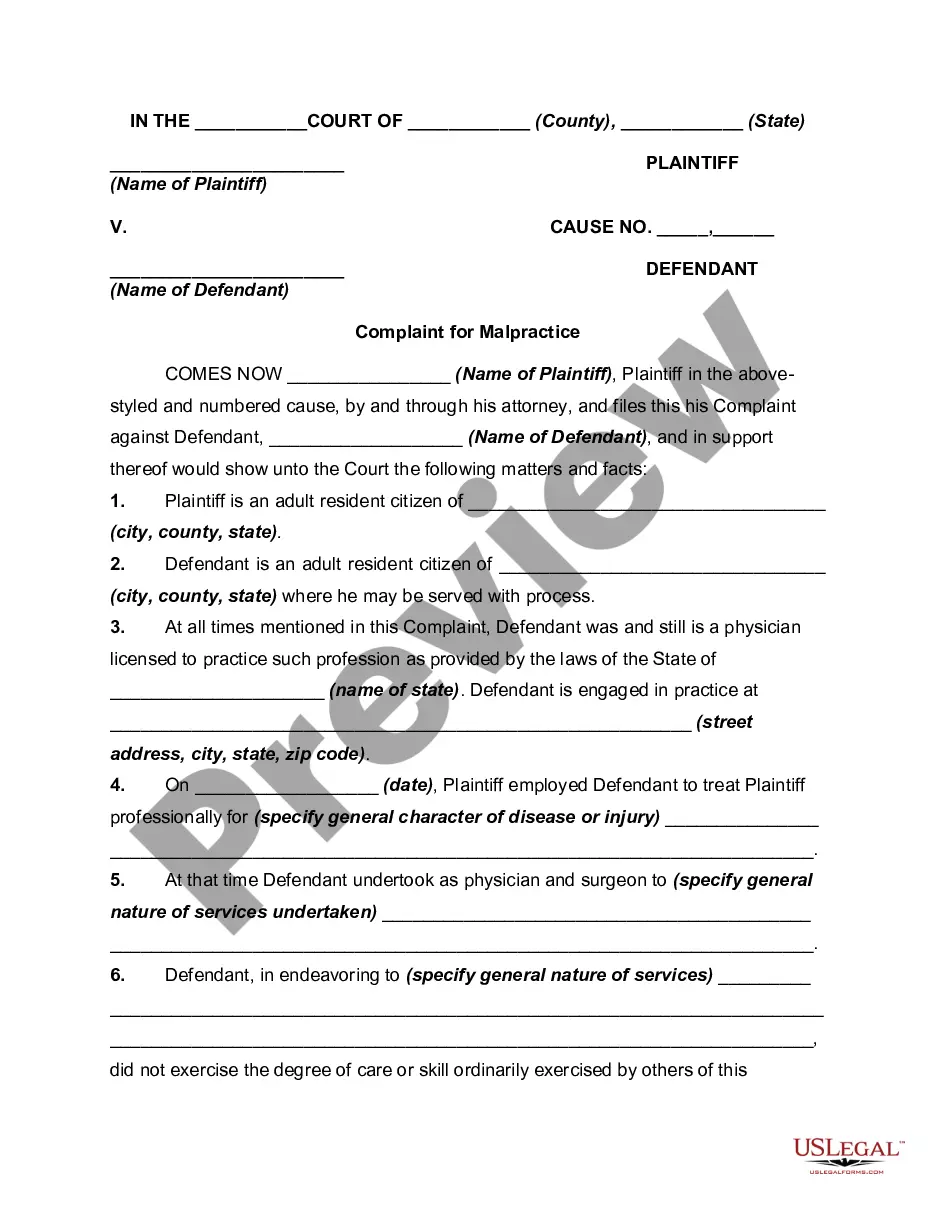

Promissory Note. The Promissory Note (or Convertible Promissory Note) is the actual debt instrument in the deal. ... Note Purchase Agreement. ... Subscription Agreement. ... Note Holders Agreements and Voting Agreements. ... Subordination Agreement. ... Warrant to Purchase Stock.