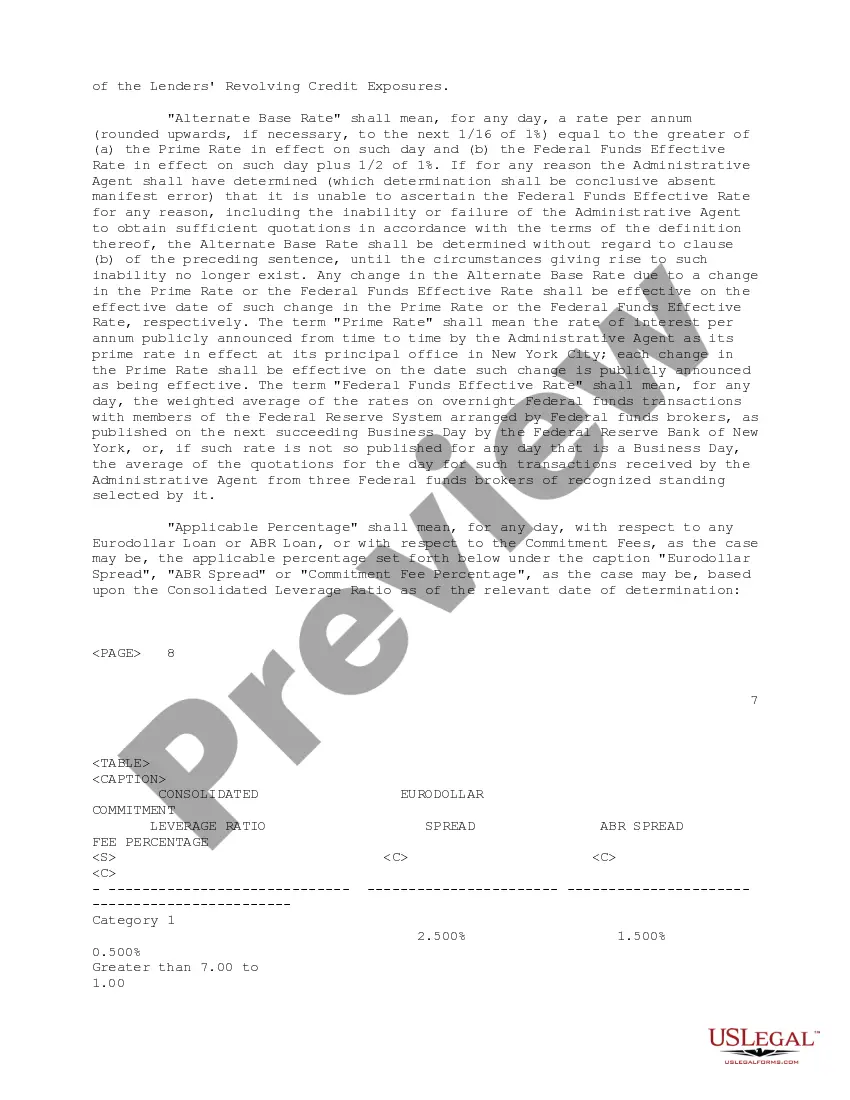

Oregon Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

Choosing the best legal papers design can be quite a have difficulties. Obviously, there are tons of layouts available on the Internet, but how can you discover the legal form you require? Utilize the US Legal Forms internet site. The services gives thousands of layouts, for example the Oregon Credit Agreement regarding extension of credit, which can be used for company and private requires. Every one of the kinds are checked by pros and satisfy federal and state demands.

In case you are already listed, log in to your profile and then click the Obtain button to have the Oregon Credit Agreement regarding extension of credit. Utilize your profile to check from the legal kinds you may have purchased in the past. Proceed to the My Forms tab of your respective profile and have yet another duplicate of the papers you require.

In case you are a new customer of US Legal Forms, allow me to share straightforward instructions for you to stick to:

- First, ensure you have selected the correct form to your area/area. You can check out the shape using the Review button and browse the shape outline to guarantee this is basically the right one for you.

- In the event the form fails to satisfy your expectations, take advantage of the Seach field to obtain the correct form.

- Once you are certain the shape is suitable, go through the Get now button to have the form.

- Choose the rates program you want and type in the needed info. Build your profile and buy an order using your PayPal profile or Visa or Mastercard.

- Choose the document format and obtain the legal papers design to your gadget.

- Full, revise and produce and signal the obtained Oregon Credit Agreement regarding extension of credit.

US Legal Forms may be the most significant local library of legal kinds where you can discover various papers layouts. Utilize the service to obtain appropriately-produced paperwork that stick to status demands.

Form popularity

FAQ

Once you've requested the extension, you automatically have an additional six months beyond the original filing deadline. That means your taxes are due on October 15.

If you need an extension of time to file and expect to owe Oregon tax, download Publication OR-40-EXT from our forms and publications page for instructions. Submit your payment electronically by selecting "Return payment" on Revenue Online.

Taxpayers who aren't able to file by the April 18, 2023, deadline can request an extension before that deadline, but they should know that an extension to file is not an extension to pay taxes. If they owe taxes, they should pay them before the due date to avoid potential penalties and interest on the amount owed.

How to change file types on Windows 10 by changing the extension Open Windows File Explorer and select a file to change. ... Replace the old file extension with a new one to change your file. ... Push the "Enter" button on your keyboard to save your changes.

Examples of activities that create nexus and a filing requirement in Oregon include: Your company has: A phone listing in Oregon. A local Oregon phone number, even if calls are forwarded to your office outside of Oregon.

In the 2022 tax year, eligible filers could claim a $219 credit for themselves, their spouse, and any dependents in the household. They can also claim additional exemptions if the filer or their spouse is severely disabled, or if they have a disabled child.

Personal Exemption credit for dependents For 2023, the maximum credit is $236 for each qualifying personal exemption. For more information, see Publication OR-17.

Submit Form 4868 to the IRS either electronically or via mail by the tax filing deadline. If you pay the IRS an estimate of your taxes owed by tax day using either your debit/credit card, IRS Direct Pay, or the EFTPS system, noting that your payment is for an extension, you can skip the paperwork altogether.