Oregon Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

How to fill out Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

You are able to invest several hours on-line searching for the legitimate papers format which fits the state and federal needs you need. US Legal Forms gives a large number of legitimate forms that happen to be examined by experts. You can easily download or print out the Oregon Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions from your services.

If you currently have a US Legal Forms bank account, you may log in and click the Obtain option. Next, you may total, modify, print out, or signal the Oregon Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions. Each and every legitimate papers format you buy is your own property for a long time. To get yet another copy of any bought form, go to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms internet site for the first time, adhere to the basic instructions under:

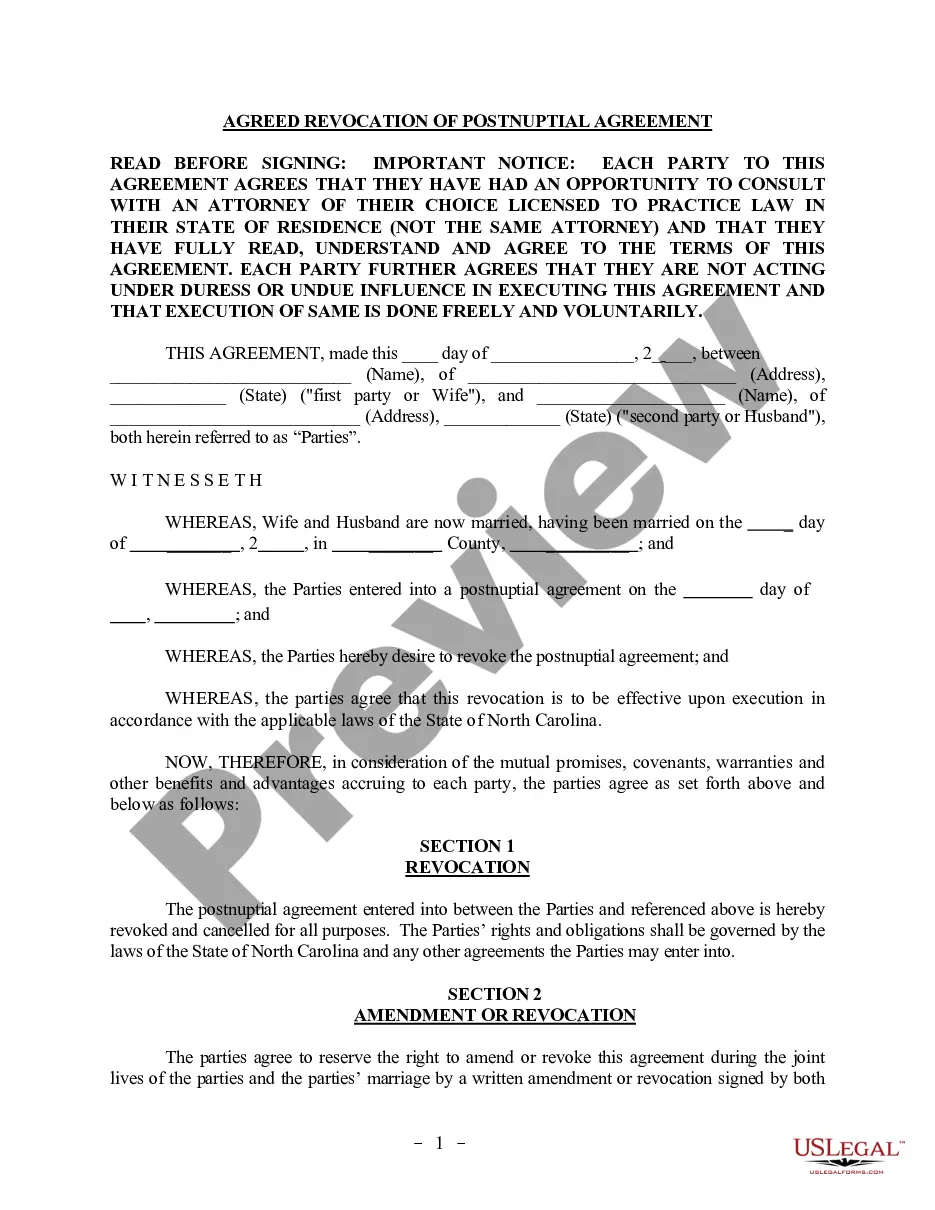

- Very first, be sure that you have chosen the correct papers format for your region/city of your choice. Look at the form outline to ensure you have chosen the appropriate form. If offered, make use of the Review option to check through the papers format too.

- If you want to discover yet another version of your form, make use of the Lookup discipline to get the format that meets your requirements and needs.

- Upon having identified the format you want, click on Get now to proceed.

- Pick the prices plan you want, type your credentials, and sign up for a free account on US Legal Forms.

- Full the deal. You can utilize your Visa or Mastercard or PayPal bank account to purchase the legitimate form.

- Pick the file format of your papers and download it for your system.

- Make adjustments for your papers if required. You are able to total, modify and signal and print out Oregon Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

Obtain and print out a large number of papers layouts using the US Legal Forms web site, that provides the biggest variety of legitimate forms. Use specialist and condition-specific layouts to take on your company or individual demands.