Oregon Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank

Description

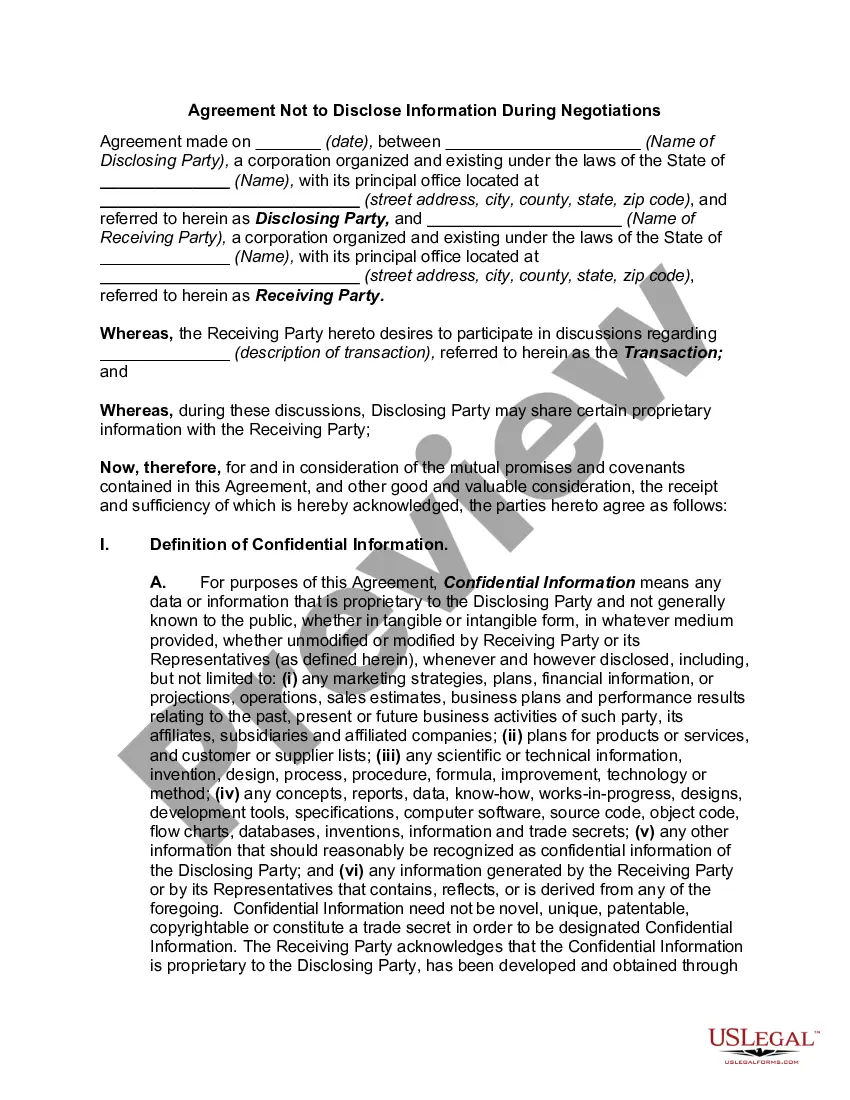

How to fill out Borrower Security Agreement Between ADAC Laboratories And ABN AMRO Bank?

US Legal Forms - among the greatest libraries of lawful kinds in the States - gives a wide array of lawful record layouts you can acquire or print. While using site, you can get 1000s of kinds for organization and specific functions, sorted by types, claims, or keywords.You will discover the newest types of kinds just like the Oregon Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank in seconds.

If you already possess a registration, log in and acquire Oregon Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank in the US Legal Forms catalogue. The Download switch will appear on every single type you view. You have accessibility to all previously saved kinds in the My Forms tab of your accounts.

If you want to use US Legal Forms initially, here are straightforward recommendations to help you get started:

- Make sure you have selected the right type to your area/area. Click on the Review switch to analyze the form`s content. Look at the type outline to actually have chosen the right type.

- If the type does not suit your needs, make use of the Lookup industry near the top of the display to find the one that does.

- Should you be satisfied with the form, verify your selection by visiting the Get now switch. Then, select the rates plan you want and offer your qualifications to register for the accounts.

- Process the transaction. Make use of bank card or PayPal accounts to complete the transaction.

- Pick the file format and acquire the form on the gadget.

- Make changes. Fill up, edit and print and indicator the saved Oregon Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank.

Every single template you included in your account lacks an expiry particular date and it is the one you have eternally. So, in order to acquire or print another copy, just check out the My Forms area and click on about the type you need.

Obtain access to the Oregon Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank with US Legal Forms, one of the most comprehensive catalogue of lawful record layouts. Use 1000s of specialist and condition-certain layouts that satisfy your small business or specific requires and needs.

Form popularity

FAQ

Each Borrower grants and pledges to Bank a continuing security interest in the Collateral to secure prompt repayment of any and all Obligations and to secure prompt performance by Borrowers of each of its covenants and duties under the Loan Documents.

If a creditor has security interest in your property, it will likely be outlined in a security agreement. This important contract should not be entered into without careful consideration, as a default could lead to harsh consequences.

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. The loan agreement has specific terms that detail exactly what is given and what is expected in return.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

Secured loans are business or personal loans that require some type of collateral as a condition of borrowing. A bank or lender can request collateral for large loans for which the money is being used to purchase a specific asset or in cases where your credit scores aren't sufficient to qualify for an unsecured loan.