Oregon Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries

Description

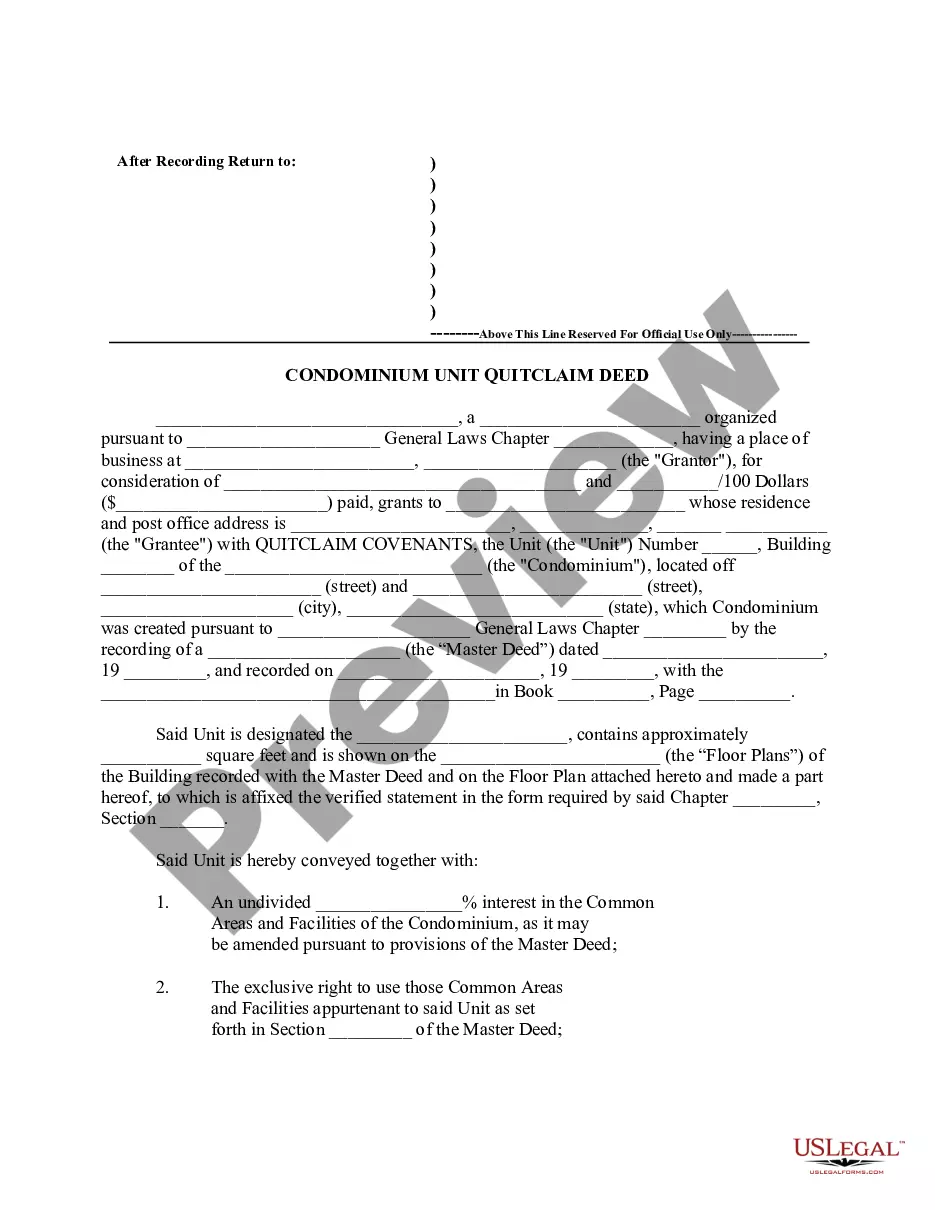

How to fill out Transfer Agreement Between Deutsche Telecom AG And NAB Nordamerika Beteiligungs Holding GMBH Regarding Transfer Of Shares To One Or More Qualified Subsidiaries?

US Legal Forms - one of the most significant libraries of lawful varieties in the USA - gives an array of lawful record layouts you may down load or printing. Utilizing the site, you may get thousands of varieties for company and individual purposes, categorized by categories, says, or keywords and phrases.You can find the most up-to-date types of varieties just like the Oregon Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries within minutes.

If you currently have a subscription, log in and down load Oregon Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries from your US Legal Forms collection. The Acquire option will show up on every kind you see. You have access to all earlier saved varieties within the My Forms tab of your account.

If you would like use US Legal Forms the first time, listed below are straightforward directions to get you began:

- Be sure you have picked out the right kind for your metropolis/state. Click the Preview option to check the form`s information. Look at the kind description to ensure that you have selected the appropriate kind.

- If the kind does not suit your demands, make use of the Research industry on top of the display to get the one which does.

- If you are content with the shape, confirm your option by visiting the Purchase now option. Then, select the costs program you favor and provide your qualifications to register to have an account.

- Method the transaction. Make use of charge card or PayPal account to complete the transaction.

- Choose the file format and down load the shape in your system.

- Make modifications. Fill up, revise and printing and signal the saved Oregon Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries.

Each template you included in your money does not have an expiration particular date which is yours for a long time. So, if you would like down load or printing yet another version, just check out the My Forms portion and click on in the kind you need.

Get access to the Oregon Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries with US Legal Forms, probably the most extensive collection of lawful record layouts. Use thousands of specialist and express-particular layouts that meet up with your company or individual needs and demands.

Form popularity

FAQ

A share transfer form, also called a stock transfer form, is a legal form used to transfer shares in a company from an existing shareholder to a new person or company.

Shares are transferred by way of gift or sale. Typically, shares are transferred to introduce a new shareholder. So long as a company has enough shares, it's possible to transfer shares in a limited company any time after incorporation.

A transfer agreement is a legally binding document that conveys ownership from one person or entity to another. Transfer agreements are used to sell real estate, businesses, and other tangible assets as well as intellectual property such as computer code, song lyrics, and industrial processes.

A share purchase agreement (also referred to as a share transfer agreement) that can be used in a sale of shares between two shareholders of a target corporation or an intercorporate transfer between two affiliates.

Share purchase agreements typically include detailed terms and conditions, including warranties and indemnities, whereas share transfer agreements are more limited in scope. Choosing the correct agreement type is crucial for ensuring a smooth transaction and mitigating legal and financial risks.