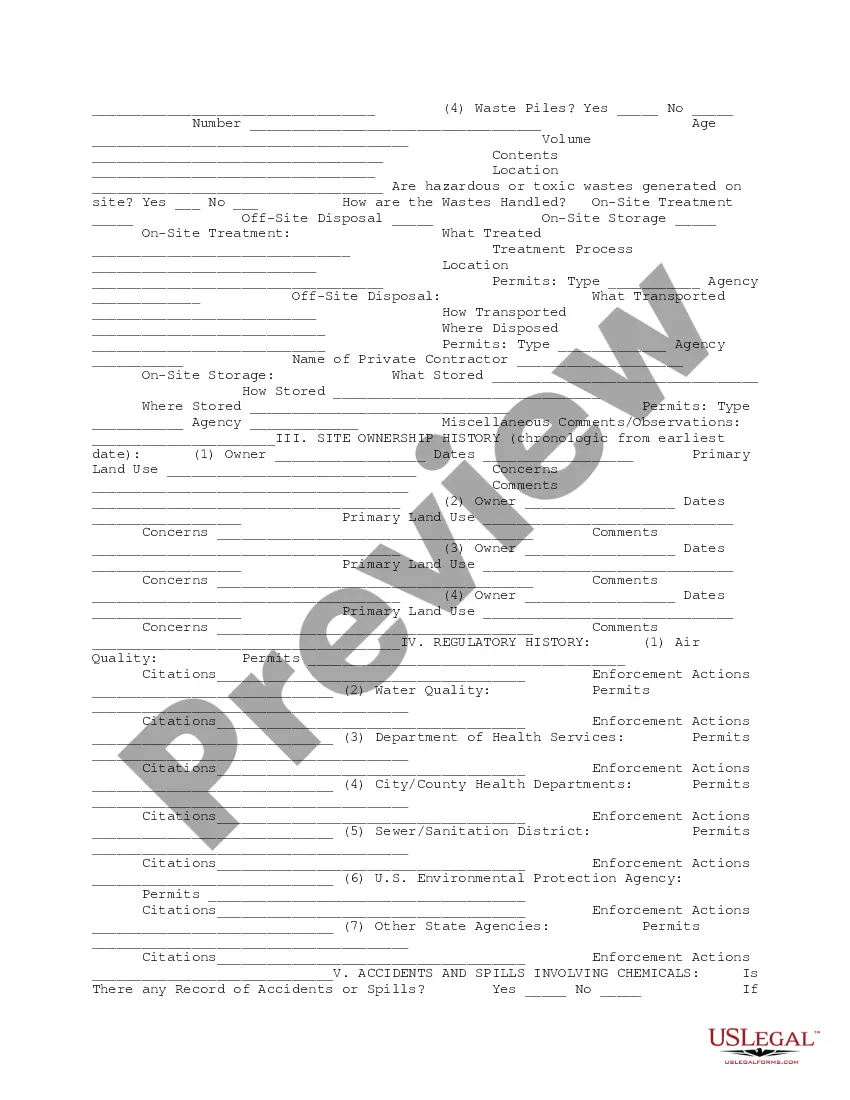

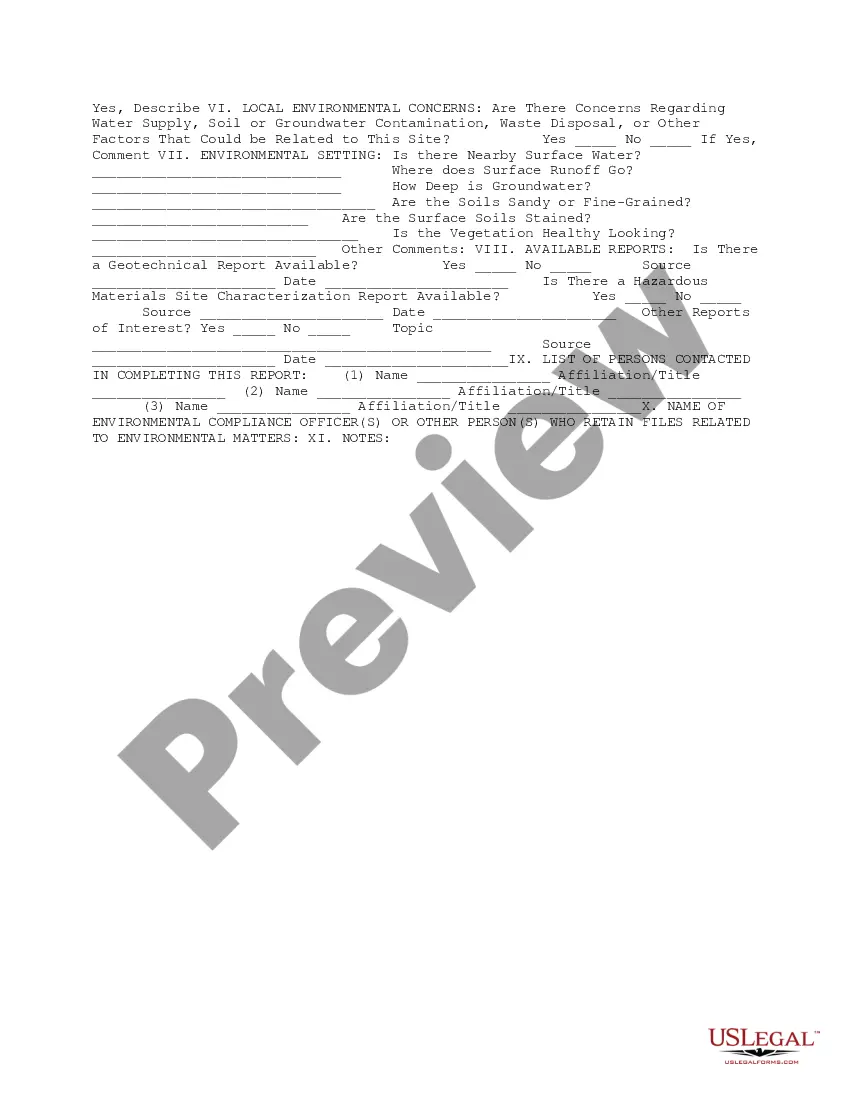

This due diligence workform is used to document company procedures and regulations for environmental information in business transactions.

Oregon Environmental Workform

Description

How to fill out Environmental Workform?

If you wish to compile, download, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Make use of the site's simple and user-friendly search feature to locate the documents you need.

A wide array of templates for corporate and personal use are sorted by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the Oregon Environmental Workform with just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Download button to access the Oregon Environmental Workform.

- You can also retrieve forms you have previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you've selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to discover additional types of the legal form template.

Form popularity

FAQ

To file a hostile work environment complaint in Oregon, begin by documenting all relevant incidents. Gather any evidence that supports your claim, such as emails, messages, or witness statements. After collecting your information, complete the Oregon Environmental Workform, an essential document that details your experiences and the impact they have had on your work life. Submitting this form can help you seek justice and improve your workplace conditions.

You can obtain Oregon tax forms at various locations, including public libraries, post offices, and the local Department of Revenue offices. Additionally, many forms are available online for download, making it convenient to access the documents you need. When preparing your Oregon Environmental Workform, ensure you have all necessary tax documents to streamline your filing process.

The DEQ exemption in Oregon allows certain vehicles and properties to bypass specific environmental regulations. For instance, older vehicles may qualify for exemption from emissions testing. If you're filling out an Oregon Environmental Workform, familiarize yourself with these exemptions to determine if they apply to your situation, ensuring compliance with state regulations.

The cut-off year for Department of Environmental Quality (DEQ) testing in Oregon typically pertains to vehicles and emissions. Vehicles made before 1975 are usually exempt from emissions testing. However, if you're completing an Oregon Environmental Workform for land use or other purposes, it's important to ensure you have the most current information, as regulations may change, and the DEQ also addresses other environmental concerns.

Deciding whether to exempt from withholding depends on your overall tax situation. If you expect to owe no tax or will receive a refund, claiming an exemption could be beneficial. However, it is crucial to evaluate your circumstances carefully; using the Oregon Environmental Workform can help you make informed decisions regarding both taxes and environmental compliance.

Filing the Oregon Form or WR is necessary if you have income that requires withholding adjustments. It's designed to help you declare your withholding preferences to your employer. Additionally, balancing your tax responsibilities with forms like the Oregon Environmental Workform can help streamline your overall compliance efforts.

Generally, anyone who makes income in Oregon is required to file an Oregon tax return, including residents and non-residents. If your income meets certain thresholds, filing becomes mandatory. Additionally, using tools like the Oregon Environmental Workform can help manage your taxes while keeping track of environmental obligations.

Yes, you will need to complete various forms and paperwork for DEQ in Oregon, especially for projects that require regulation compliance. This paperwork ensures that your activities meet the environmental standards set by the state. For a comprehensive approach, consider utilizing the Oregon Environmental Workform to keep your documentation organized.

DEQ supplemental environmental projects are initiatives that allow businesses to invest in environmentally beneficial projects as a part of a compliance agreement. These projects help improve the environment while providing companies with a means to offset certain penalties. If you're interested in participating, the Oregon Environmental Workform can guide you through the required processes.

The Oregon tax form or WR is a specific tax document that individuals must complete to report their withholdings. This form is essential for taxpayers who wish to adjust their withholding amounts. Understanding the Oregon Environmental Workform can also help you manage environmental taxes effectively, ensuring compliance with state regulations.