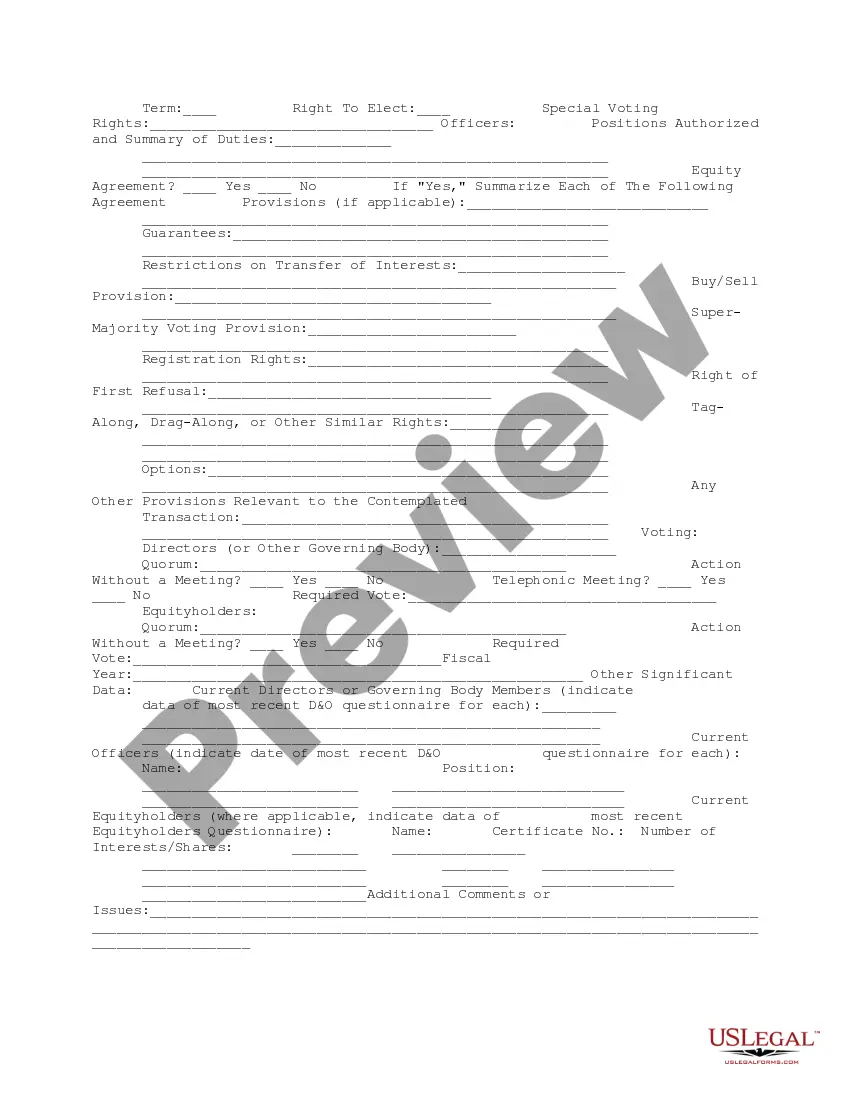

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Oregon Company Data Summary

Description

How to fill out Company Data Summary?

If you aim to finalize, retrieve, or print sanctioned document templates, use US Legal Forms, the most extensive collection of legal formats available online.

Utilize the site's straightforward and convenient search function to find the documents you require.

A variety of templates for business and personal applications are organized by categories and regions, or keywords.

Step 5. Complete the payment. You may use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal document and download it to your device.

- Utilize US Legal Forms to acquire the Oregon Company Data Summary with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and press the Obtain button to retrieve the Oregon Company Data Summary.

- You can also access forms you previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/county.

- Step 2. Utilize the Review option to browse the form's details. Always remember to check the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative formats in the legal template style.

- Step 4. Once you have located the form you require, click the Purchase now button. Choose the pricing plan you prefer and provide your information to register for the account.

Form popularity

FAQ

The Oregon Open Data Standard establishes guidelines for sharing public data in a consistent and accessible manner. This standard promotes transparency and collaboration among state agencies, businesses, and citizens. By adhering to these guidelines, companies can ensure that they have reliable data sources when preparing their Oregon Company Data Summary. Such access plays a critical role in fostering innovation and economic growth in the state.

The Oregon data strategy aims to streamline data collection and improve access for businesses and residents. This initiative seeks to make data more transparent, allowing for informed decision-making. By creating a centralized repository, the strategy enhances the overall quality of the Oregon Company Data Summary. Companies will benefit significantly as they gain better insights into the data landscape in Oregon.

Businesses may leave Oregon for various reasons, including high taxes, regulatory challenges, and rising costs of living. Some companies seek more favorable conditions in neighboring states, while others pursue lower operational expenses. Understanding these factors through the Oregon Company Data Summary can provide insight into trends affecting local businesses, helping you make informed decisions for your company.

Filing your Oregon LLC annual report can be done online through the Oregon Secretary of State's website. You need to supply essential details about your LLC, including any updates to your management structure or address. The Oregon Company Data Summary is a valuable resource, as it offers insights into your business compliance and helps streamline your filing process.

Yes, registering your business with the Oregon Secretary of State is necessary for legal recognition and operation within the state. This registration provides various benefits, including limited liability protection for owners and access to business resources. To facilitate this process, refer to the Oregon Company Data Summary, which outlines the requirements and provides guidance.

If your LLC fails to file an annual report in Oregon, it may face penalties or even administrative dissolution. This means your business could lose its registered status, making it difficult to operate legally in the state. It’s crucial to stay informed using the Oregon Company Data Summary, which can alert you to important due dates and help you maintain compliance.

Filing an annual report for your LLC in Oregon involves completing an online submission through the Oregon Secretary of State's website. You'll need to provide details such as your business name, registration number, and any changes in your business structure. Utilizing the Oregon Company Data Summary can simplify this process and help ensure all information is precisely reported.

To update your Oregon business information, you should file the appropriate form with the Oregon Secretary of State. This process can involve submitting updates for your registered agent, business address, or other essential details. Using the Oregon Company Data Summary, you can easily access your business record and ensure that all information remains accurate and current.

To file a Worker’s Compensation (WR) in Oregon, you need to complete the appropriate forms and submit them to the Workers' Compensation Division. This action can be vital for maintaining a good standing for your Oregon Company Data Summary. Ensure that you have all necessary information, such as your business details and employee information, readily available. To ease this process, uslegalforms offers resources that can help you through the filing requirements.

Filing an annual report for your LLC in Oregon is a straightforward process. You can do this online through the Oregon Secretary of State's website or by submitting a paper form. It’s essential to provide accurate information about your business to keep your Oregon Company Data Summary correct and complete. Consider using uslegalforms to guide you through the filing steps and ensure accuracy.