This checklist is an outline of all matters considered and reviewed in by the due diligence team in the acquisition of a company.

Oregon Checklist Due Diligence for Acquisition of a Company

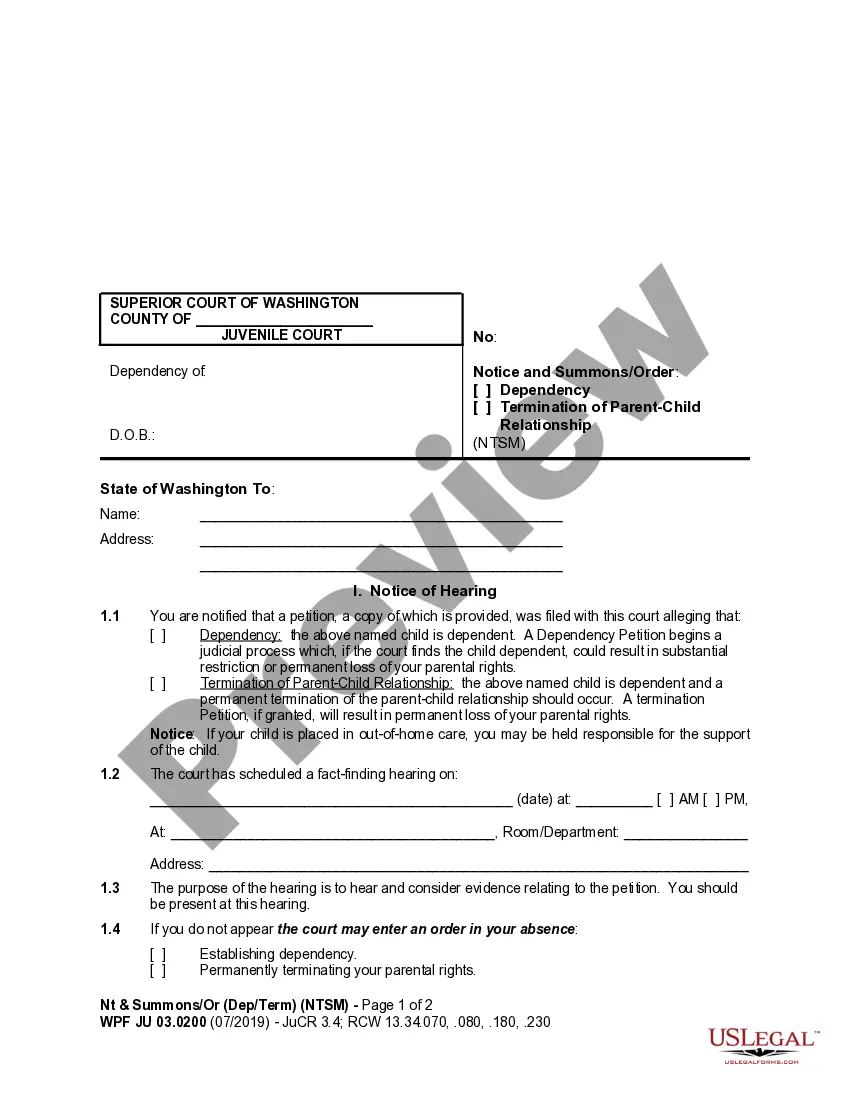

Description

How to fill out Checklist Due Diligence For Acquisition Of A Company?

You might devote hours online seeking the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that have been verified by experts.

You can download or print the Oregon Checklist Due Diligence for Acquisition of a Company from our services.

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can complete, modify, print, or sign the Oregon Checklist Due Diligence for Acquisition of a Company.

- Every legal document template you purchase is yours forever.

- To obtain an additional copy of any purchased form, go to the My documents tab and select the respective option.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure you have selected the correct document template for your state/area.

- Read the form description to verify you've chosen the correct form.

Form popularity

FAQ

To conduct due diligence when buying a business, start by utilizing the Oregon Checklist Due Diligence for Acquisition of a Company. This checklist guides you through critical areas such as financial records, legal compliance, and operational assessments. Engaging professionals to assist with legal advice and financial analysis can enhance your understanding of the acquisition. Taking these steps will ensure you make a well-informed decision that protects your investment.

Before buying a business, it is crucial to review various documents, including financial statements, tax returns, contracts, and licenses. Additionally, you should examine employee agreements and any pending litigation. By adhering to the Oregon Checklist Due Diligence for Acquisition of a Company, you will have a clear understanding of the necessary documentation required to make a sound purchasing decision.

The 4 P's of due diligence refer to People, Property, Processes, and Performance. Examining these four aspects allows buyers to understand the critical components of a business and assess potential risks effectively. By using the Oregon Checklist Due Diligence for Acquisition of a Company, you can ensure a comprehensive review of all 4 P's in a structured manner.

The checklist for share acquisition outlines the specific documentation and due diligence procedures needed to evaluate the shares of a company. It includes financial statements, shareholder agreements, and any legal encumbrances associated with the shares. By following the Oregon Checklist Due Diligence for Acquisition of a Company, you can ensure that you gather all relevant information necessary to make an informed decision about acquiring shares.

The due diligence process in acquisitions typically involves several phases: preparation, data collection, analysis, and reporting. Initially, the buyer defines the scope of due diligence to focus on key areas such as finances, contracts, and market conditions. Utilizing the Oregon Checklist Due Diligence for Acquisition of a Company helps streamline this process, ensuring you comprehensively assess the potential investment.

A due diligence checklist is a tool that outlines the necessary documents and information to gather during the due diligence process. This checklist serves as a guide to ensure no critical areas are overlooked, providing a structured approach to reviewing a target company. The Oregon Checklist Due Diligence for Acquisition of a Company is an excellent resource to help you systematically cover every essential aspect.

To prepare an effective due diligence checklist, start by defining the objectives of your acquisition. List all areas you need to assess, including financial, legal, and operational components. By utilizing tools like the Oregon Checklist Due Diligence for Acquisition of a Company, you can systematically structure and refine your checklist, making it a valuable asset in your acquisition journey.

The 3 P's of due diligence are People, Processes, and Products. Understanding the people involved helps assess management quality, while evaluating processes ensures operational efficiency. Finally, reviewing products allows for an analysis of market viability. Incorporating these elements into the Oregon Checklist Due Diligence for Acquisition of a Company can significantly enhance your acquisition strategy.

A comprehensive due diligence checklist should include items like financial statements, legal documents, tax returns, employee agreements, and any previous litigation records. This checklist serves as a roadmap to ensure you cover all necessary aspects of the acquisition. By utilizing the Oregon Checklist Due Diligence for Acquisition of a Company, you can streamline this process and avoid missing critical information.

The due diligence process for acquisition consists of assessing various aspects of a target company. This includes examining financial records, evaluating legal compliance, and assessing operational risks. By following the Oregon Checklist Due Diligence for Acquisition of a Company, you can systematically gather important information, making informed decisions easier.