This form is a list of requested due diligence documents. The list consists of documents and information to be submitted to the due diligence team proposed public offering of common stock. This request list is intended to update the diligence materials that were received in connection with the Initial Public Offering.

Oregon Document and Information Request List for Secondary Stock Offering

Description

How to fill out Document And Information Request List For Secondary Stock Offering?

If you wish to compile, acquire, or generate legal document templates, utilize US Legal Forms, the leading selection of legal forms available on the web.

Make use of the site’s simple and user-friendly search function to locate the documents you require.

Multiple templates for business and personal purposes are categorized by groups and states, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you have downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and obtain, and print the Oregon Document and Information Request List for Secondary Stock Offering with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal requirements.

- Use US Legal Forms to quickly find the Oregon Document and Information Request List for Secondary Stock Offering.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to obtain the Oregon Document and Information Request List for Secondary Stock Offering.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

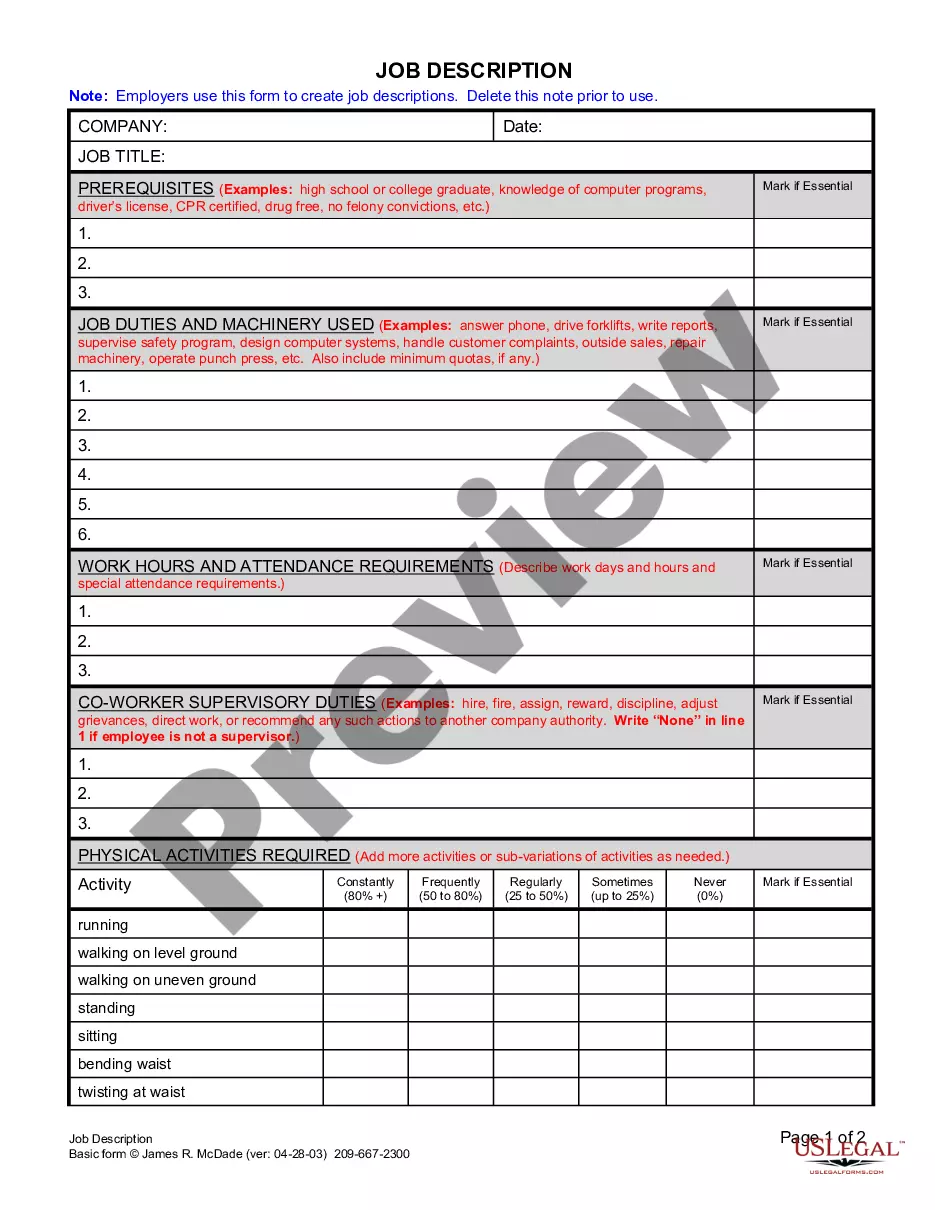

- Step 2. Use the Preview feature to review the content of the form. Be sure to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative templates of your legal form type.

- Step 4. Once you find the form you need, click on the Get now button. Select the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the purchase process. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Oregon Document and Information Request List for Secondary Stock Offering.

Form popularity

FAQ

To renew your Oregon LLC, you must file an annual report with the Oregon Secretary of State. This report confirms your ongoing business activities and provides updated information about your LLC. Make sure to complete the renewal process on time to maintain your LLC's active status. The Oregon Document and Information Request List for Secondary Stock Offering offers helpful resources for this and other documentation needs.

Filing an annual report in Oregon involves filling out the designated form available on the Oregon Secretary of State's website. You'll need relevant business details, such as the entity name and address. Once completed, you can submit the report electronically, ensuring timely compliance with state regulations. For assistance with documentation, consider the Oregon Document and Information Request List for Secondary Stock Offering.

You can file your Oregon annual report online through the Oregon Secretary of State's website. This filing ensures your business remains in good standing, complying with state regulations. It is crucial to submit your report by the due date to avoid any penalties. Utilizing the Oregon Document and Information Request List for Secondary Stock Offering can help streamline this process.

The articles of conversion in Oregon are formal documents required to change a business entity's structure. This documentation is essential when moving from one type of business entity, like an LLC, to another, such as a corporation. By submitting the correct articles, you align your business operations with Oregon laws. For detailed guidance on these requirements, refer to the Oregon Document and Information Request List for Secondary Stock Offering.

Exemptions from the registration of the Securities Act cover a range of offerings that do not require the same level of disclosure as traditional securities. Typically, these exemptions include private placements and intrastate offers. Understanding these nuances is crucial when planning a secondary stock offering. The Oregon Document and Information Request List for Secondary Stock Offering can be a valuable resource in identifying and leveraging these exemptions.

Blue sky laws refer to state regulations designed to protect investors from fraud in securities offerings. In Oregon, these laws govern the sale of securities, requiring registration and disclosure to ensure transparency. To navigate these laws effectively, consult the Oregon Document and Information Request List for Secondary Stock Offering, which provides essential information for compliance.

A statement of good standing is a document that indicates a business is compliant with state requirements, such as tax and filing obligations. This statement is essential for businesses engaging in securities offerings, as it establishes credibility and trustworthiness. You can obtain this document through the Oregon Document and Information Request List for Secondary Stock Offering to ensure you meet all regulations.

Oregon securities exemption allows certain securities transactions to bypass the registration process. These exemptions primarily focus on private placements, limited offerings, and specific types of investor qualifications. Utilizing the Oregon Document and Information Request List for Secondary Stock Offering can help clarify which exemptions apply to your situation.

The Oregon Securities Law provides several exemptions that allow certain transactions to occur without registration. These exemptions can vary based on the type of offering and the issuer's status. For instance, some small private offerings and intrastate transactions may qualify. To explore these exemptions and understand your specific situation, refer to the Oregon Document and Information Request List for Secondary Stock Offering.

A certificate of Good Standing in Oregon serves as proof that your business is legally recognized and meets state requirements. Obtaining this certificate can be vital for engaging with investors or financial entities. You can refer to the Oregon Document and Information Request List for Secondary Stock Offering to understand how to get this essential document for your business.