Oregon Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

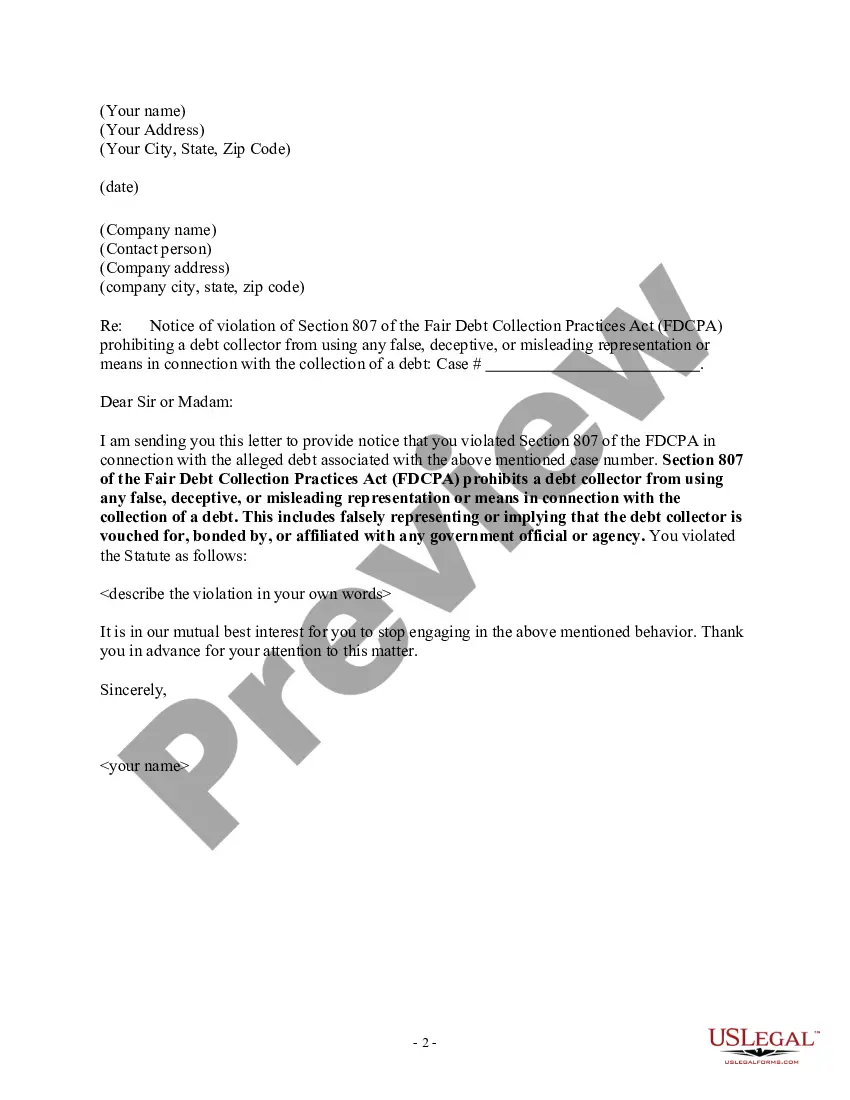

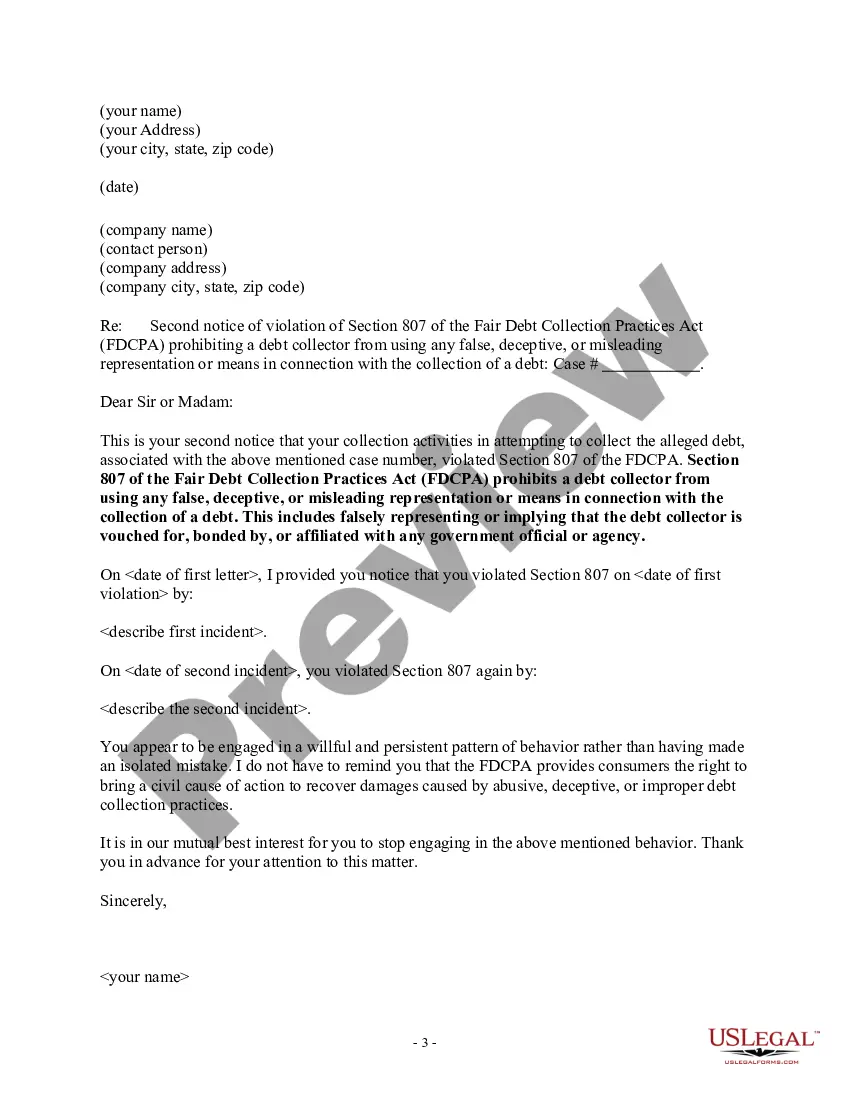

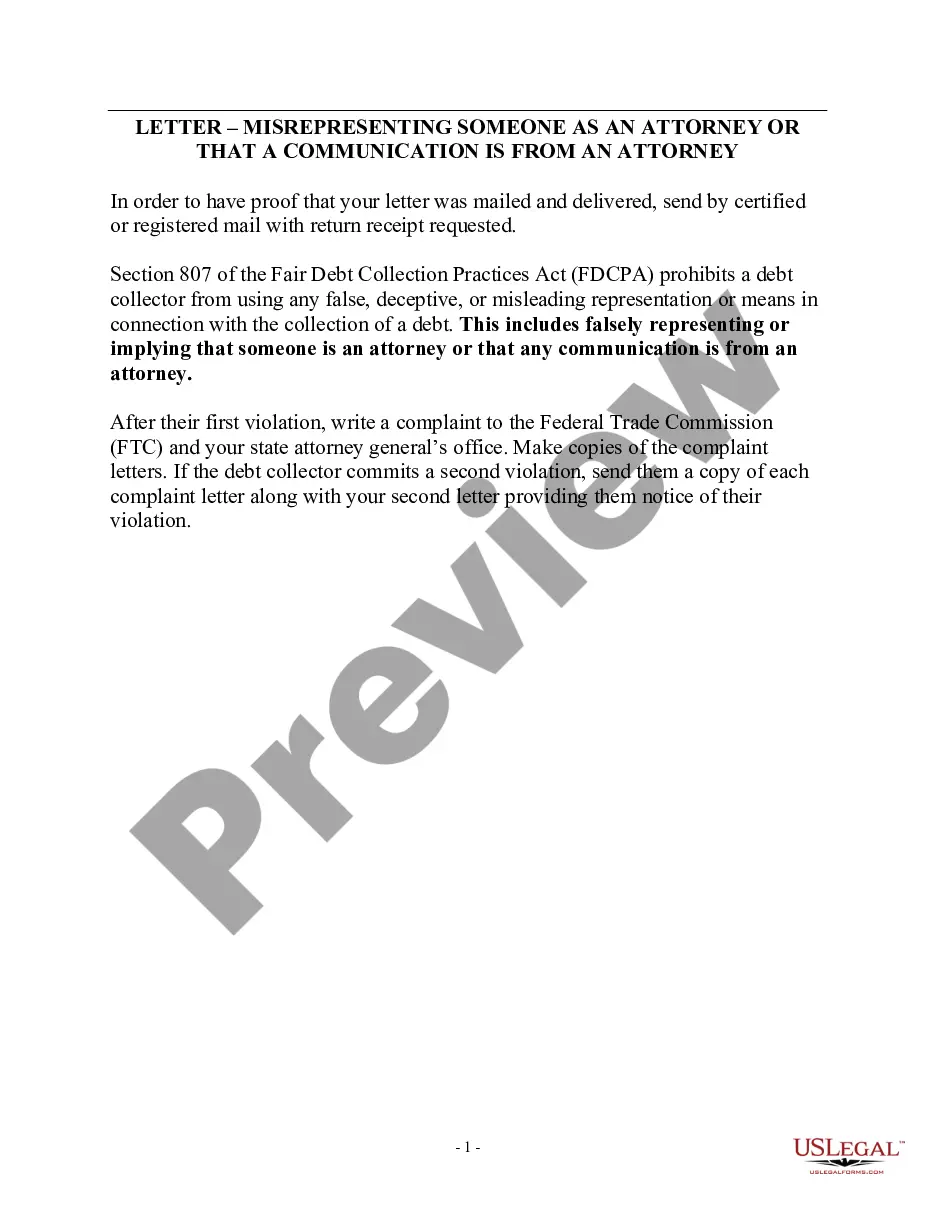

How to fill out Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

Selecting the optimal valid document format can be a challenge.

Certainly, there are numerous templates available online, but how will you find the legitimate form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Oregon Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, that you can use for business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

Once you are certain that the form is suitable, click the Purchase now button to acquire the form. Choose the pricing plan you want and enter the necessary details. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Oregon Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself. US Legal Forms is the largest collection of legal forms where you can discover various document templates. Utilize this service to download properly crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to access the Oregon Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

- Use your account to search for the legal documents you have purchased previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the right form for your city/region. You can review the form using the Review button and examine the form details to confirm it is the correct one for you.

- If the form does not fit your needs, use the Search field to find the appropriate form.

Form popularity

FAQ

The law makes it illegal for debt collectors to harass debtors in other ways, including threats of bodily harm or arrest. They also cannot lie or use profane or obscene language. Additionally, debt collectors cannot threaten to sue a debtor unless they truly intend to take that debtor to court.

In Oregon, the statute of limitations for debt is six years. This means a creditor has up to six years to file a lawsuit to collect on the debt. The six-year statute of limitations applies to medical debt, credit card debt, auto loan debt, etc.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

How long does a judgment lien last in Oregon? A judgment lien in Oregon will remain attached to the debtor's property (even if the property changes hands) for ten years.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Are debts really written off after six years? After six years have passed, your debt may be declared statute barred - this means that the debt still very much exists but a CCJ cannot be issued to retrieve the amount owed and the lender cannot go through the courts to chase you for the debt.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.