Oregon Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth

Description

How to fill out Proposal To Increase Common Stock Regarding To Pursue Acquisitions - Transactions Providing Profit And Growth?

Discovering the right legal file template can be a have a problem. Needless to say, there are plenty of layouts available on the Internet, but how will you find the legal kind you need? Make use of the US Legal Forms web site. The service delivers a large number of layouts, for example the Oregon Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth, that you can use for business and private requires. Each of the kinds are examined by professionals and fulfill state and federal specifications.

If you are currently listed, log in for your profile and click on the Down load button to find the Oregon Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth. Utilize your profile to look from the legal kinds you have bought in the past. Check out the My Forms tab of your own profile and acquire one more duplicate of the file you need.

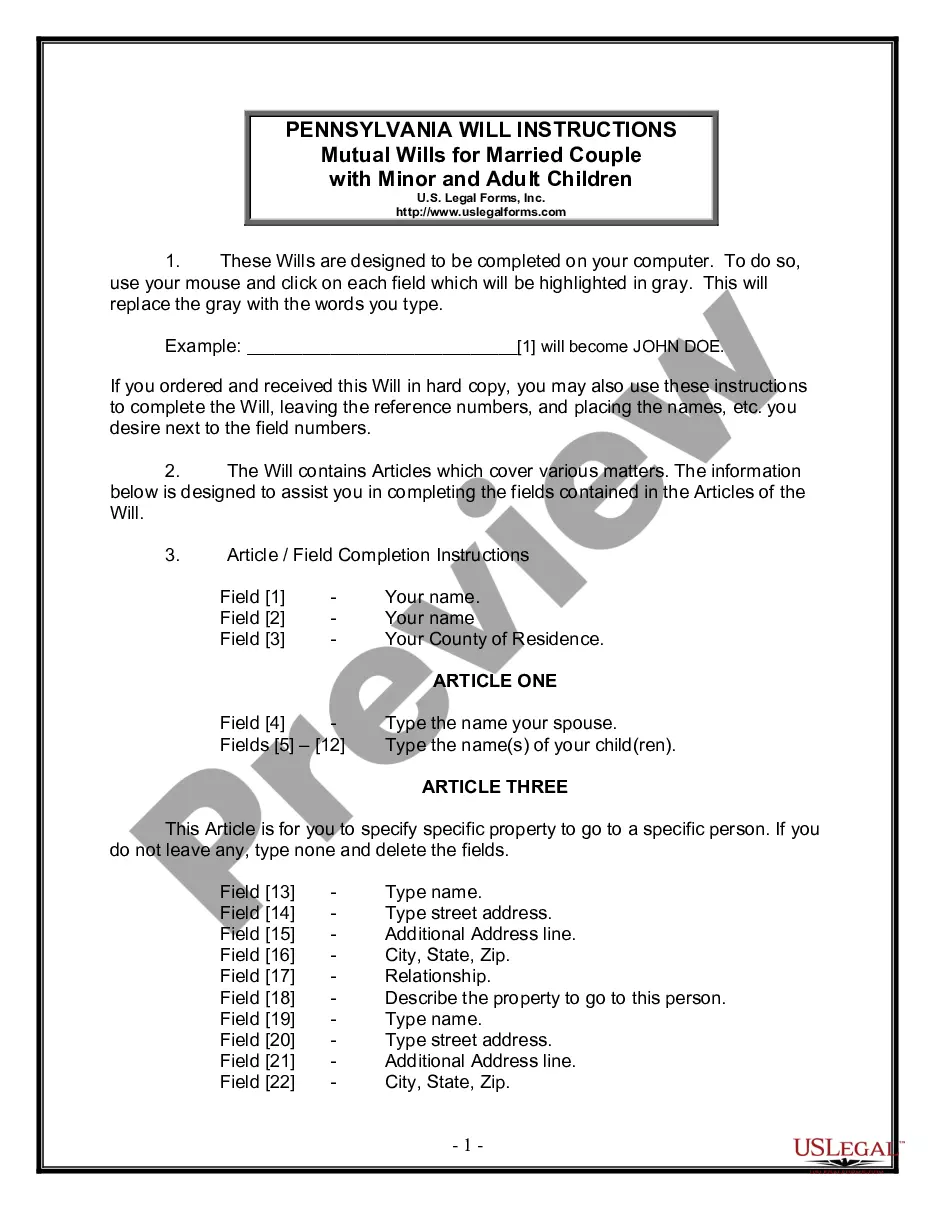

If you are a fresh end user of US Legal Forms, allow me to share easy directions that you should adhere to:

- First, make sure you have selected the appropriate kind to your city/area. You may examine the form utilizing the Review button and study the form explanation to guarantee it will be the right one for you.

- In case the kind will not fulfill your needs, utilize the Seach area to obtain the right kind.

- Once you are positive that the form is acceptable, select the Buy now button to find the kind.

- Select the pricing strategy you want and type in the essential details. Build your profile and pay for the transaction making use of your PayPal profile or Visa or Mastercard.

- Pick the file file format and download the legal file template for your system.

- Full, revise and printing and indication the obtained Oregon Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth.

US Legal Forms is definitely the largest local library of legal kinds for which you will find different file layouts. Make use of the service to download skillfully-made papers that adhere to status specifications.

Form popularity

FAQ

Our board of directors is authorized, without stockholder approval except as required by the listing rules of The Nasdaq Stock Market LLC (?Nasdaq?), to issue shares of our capital stock. We have four series of authorized common stock: Class A, Class B, Class C, and Class H common stock.

known example of a controlled company is Facebook, Inc.

Zuckerberg personally owns nearly 360 million Class B shares, and through agreements with other Class B shareholders, controls the vote of another 32 million. That gives him control of some 392 million Class B Shares, some 90% of the total. Here's how it plays out when it comes to proxy voting.

The technology company Facebook, Inc., held its initial public offering (IPO) on Friday, . The IPO was one of the biggest in technology and Internet history, with a peak market capitalization of over $104 billion.

Facebook Screenshot Mark Zuckerberg's profile (viewed when logged out)OwnerMeta PlatformsFounder(s)Mark Zuckerberg Dustin Moskovitz Chris Hughes Andrew McCollum Eduardo SaverinCEOMark ZuckerbergURLfacebook.com12 more rows

Facebook, rebranded as Meta in 2021, is primarily owned by Mark Zuckerberg, founder and CEO. Zuckerberg keeps tight control over the ownership and decision-making of the company. Other large individual shareholders comprise former COO Sheryl Sandberg and co-founder Eduardo Saverin.

J.P. Morgan, BofA Merrill Lynch, Morgan Stanley and Barclays are serving as joint bookrunners for the offering. BNP PARIBAS, Citigroup, RBC Capital Markets, Credit Suisse, HSBC, RBS, Standard Chartered, Piper Jaffray and Allen & Company LLC are serving as co-managers for the offering.

Meta, formerly known as the Facebook Company, is publicly traded, so it's not owned by a single person or company. But Facebook founder Mark Zuckerberg still mostly owns and controls it with his majority stake. Going all in on Zuckerberg's metaverse bet, Facebook became Meta in 2021.