Tennessee Conduct Policies for Board Members

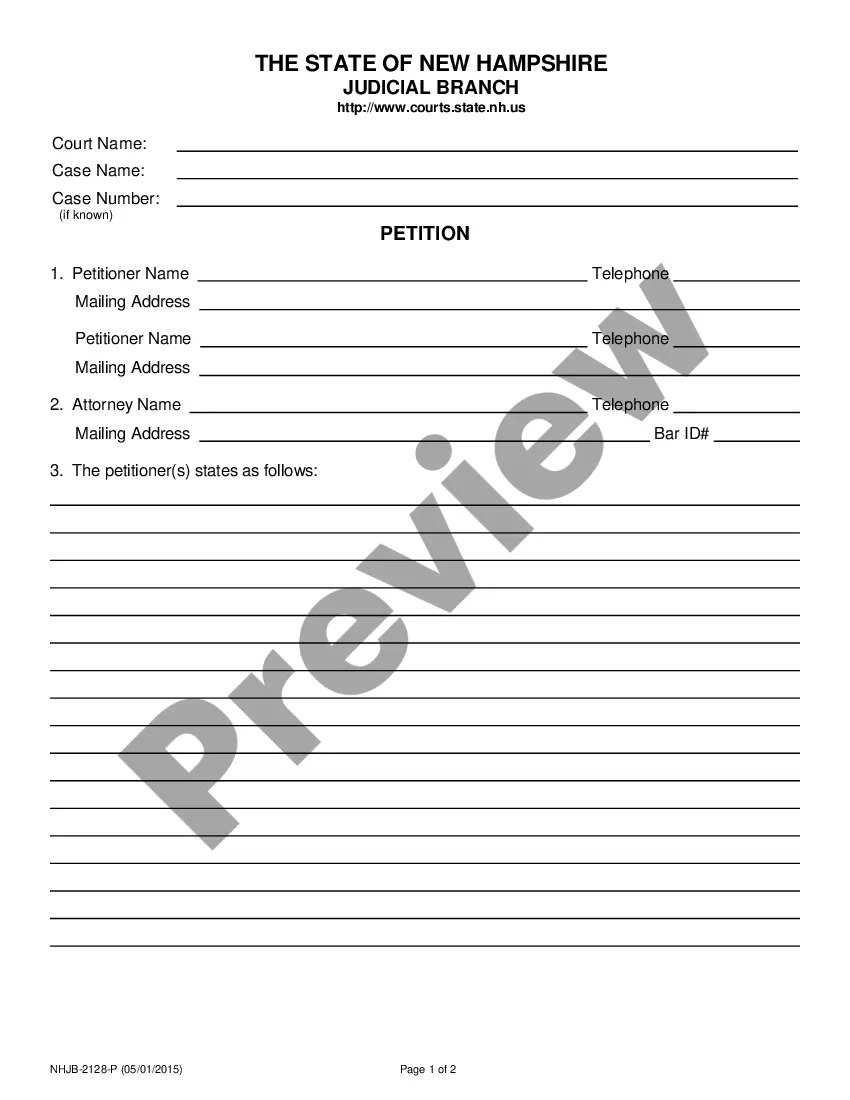

Description

How to fill out Conduct Policies For Board Members?

If you wish to total, down load, or print authorized papers themes, use US Legal Forms, the largest variety of authorized kinds, which can be found on the web. Take advantage of the site`s simple and convenient search to obtain the papers you need. Numerous themes for organization and person purposes are sorted by types and says, or keywords and phrases. Use US Legal Forms to obtain the Tennessee Conduct Policies for Board Members in a couple of click throughs.

When you are currently a US Legal Forms consumer, log in to your profile and then click the Acquire option to obtain the Tennessee Conduct Policies for Board Members. You may also gain access to kinds you previously saved inside the My Forms tab of your own profile.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for that appropriate area/land.

- Step 2. Take advantage of the Preview solution to look through the form`s articles. Never overlook to see the description.

- Step 3. When you are unhappy using the kind, make use of the Lookup area at the top of the display to find other versions in the authorized kind format.

- Step 4. Once you have located the shape you need, click on the Purchase now option. Opt for the costs strategy you favor and put your qualifications to sign up for an profile.

- Step 5. Procedure the purchase. You can use your credit card or PayPal profile to finish the purchase.

- Step 6. Select the file format in the authorized kind and down load it on your device.

- Step 7. Complete, revise and print or sign the Tennessee Conduct Policies for Board Members.

Each authorized papers format you purchase is yours permanently. You possess acces to every single kind you saved in your acccount. Click on the My Forms area and choose a kind to print or down load once again.

Be competitive and down load, and print the Tennessee Conduct Policies for Board Members with US Legal Forms. There are many expert and state-particular kinds you can use for your organization or person requirements.

Form popularity

FAQ

If your organization is listed as a public charity, the IRS states that no part of the organization's net earnings can be used to benefit a private person. If a board member receives a benefit from the loan, it violates IRS rules.

Nonprofit organizations include hospitals, universities, national charities, and foundations. To qualify as a nonprofit, your business must serve the public good in some way. Nonprofits do not distribute profit to anything other than furthering the advancement of the organization.

Many organizations refer to the 80-20 rule (or the Pareto principle) to discuss the importance of major donations. This principle dictates that 80% of a nonprofit's funding is contributed by only the top 20% of their donors.

As a board member you need to have a general knowledge and reasonable access to the organization's records including but not limited to the articles of incorporation, the original by-laws and any amended copies, 501c3 determination letter, tax records, bank records, audits, meeting minutes, etc.

Common Uses for Donations Programs: Organizations often need funding to carry out their mission-oriented programs. This could include running educational programs, providing medical care to underserved populations, or any other initiatives the nonprofit has set forth.

A Complete List of Nonprofit Expenses + How To Navigate Them Advertising costs. IT services. Fundraising events. Volunteer recruitment.

A 501c3 organization can spend funds only related to its tax-exempt philanthropic purposes. As we discussed above, if the nonprofit falls under one of these categories- charitable, educational, religious, scientific, literary, or other specified purposes, then it is only under this category that they can make spends.

Tennessee nonprofit corporations must have at least three board members.