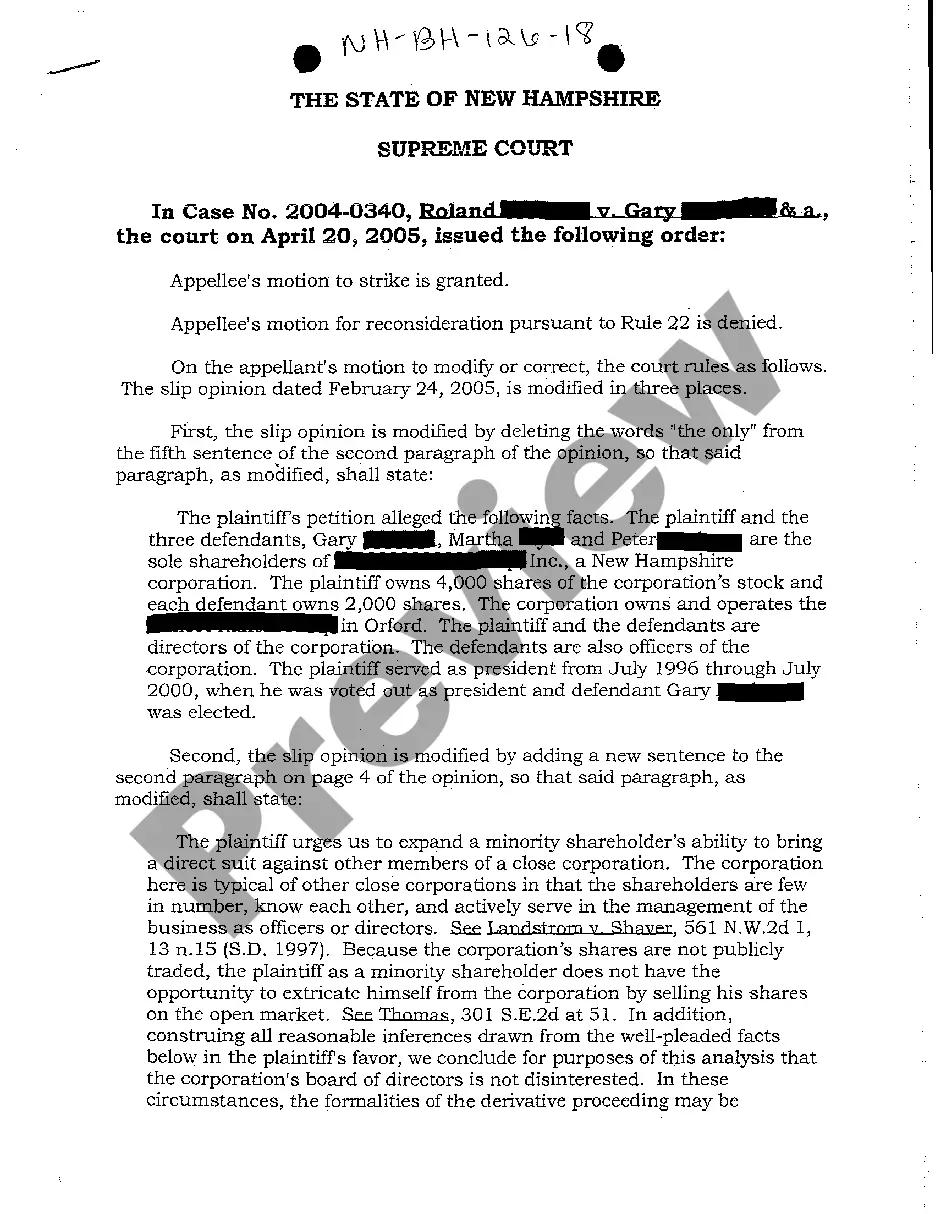

Oregon Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

How to fill out Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

If you wish to full, download, or printing legitimate papers themes, use US Legal Forms, the biggest assortment of legitimate kinds, that can be found on the web. Utilize the site`s simple and easy practical research to find the documents you need. Different themes for company and person reasons are categorized by groups and claims, or keywords. Use US Legal Forms to find the Oregon Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company in a couple of mouse clicks.

In case you are presently a US Legal Forms consumer, log in to your account and click on the Down load option to obtain the Oregon Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company. Also you can gain access to kinds you previously delivered electronically in the My Forms tab of your account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your proper area/land.

- Step 2. Take advantage of the Review solution to examine the form`s content. Don`t overlook to read through the description.

- Step 3. In case you are unhappy together with the kind, make use of the Research area towards the top of the screen to find other types in the legitimate kind template.

- Step 4. Once you have found the shape you need, go through the Acquire now option. Opt for the rates program you favor and add your references to sign up for the account.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal account to complete the financial transaction.

- Step 6. Choose the formatting in the legitimate kind and download it on your own device.

- Step 7. Total, modify and printing or indication the Oregon Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company.

Each legitimate papers template you buy is your own property permanently. You may have acces to every kind you delivered electronically with your acccount. Click on the My Forms portion and decide on a kind to printing or download again.

Be competitive and download, and printing the Oregon Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company with US Legal Forms. There are millions of expert and status-specific kinds you may use for your company or person needs.

Form popularity

FAQ

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.

Purpose of shareholder agreement 1.2 The Shareholders are entering into this Shareholder Agreement to provide for the management and control of the affairs of the Corporation, including management of the business, division of profits, disposition of shares, and distribution of assets on liquidation.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

A good shareholders agreement should set out the decisions a shareholder-director may and may not make without agreement from others. These are known as reserved matters. Disclosure of decision making is also important. A shareholder-director may be able to make decisions that aren't reported to other shareholders.