West Virginia Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares

Description

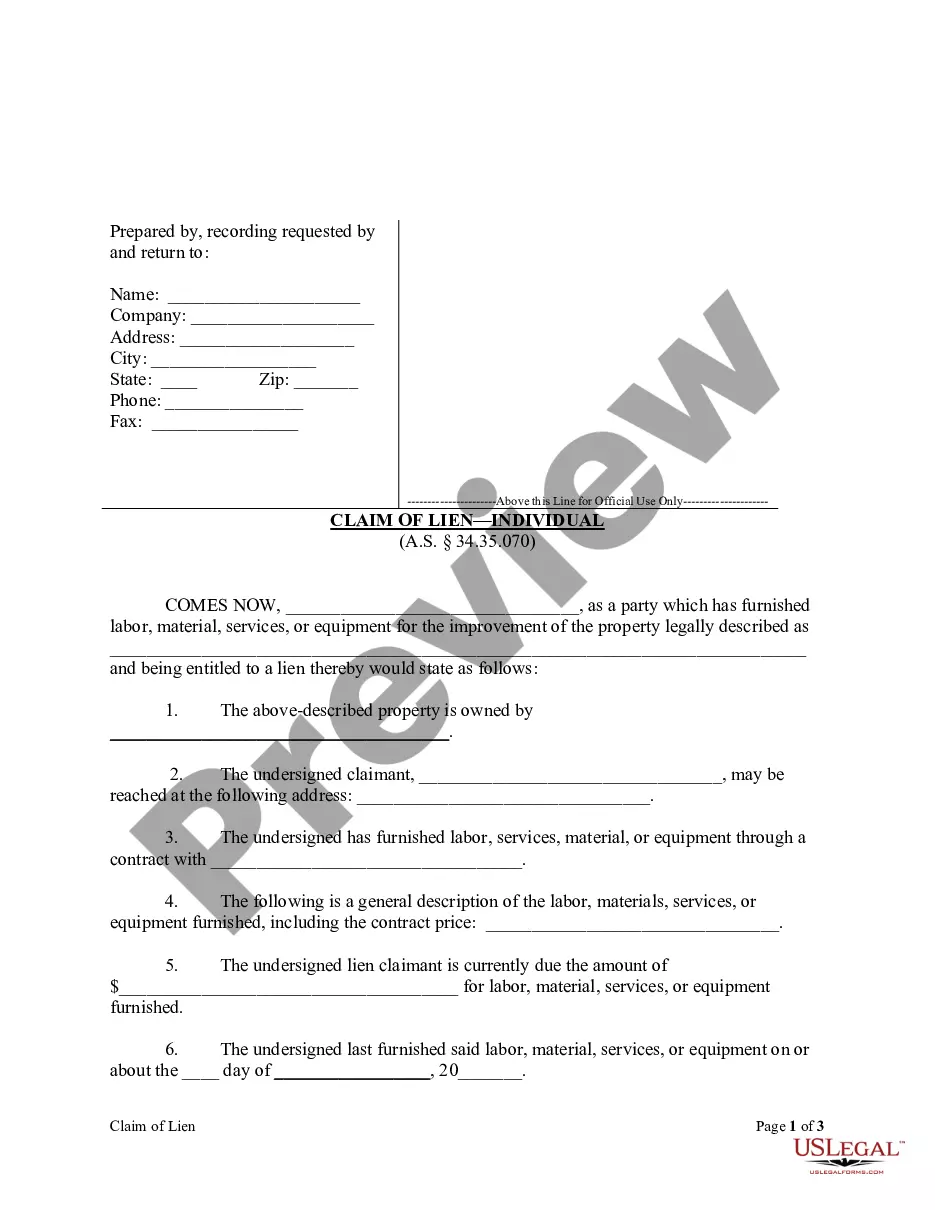

How to fill out Acquisition Agreement Between GO Online Networks Corp And Westlake Capital Corp Regarding Purchase And Sale Of Company Shares?

Have you been inside a situation that you need papers for possibly business or specific uses virtually every time? There are plenty of authorized papers web templates available on the net, but finding kinds you can depend on isn`t easy. US Legal Forms offers a huge number of form web templates, such as the West Virginia Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares, that are created to satisfy state and federal demands.

When you are already familiar with US Legal Forms internet site and also have a merchant account, merely log in. Afterward, you can acquire the West Virginia Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares template.

Should you not provide an accounts and want to begin to use US Legal Forms, abide by these steps:

- Find the form you will need and ensure it is for your proper metropolis/county.

- Take advantage of the Preview key to check the form.

- See the information to ensure that you have chosen the correct form.

- When the form isn`t what you are searching for, utilize the Research field to get the form that meets your requirements and demands.

- Once you obtain the proper form, simply click Get now.

- Opt for the pricing prepare you want, complete the specified information and facts to produce your bank account, and purchase the order using your PayPal or bank card.

- Decide on a convenient data file formatting and acquire your version.

Discover all of the papers web templates you may have bought in the My Forms food list. You can get a extra version of West Virginia Acquisition Agreement between GO Online Networks Corp and Westlake Capital Corp regarding purchase and sale of company shares any time, if possible. Just click on the required form to acquire or print the papers template.

Use US Legal Forms, by far the most considerable selection of authorized types, to save lots of time as well as stay away from mistakes. The assistance offers expertly produced authorized papers web templates which you can use for an array of uses. Create a merchant account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

Standard clauses for use in an asset purchase agreement where all or part of the consideration will be satisfied by the allotment and issue of shares in the buyer to the seller.

Answer. Firstly, the Consideration Paid is the amount the new Shareholder will pay in exchange for the shares. The Amount Paid, as recorded in ASIC, is the original value of the Shares when they were originally issued.

When reviewing a Share Purchase Agreement (SPA), some of the key clauses to examine include: The parties to the transaction. The number and type of shares being sold. The purchase price and any adjustments. Representations and warranties of both parties. Indemnities and liabilities. Restrictions post completion.

A share sale agreement protects both parties by defining their respective rights and obligations, such as: what happens if the business fails; how many shares will be sold and at what price; how much time there is for due diligence before closing on the deal; under what circumstances either party can terminate the ...

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.

The buyer agrees to pay to the seller the purchase price for the acquisition of the sale shares (consideration) in return for which the seller transfers title in the sale shares to the buyer (by executing a stock transfer form).

A share purchase agreement (SPA) is an agreement between a buyer and seller(s) of a target company, setting out the terms and conditions relating to the sale and the purchase of a specific number of shares in the target company.

The key clauses that should be included in any stock purchase agreement are: Ownership: The type of ownership will determine the rights and obligations, including who has voting power. Dividends: The number of dividends paid out per year will depend on how many profits and losses the company experiences.