Oregon Proposal to authorize and issue subordinated convertible debentures

Description

How to fill out Proposal To Authorize And Issue Subordinated Convertible Debentures?

Have you been in the situation the place you will need files for possibly business or personal uses virtually every day? There are a lot of authorized record web templates available online, but discovering kinds you can trust is not straightforward. US Legal Forms gives a large number of form web templates, much like the Oregon Proposal to authorize and issue subordinated convertible debentures, which can be published to meet federal and state demands.

When you are presently knowledgeable about US Legal Forms web site and possess a free account, merely log in. After that, you may obtain the Oregon Proposal to authorize and issue subordinated convertible debentures format.

Unless you come with an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Get the form you require and ensure it is to the right metropolis/area.

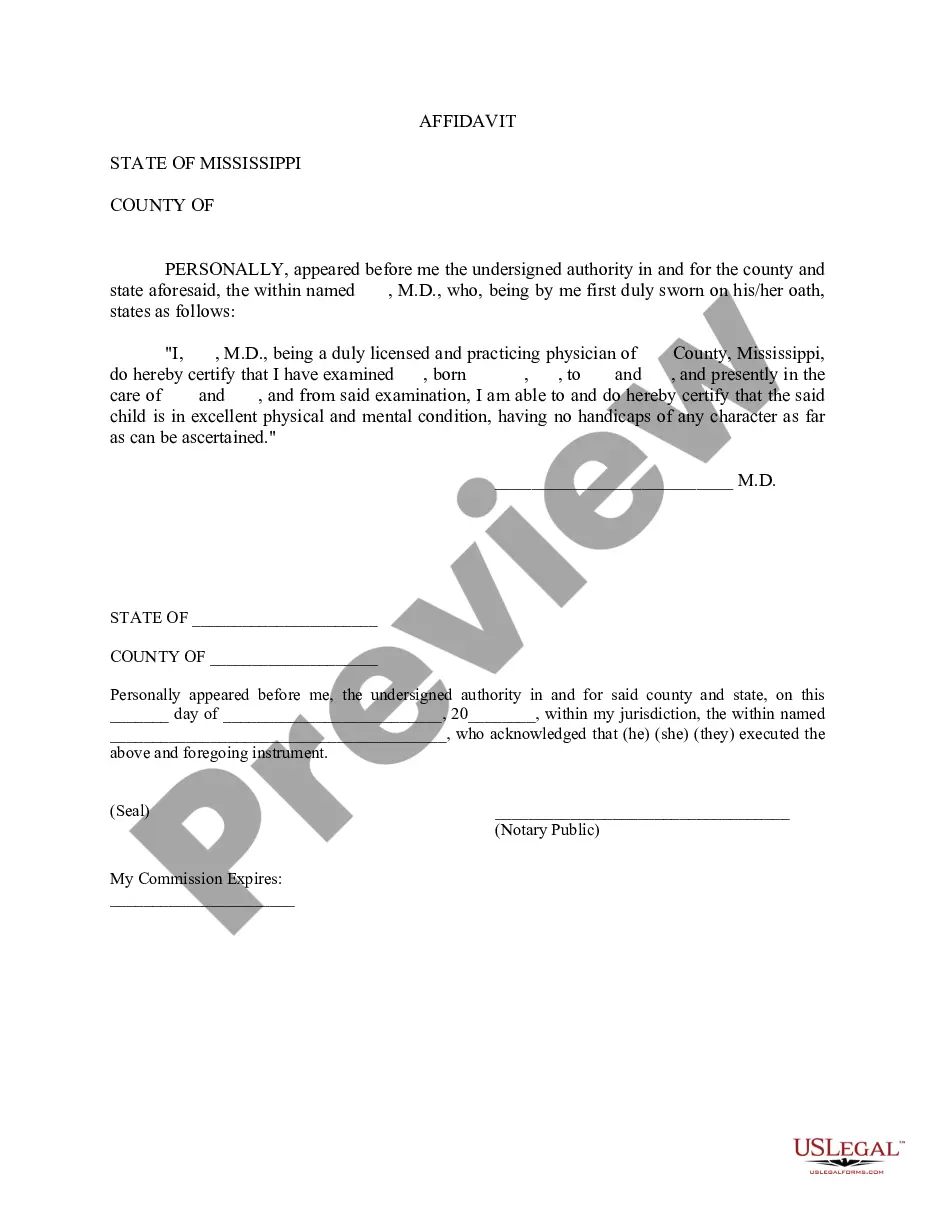

- Take advantage of the Preview key to analyze the form.

- Look at the description to actually have selected the appropriate form.

- In case the form is not what you`re looking for, utilize the Research field to find the form that suits you and demands.

- When you obtain the right form, simply click Purchase now.

- Pick the rates strategy you desire, submit the specified information and facts to generate your account, and purchase an order with your PayPal or Visa or Mastercard.

- Decide on a hassle-free document format and obtain your backup.

Find each of the record web templates you have purchased in the My Forms menus. You can get a additional backup of Oregon Proposal to authorize and issue subordinated convertible debentures at any time, if necessary. Just click the needed form to obtain or print out the record format.

Use US Legal Forms, the most considerable variety of authorized kinds, to conserve time and prevent faults. The service gives expertly created authorized record web templates that you can use for a range of uses. Make a free account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

CCD'S can be issued at any amount. There is no minimum amount criteria. Convertible Notes can be issued without prior valuation. The company raising funds should be recognized as a Startup Company by the government.

Fully Convertible Debenture: These are debentures in which the whole value of debentures can be converted into equity shares of the company. Partly Convertible Debenture: In this kind of debentures, only a part of the debentures will be eligible for conversion into equity shares.

Unless the articles of incorporation or bylaws provide otherwise, action required or permitted by this chapter to be taken at a board of directors' meeting may be taken without a meeting if the action is taken by all members of the board.

A convertible debenture differs from convertible notes or convertible bonds, generally in that debentures have longer maturities.

A convertible debenture is a hybrid financial instrument that has both fixed income and equity characteristics. In its simplest terms, it is a bond that gives the holder the option to convert into an underlying equity instrument at a predetermined price.

What are the main differences between NCDs and CCDs? NCDs provide fixed returns without an option for conversion into equity, while CCDs offer potential equity conversion at a predetermined time, combining debt and equity features.

Next, a convertible bond yields interest payments that can also be converted into equity or stock as well. Convertible debt is pure capital and does not have interest payments associated with it.

ORS Chapter 65 ? Nonprofit Corporations.