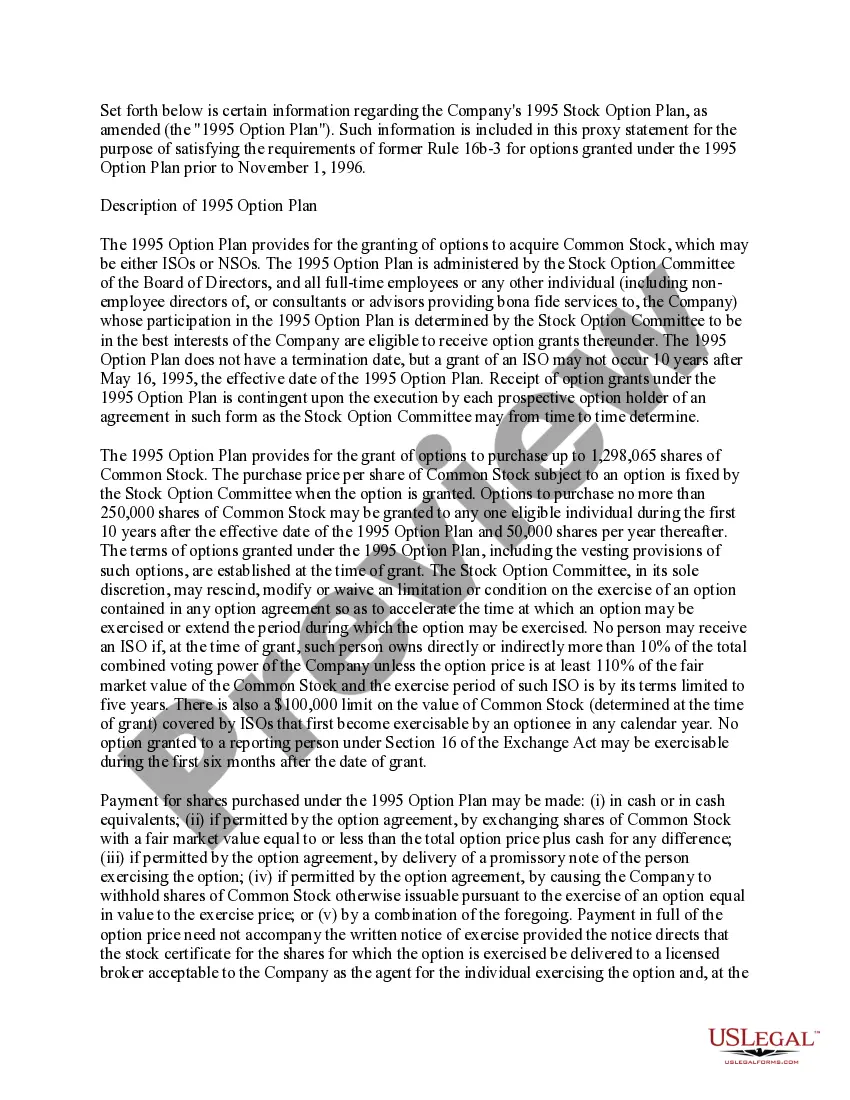

Missouri Approval of Stock Option Plan

Description

How to fill out Approval Of Stock Option Plan?

You can spend several hours on-line looking for the lawful papers web template that fits the state and federal specifications you require. US Legal Forms provides thousands of lawful kinds which are examined by specialists. It is possible to download or produce the Missouri Approval of Stock Option Plan from the service.

If you already have a US Legal Forms account, you may log in and click the Down load button. Following that, you may complete, edit, produce, or indicator the Missouri Approval of Stock Option Plan. Each and every lawful papers web template you acquire is yours for a long time. To acquire another copy associated with a obtained type, check out the My Forms tab and click the corresponding button.

If you use the US Legal Forms web site the very first time, follow the easy directions under:

- Initial, make sure that you have selected the best papers web template for the county/town of your choice. Browse the type description to ensure you have chosen the correct type. If available, make use of the Review button to appear throughout the papers web template also.

- If you would like locate another version in the type, make use of the Look for discipline to obtain the web template that meets your needs and specifications.

- After you have identified the web template you need, click on Purchase now to move forward.

- Select the costs program you need, key in your qualifications, and register for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your charge card or PayPal account to purchase the lawful type.

- Select the file format in the papers and download it for your system.

- Make alterations for your papers if required. You can complete, edit and indicator and produce Missouri Approval of Stock Option Plan.

Down load and produce thousands of papers web templates utilizing the US Legal Forms site, which offers the largest assortment of lawful kinds. Use skilled and status-particular web templates to take on your organization or person requires.

Form popularity

FAQ

In Missouri, both U.S. residents and nonresidents use the same forms. If you are single or married with one income, you can probably use the MO-1040A. There is a longer MO-1040 form that married couples with two incomes must use.

Form MO-A is a supplemental form that should be used by all Missouri nonresidents who need to claim tax adjustments.

Key Takeaways. Form 1040-A was a simplified version of Form 1040 used for filing individual income tax. Filers using 1040-A were required to have less than $100,000 in taxable income and not have exercised any incentive stock options during the year.

Yes. Under Missouri statute (Section 143.436. 9, RSMo) the member is allowed a credit for the pro rata share of such a tax paid to another state as long as the tax in the other state is substantially similar to Missouri's pass-through entity tax.

PART 1 - Missouri Modifications to Federal Adjusted Gross Income. Form MO-A, Part 1, computes Missouri modifications to federal adjusted gross income. Modifications on Lines 1, 2, 3, 4 and 5 include income that is exempt from federal tax, but taxable for state tax purposes.

Because Missouri adopts federal adjusted gross income in calculating Missouri taxable income, Missouri allows a net operating loss (NOL) deduction as a carryover or carryback in the same manner as allowed for federal purposes.

Missouri Form 1040 ? Personal Income Tax Return for Residents.

Complete Forms MO-1040 and MO-A, pages 1 and 2, using corrected figures. Attach all schedules along with a copy of your federal changes and your Federal Form 1040X. If you are due a refund, mail to: Department of Revenue, P.O. Box 500, Jefferson City, MO 65106-0500.