Oregon Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

If you wish to finalize, download, or print authentic document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's simple and accessible search to locate the files you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you purchase is yours forever.

You will have access to every form you saved in your account. Click on the My documents section to select a form to print or download again. Stay competitive and download and print the Oregon Employee Evaluation Form for Sole Trader with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to acquire the Oregon Employee Evaluation Form for Sole Trader in just a few clicks.

- If you are an existing US Legal Forms user, sign in to your account and click the Download button to access the Oregon Employee Evaluation Form for Sole Trader.

- You can also access forms you've previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

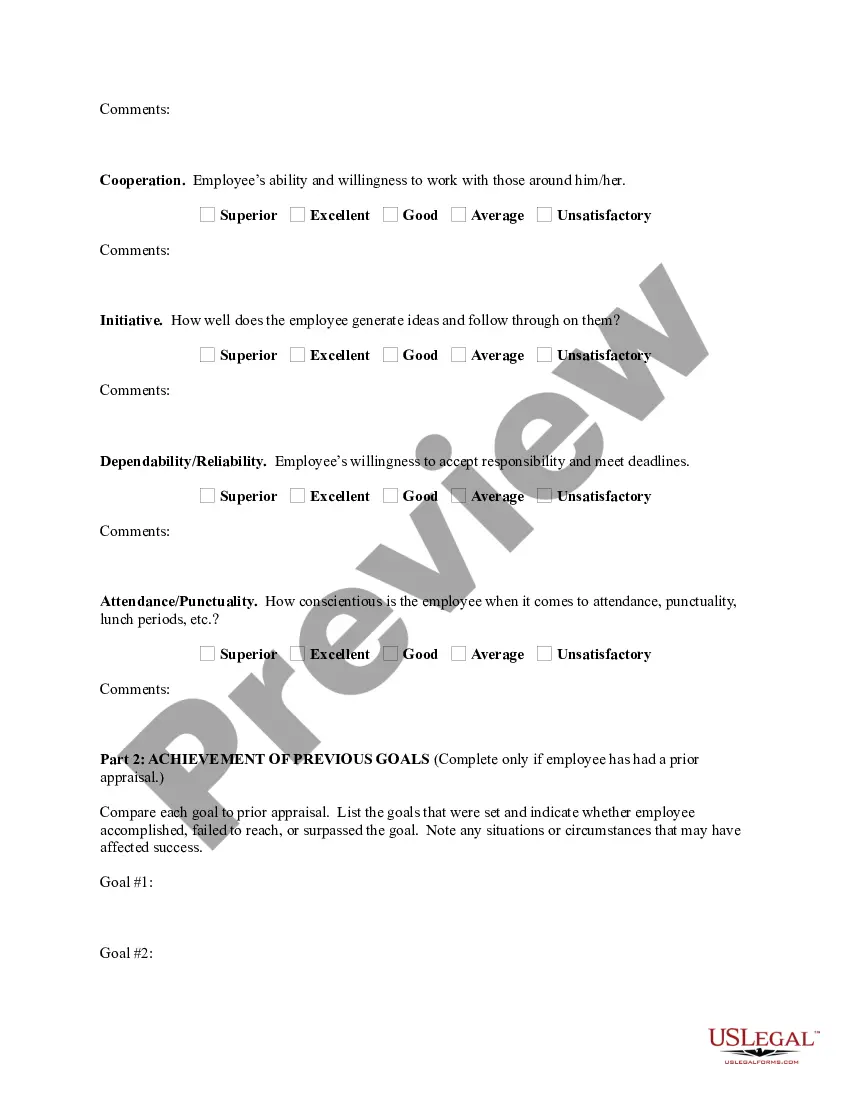

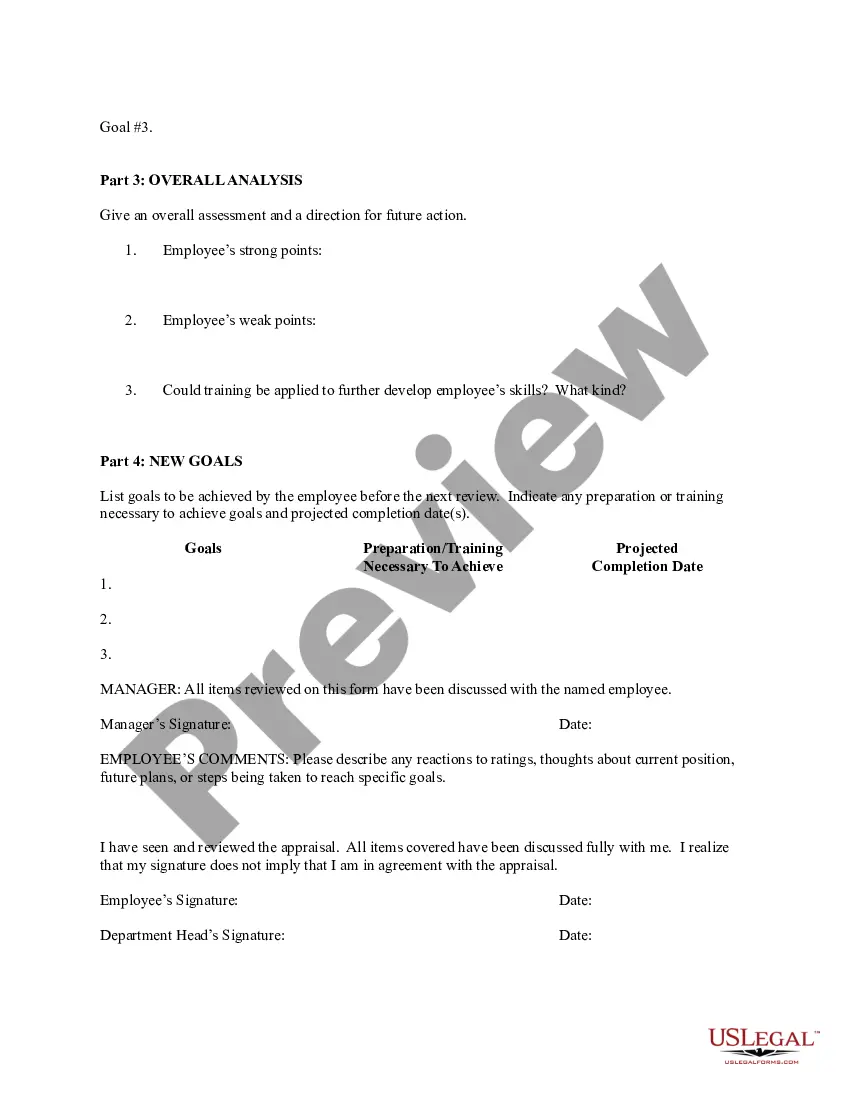

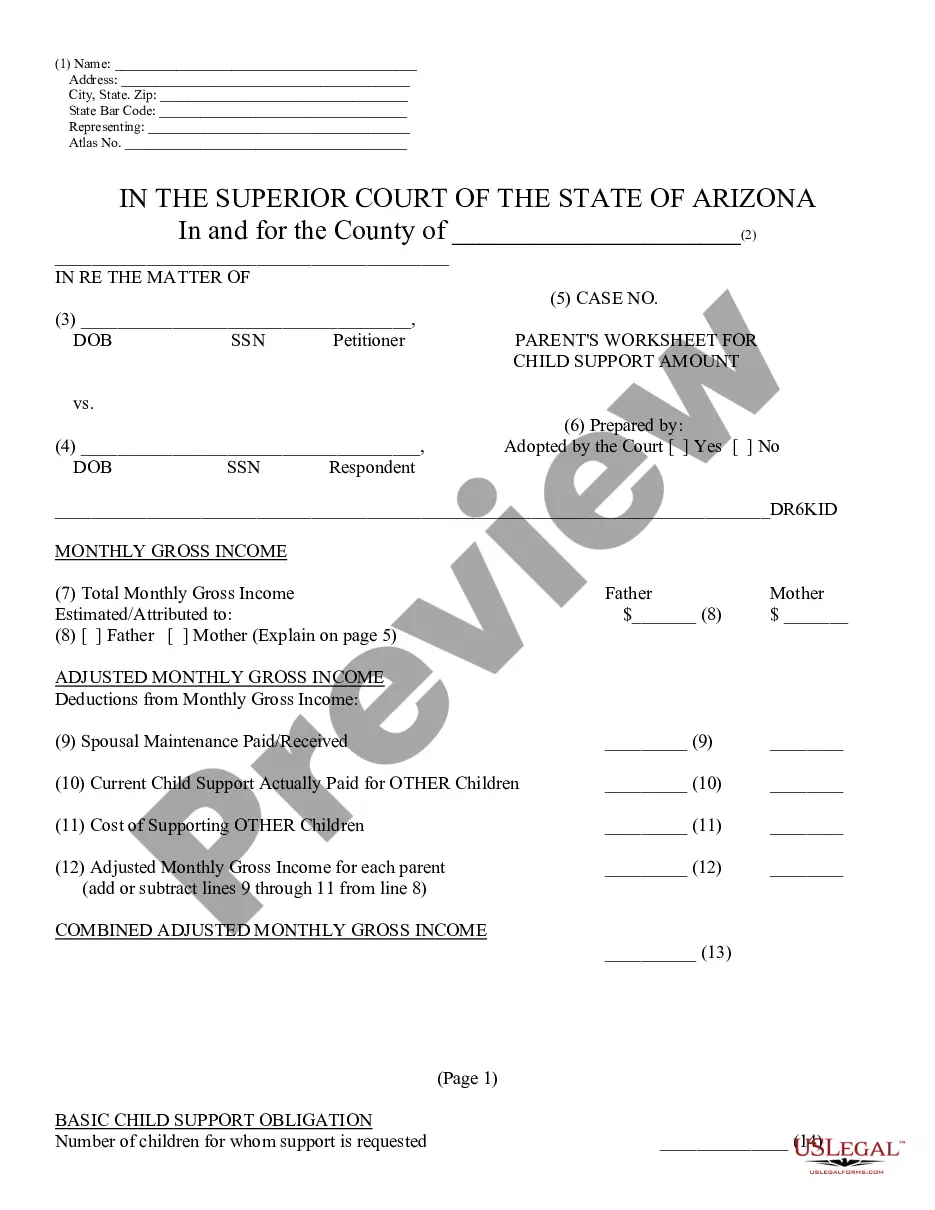

- Step 2. Use the Preview function to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other variants of the legal form design.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Oregon Employee Evaluation Form for Sole Trader.

Form popularity

FAQ

When filling out the W-4 Oregon single, you should provide your personal details and specify your allowances. This step is vital for determining the correct amount of tax withholding. By utilizing resources like the Oregon Employee Evaluation Form for Sole Trader, you can reference the income details necessary to make informed choices while completing the W-4.

The Oregon Form or W-4 is a tax form that allows employees to indicate their tax withholding preferences. For sole traders, understanding the function of this form can help in managing your taxes effectively. When you use the Oregon Employee Evaluation Form for Sole Trader, it provides clarity on earnings and deductions that are essential for accurate tax reporting.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

Qualifications for EUC:Your base year wages must equal or exceed 40 times your weekly benefit amount. (If your claim pays 26 weeks of benefits, you have met this qualification.) Your most recent claim must have tired regular benefits or be expired.

All Oregon employers who have an income tax with- holding and statewide transit tax account open with the Oregon Department of Revenue must file Form OR-WR, Oregon Annual Withholding Tax Reconciliation Report. The 2018 form is due January 31, 2019.

Newly hired employees must complete and sign Section 1 of Form I-9 no later than the first day of employment. Generally, only unexpired, original documentation is acceptable (i.e., driver license or passport). The only exception is that an employee may present a certified copy of a birth certification.

Oregon employers should provide each new employee with a federal Form W-4 and a Form OR-W-4 for tax withholding purposes. See Employee Withholding Forms. Oregon employers must provide new employees with a notice of the right to pregnancy accommodations.

Definitions as they pertain to Oregon Employment Department Law. An employer is subject to unemployment insurance taxes when the employer pays wages of $1,000 or more in a calendar quarter, or employs one or more individuals in any part of 18 separate weeks during any calendar year.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.